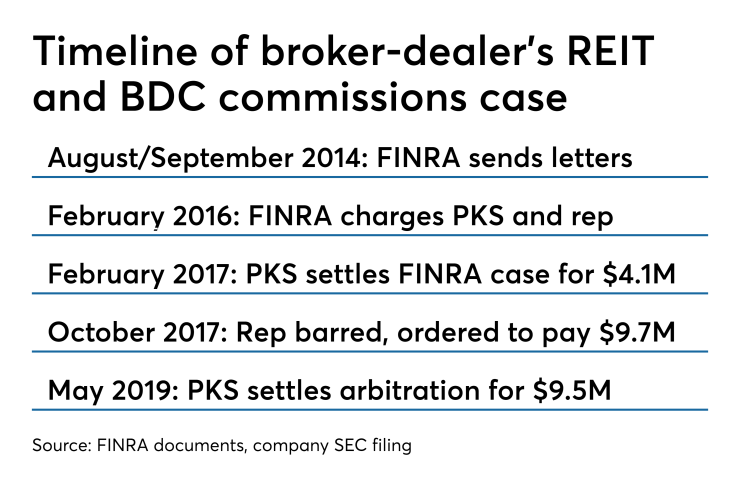

Nearly five years after FINRA posed questions to Purshe Kaplan Sterling Investments about commissions on REITs and BDCs, the firm may have finally put the case in its rearview mirror.

PKS — a hybrid RIA-friendly independent broker-dealer

Barred former PKS representative Gopi Vungarala sold the Saginaw Chippewa Indian Tribe of Michigan $190 million in nontraded REITs and BDCs over a 3 ½-year span without disclosing the product’s commissions or obtaining the available volume discounts, FINRA

PKS settled the tribe’s arbitration case for $9.5 million, the May 30 filing notes. The firm had

The Albany, New York-based firm also paid $3 million in connection with additional outstanding claims prior to the deal, according to the annual audit document. It faces two other pending arbitration claims for $2.5 million in damages and an unspecified amount.

It’s not immediately clear whether the other claims relate to the tribe’s case or whether any other claims connected to it will be filed in the future. The tribe didn’t return a phone call to its public relations office about the case.

-

Wealth management transaction activity will reach a record level for the sixth straight year in 2018, according to one forecast.

December 7 -

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5 -

The firm left Kestra for PKS as part of the move as increasingly large breakaways fuel the independent movement.

May 16

Representatives for PKS and Wentworth — a strategic acquirer that owns additional

Vungarala resigned in February 2016 in order to defend himself against FINRA’s allegations,

FINRA barred him the following year after a disciplinary panel

“He profited handsomely from his misconduct, and the tribe — which trusted Vungarala and depended upon him for objective investment advice — suffered financial harm as a result of its lost volume discounts,” the panelists wrote.

The regulator’s nationwide sweep of missing volume discounts led it to the case in 2014. Tribal members began to be suspicious that year when Vungarala invited them to the grand opening of his second Cherry Berry yogurt shop, according to a briefing on the case in the initial ruling.

FINRA charged Vungarala with two counts of securities fraud in 2016 for willful misrepresentation of material facts and alleged two counts of failure to supervise against PKS. The firm later

In its arbitration claim filed before the acquisition deal, the tribe alleged it made unsuitable REIT purchases and requested a full payback of the commissions, the PKS filing to the SEC states. The settlement holds PKS shareholders and parent entities jointly liable for the settlement.

While the parties didn’t disclose financial terms of the acquisition, Wentworth paid for it with the aid of a senior credit facility of $43.5 million. At the time, the nearly 500 BD-affiliated hybrid RIA offices of PKS included some 1,200 representatives.