After months of anticipation, someone in South Carolina has finally

While the odds are exponentially against winning this prize, there are many smaller but more likely jackpots you can help your clients plan for and protect when they inherit a parent’s IRA or Roth IRA.

In particular I’m referring to IRAs that children inherit after both parents have died, rather than those that are inherited by a spouse.

Here are some ways you can protect that IRA now, and keep it growing for the next generation.

Proactive lifetime measures:

First things first.

Advisors can help make sure the right beneficiary is named. It’s also important to have a contingent beneficiary named to allow more post-death flexibility or if the beneficiary pre-deceases the IRA owner and the beneficiary form was not updated.

Naming an individual on the IRA beneficiary form can allow the beneficiary to extend required minimum distributions over his or her lifetime, known as the stretch IRA. This can keep that inherited IRA growing for decades.

However, the stretch IRA does not protect those funds from being squandered. It only allows the beneficiary to extend RMDs over the longest possible time frame. The beneficiary can always withdraw more and empty the account when they wish, like many lottery winners.

If the IRA is large, or their beneficiaries may not be equipped to handle a large inheritance whether due to age, incapacity, lawsuits or having a history of financial problems, your client may wish to name a trust as the IRA beneficiary. The trust can be used to make sure that large distributions are not withdrawn unwisely. It should be flexible enough, though, to allow the beneficiary to withdraw funds in addition to the annual RMDs, for items like health, education or financial emergencies. A reliable and competent trustee should be named to make your sure your client’s wishes are followed and that the IRA is protected over the lifetime of the beneficiary.

The U.S. Supreme Court has ruled that inherited IRAs are not creditor protected in bankruptcy (Clark et ux. v. Rameker, Trustee, et al.,Supreme Court of the United States, No. 13-299, June 12, 2014). Let your clients know this in case they are worried about their beneficiaries being vulnerable to financial woes.

Like lottery winnings, this inheritance may likely be a one-time event and the funds need to be similarly protected. Naming a trust in this case will provide more protection than having a beneficiary inherit directly.

Post-death protection:

Many inherited IRAs are lost immediately after death, mainly to unintended taxation.

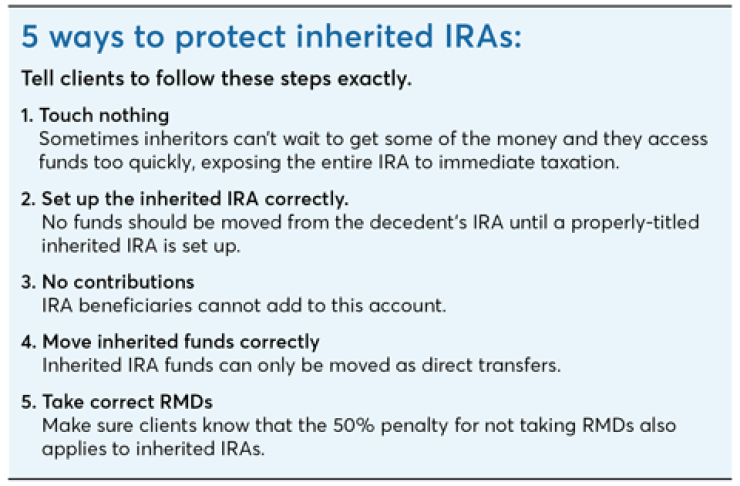

Here are 5 rules to follow to avoid this.

1 – Touch nothing!

Advice is critical at this first stage. The biggest mistakes happen here. Sometimes inheritors can’t wait to get some of that money and they access the funds too quickly, exposing the entire IRA to immediate taxation.

Advisors need to educate clients and to inform beneficiaries that withdrawing inherited IRA funds cannot be undone. Once inherited IRA funds are withdrawn by a non-spouse beneficiary (a child, grandchild, friend or anyone other than a spouse) those funds are subject to taxation and they cannot be rolled over. A non-spouse beneficiary cannot do a rollover so the mistake cannot be undone.

We had a beneficiary years ago who withdrew around $600,000 from his father’s IRA before an inherited IRA was set up, and immediately over $200,000 was lost to taxes and the funds ceased to exist as an inherited IRA.

2 – Set up the inherited IRA correctly

What should be done first? Advisors should know that after death, no funds should be moved from the decedent’s IRA until a properly-titled inherited IRA is set up.

The IRA should be titled as an inherited IRA. Before any funds are moved, the account should be re-titled keeping the name of the deceased IRA owner on the account and adding the beneficiary’s name to the title.

One example of a properly-titled inherited IRA is: “John Smith IRA, deceased 11-5-18, f/b/o John Smith, Jr., beneficiary.”

Correct titling must also be done when a trust is the IRA beneficiary.

In that case the account can be titled as: “John Smith IRA, deceased 11-5-18, f/b/o Adam Taylor, Trustee of The John Smith Trust, beneficiary.”

If there are multiple beneficiaries, then each beneficiary’s share must be set up as a separate inherited IRA. The split must be done as a direct transfer, and the split must be done by the end of the year after death to allow each beneficiary to do a stretch IRA based on their own life expectancy.

3 – No contributions

Let IRA beneficiaries know that this is an inherited IRA, not their own IRA. They cannot make contributions to this account. If they do, they are deemed to have treated the account as their own and the entire account balance becomes subject to taxation and must be emptied. An inherited Roth IRA may not be taxable, but the inherited Roth IRA is also deemed withdrawn and the funds are no longer inherited Roth funds, if contributions are made to the account.

4- Move inherited funds correctly

Inherited IRA funds can only be moved as direct transfers. As mentioned earlier, a non-spouse beneficiary can never do a rollover. A common mistake occurs when an uninformed beneficiary wishes to move the funds to a different bank, broker or financial advisor, or to you. If the funds are withdrawn as opposed to a direct transfer, they become subject to taxation and cannot be rolled over. This is another mistake that cannot be corrected.

5- Take correct RMDs

The 50% penalty for not taking RMDs also applies to inherited IRAs. Help IRA beneficiaries calculate the correct RMD. If they are a designated beneficiary, meaning the beneficiary is an individual or a qualifying trust, they can use the stretch IRA. Use the IRS Single Life Table. Use the age of the beneficiary in the year after death when RMDs will begin.

In addition, if the decedent died before taking any year-of-death RMD, the beneficiary must take that RMD. If it is missed, it is the beneficiary who will be hit with the 50% penalty.

If the inherited IRA is a Roth IRA it is subject to RMDs, even though Roth IRAs are exempt from lifetime RMDs. The beneficiary must take RMDs the same as for an inherited traditional IRA. The RMD from the inherited Roth will generally be tax free but it still must be taken. If it is not, it will be subject to the 50% penalty even if the RMD would have been tax free.

If you have a client who will be leaving an IRA to the next generation, or your client has just won the IRA lottery by inheriting a significant IRA, use these proactive steps to protect those funds and make them last. This is a valuable service that is often neglected. Help your new beneficiary clients keep their IRA proceeds.