It turns out that the principles of behavioral finance are not limited to investment strategies. They can apply equally as well to Social Security planning.

Roughly 10,000 baby boomers will turn 65 every day for the next 14 years, and when they do they will have to navigate over 2,700 rules on benefits claiming.

To help clients get the most out of their benefits, advisers need to look out for psychological biases that may lead to less-than-ideal outcomes, said two experts during Financial Planning’s webinar “How to guide clients on optimizing their Social Security benefits.”

TIMING IS EVERYTHING

Much of the Social Security Administration’s rules are aimed at deterring people from claiming benefits before they hit FRA, or full retirement age, said John Brenkovich, founder of Brenkovich Financial Management, an RIA based in Mamaroneck, New York.

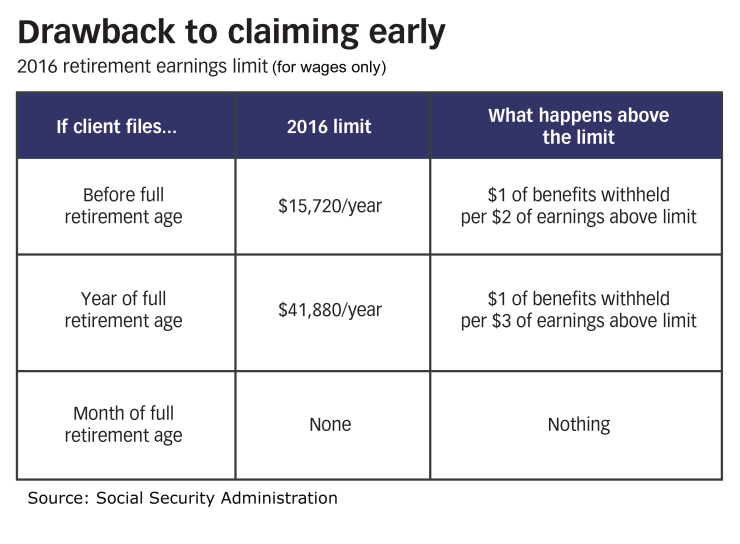

For instance, a client who wants to collect benefits and continue working will be subject to an earnings limit if the client has not yet reached his or her FRA, which is currently set at 66 for people born in 1943 to 1954, and 67 for those born in 1960 or later.

Any income above that limit will result in the SSA withholding a portion of the client’s monthly benefit payments, Brenkovich explained.

“Claiming Social Security benefits is not just about maximizing one’s own payments, it’s also about what you’ll be leaving for your surviving spouse." - John Brenkovich, founder of Brenkovich Financial Management

In contrast, if a client waited until FRA, no money would be withheld.

THE ‘GRANDDADDY OF FINANCIAL BEHAVIORAL BIAS’

Despite the obvious drawback of claiming early, many clients will be tempted to do so as soon as they turn 62, the earliest age at which they are permitted to file for benefits.

This is largely due to people’s natural propensity for negative thinking and extreme aversion towards loss, whether it’s real or perceived, said Paul Norr, a certified financial planner with Thousand Oaks, California-based Bucks County Financial Planning Group.

“We hate losses — it seems to be built in. Losing $100 feels twice as bad as it feels good to gain $100. When it comes to Social Security, people are afraid of losing money if they can’t have it right away," he said.

When clients hear that they will benefit from waiting until FRA, or even later at age 70 so they become eligible to receive an 8% delayed retirement credit, they tend not to register any of that, Norr added. Instead, they are focused on the four- to eight-year loss in the meantime.

People put more weight on bad news than good. They are also prone to catastrophizing that “bad things could happen,” so money now always feels better than money later.

A handy cheat sheet of some of the most useful Social Security planning strategies.

Norr recalls a time when a prospective client walked in with the opening line “It’s all going to hell,” followed by “I’m trading gold and silver, the stock market is going to crash, the government can’t be trusted so I need to get my Social Security ASAP!”

Norr pointed out that, while those concerns are all arguably valid, the greatest risk to this client was his own negativity, to which the client agreed.

DOUBLE WHAMMY

Clients who fall prey to these hardwired emotional traps may see dire consequences down the road, and not just for themselves.

Once someone has decided to start collecting Social Security benefits, that decision impacts the spousal benefits his or her partner will be eligible to receive, Brenkovich warned. Under SSA rules, a spouse is entitled to 50% of the benefits of the person to whom they’re married, as long as that spouse has filed for Social Security.

This is especially important for a spouse whose partner has passed away, after which he or she can collect survivor benefits, Brenkovich explained. When both members of the couple worked, the surviving spouse will get the higher of the two Social Security payments. If that turns out to be the payment of the deceased spouse, and he or she claimed the benefits early, then the surviving spouse will get less as well. The same logic applies in reverse.

“Claiming Social Security benefits is not just about maximizing one’s own payments, it’s also about what you’ll be leaving for your surviving spouse,” Brenkovich emphasized.

TURNING LOSSES INTO GAINS

So what can advisers do to mitigate some of these behavioral biases?

For one, establish helpful anchors, and start the conversation by defining 68 or 70 as the appropriate claiming age, according to Norr.

-

When advisers blend behavioral finance approaches with data insights, it makes them even more valuable.

September 22 -

Like many planners, Shane Larson never received any training in psychology. Now he finds using basic counseling skills can help make relationships with his clients stronger.

August 26 -

Positive psychology might be the key to determining just what a client needs.

September 15 -

Experts say planners ignore offering counsel beyond numbers and investments at their own peril.

September 23

Anchoring refers to our inability to ignore arbitrary numbers, he explained. Often, the first number that enters any discussion becomes the main reference point, even if it is not necessarily better or worse than other numbers. As a result, advisers should take the lead and instill a late retirement age in the client’s head right off the bat.

From there, try to present anything less than 68 to 70 as a monetary loss, Norr advised, by spelling out how much the client would lose if they claimed at 62, 63, 64 or 65.

“Use loss aversion to your benefit," he said.

EYES ON THE PRIZE

More importantly, Norr added, advisers need to remind clients to focus on the end goal, which is to live out their best lives in retirement.

At the end of the day, financial decisions such as when to claim Social Security benefits are only instruments to achieve that goal. People become obsessed with arbitrary numbers like 62 or 63, Norr stressed, but most of the time claiming a few years later will not be nearly as injurious as people expect. Therefore, it is up to advisers to share their past experiences and ease clients' fears.

“Most people do not care about the details related to Social Security or investing, they just want to live their lives to the best within their means," he said.