Some wealth management firms are finding that solutions to two of the industry’s big stumbling blocks — succession planning and diversity — may be intertwined.

Indeed, a link between the two emerged when firms began to diversify their advisor staffs, according to executives.

In hiring more diverse candidates and assigning them to a mentor, firms are helping both sides: the new hires get a mentor to help their career progress and the older advisors are able to grow more comfortable with the idea of handing their business over to the next generation.

“Across the industry we have an aging population of financial advisors … so we want to think about what that new generation of advisors looks like,” says Andrea Fannemel, senior manager, recruiting at RBC Wealth Management.

This is also a key tactic that Wells Fargo uses to diversify its advisor pool while helping prepare their aging employees for retirement. The wirehouse’s Associate Financial Advisor program, which fosters mentor/protégé relationships, is 36% women and 48% minorities. The industry standard for both is 16%, Wells Fargo says.

Succession planning “is definitely one of the reasons we’re doing this,” says Diane Gabriel, the head of Wells Fargo’s next generation talent program. “We talk about this all the time … bringing on that next generation of advisors is crucial.”

The succession planning ramifications are not being lost on the older advisors. Gabriel cited at least one senior advisor who joined Wells from another firm specifically because of the career support his assistant could get at the wirehouse.

"She is now a part of his succession plan and the [next generation talent] program providing opportunities for the younger, female aspiring FA was the impetus for the move,” Gabriel says.

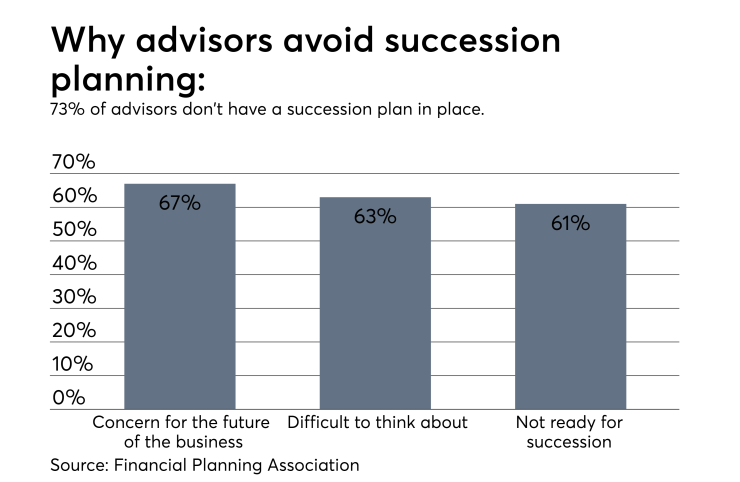

To be sure, there is a significant need in the industry to help older advisors. Experts at helping clients prepare for the future, they simply don’t afford themselves the same consideration. In fact, 73% of advisors do not have a succession plan in place, according to

-

When experienced advisors mentor new planners, they transform the profession in the process.

October 2 -

Developing a team is crucial for RIA owners thinking about winding things down.

April 19 -

Like other broker-dealers, the firm is far from achieving a ratio of 50/50 men-and-women planners.

April 10

Key reasons that advisors are avoiding this subject — according to the FPA — are because they are worried the business will not be as successful without them (67%); they’re having a hard time thinking about moving on from the business (63%); and they’re not ready for succession even if the firm is ready (61%).

FOLLOWING SUIT

Other firms are making similar moves to help with these two challenges. RBC recently announced plans to revamp its Associate Financial Advisor training program to bring in more diverse candidates from inside and outside of the industry. The program is designed to prepare new advisors for the role while also offering individualized training, mentorship and support, the firm says.

Similarly, UBS has just launched a wealth manager development program in order to increase the firm’s ability to source, team with other UBS planners and train the next generation of advisors.

“We need to look at a demographic of advisors that more accurately reflects our client demographics and in particular not just the demographics of today, but into the future as well,” says Emily de la Reguera, head of next generation advisor development at UBS. “Whether it is gender diversity or ethnic diversity, we want to attract the very best talent in order to create an advisor population that more accurately reflects our client demographics.”