Want unlimited access to top ideas and insights?

We are constantly reminded that funds' past performance is no guarantee of future performance. But if we can’t evaluate past performance, what are we supposed to look at to make reasonable and thoughtful investment decisions?

Averages derived over many years matter because future performance tends to progress or regress toward the long-term average. It’s helpful to know the past to get a sense of the present.

Look Beyond Short-Term Fund Performance

However, as shown in the chart “Performance of funds,” mutual fund and ETF average performance by category over more recent time frames has, in some cases, diverged considerably from the 30-year average performance. The general notion here is that the longer the time period is, the more reliable and useful the performance figure.

For instance, the 30-year average performance for large-cap U.S. blend mutual funds as of Oct. 31, 2019, was 9.63%. As we scan across the table, we observe more recent returns in the large-cap blend category that are considerably higher, such as a return through October 2019 of 21.25% , a category average three-year annualized return of 13.26% and a 10-year figure of 12.42%.

But then, to confound the situation, the 20-year period produced an average return among large-cap blend funds of 6.39%, which is well below the 30-year figure. In short, the returns over the various time frames are all over the map.

To illustrate this in the “Performance of funds” chart, I’ve highlighted in yellow all the time frames where the return exceeds the 30-year average return for large-cap U.S. equity funds, mid-cap funds and small-cap funds. There is quite a bit of yellow in the table — particularly in the shorter time periods and among growth-oriented funds. The implication is that recent performance is well above historical averages and that a reversion should not come as a shock.

So which time period is the most reliable indicator of so-called performance reality? Said differently, do you want your clients who are invested in large-cap blend funds forming performance expectations from a three-year average return of 13.26%, a 20-year average of 6.39% or a 30-year average of 9.63%? Each of those numbers is true, but they’re also quite different. Which time period represents the most useful gauge of anticipated performance going forward?

It may be tempting to highlight performance over time periods that were particularly robust, such as the three-year average of 16.66% for large-cap growth funds, or the 15.30% three-year average return for midcap growth funds. The risk in doing that, however, should be obvious. It sets in place an expectation level that is not supported by the longer-term performance.

Which time period represents the most useful gauge of anticipated performance going forward?

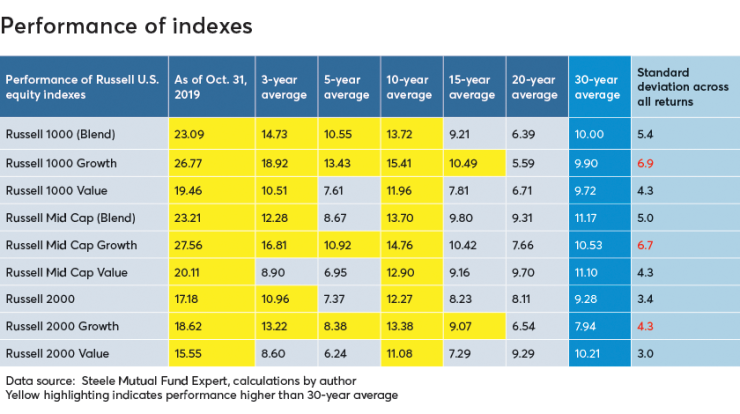

The second table, “Performance of indexes,” presents the performance of Russell U.S. equity indexes covering the large-cap, midcap and small-cap space over the same multiple time frames. In addition, there is a similar breakout of blend, growth and value index performance.

The performance results among the Russell indexes are similar to what we saw among fund category averages in terms of the time periods in which the indexes have produced results higher than the 30-year average. The one difference between the average fund performance and the index performance is the five-year period — November 2014 through October 2019 — in which several of the indexes had elevated performance relative to the 30-year average, most notably growth-oriented indexes.

If you take a macro look at the tables, it’s clear the concentration of yellow highlighting is in the October, three-year, five-year and 10-year figures. Secondly, growth-oriented funds and indexes are more “in the yellow” than blend and value-oriented funds and indexes. Growth-based funds have enjoyed more recent success than blend- and value-oriented funds, hence are more likely to suffer more as they revert toward their longer-term average performance.

There is another metric in both tables that is somewhat unique and hopefully helpful. In the far-right column we see a standard deviation calculation. This figure represents the variation among the returns for all seven time periods. While this represents an unusual approach to the calculation of standard deviation, it is actually quite revealing.

What we see is a consistent pattern in which the standard deviation for growth-oriented funds and growth-oriented indexes is higher than blend (where blend is a mix of growth and value) and value-oriented funds and indexes. This clearly suggests that growth-oriented funds and indexes demonstrate wider swings in performance based on the time period being looked at. Mutual funds and ETFs that are classified as “blend” are the second-most volatile in terms of performance variation over different time periods, while value-oriented funds and indexes have the least amount of time-period performance variation.

Compare Different Time Periods To Gauge Reliability

What’s the takeaway from all this? There is considerable risk in showing clients the performance of growth-oriented funds or indexes over only one time period — regardless of the length of the period. That being said, the longer the time period, the better. The amount of performance dispersion among growth-oriented funds demands that multiple time periods be shown to clients so they can see for themselves the fickle nature of growth-based performance swings. They need to see the amount of variance that exists in order to be prepared for volatility.

Value-oriented funds, on the other hand, demonstrate a narrower range of performance variation. This does not suggest that citing performance over only one time period is recommended, but it is certainly less distorting than showing only one time period for growth-based funds.

One example will clearly illustrate this. In “Performance of indexes” we see a 30-year return of 7.94% for the Russell 2000 Growth Index. The 20-year figure is 6.54%, the 15-year number is 9.07% and the 10-year return is 13.38%. This is quite a range. By comparison, the Russell 2000 Value Index had a 30-year return of 10.21%, 9.29% over 20 years, 7.29% over 15 years and 11.08% over 10 years.

We still see dispersion across the various time frames, but far less compared to the growth index.

Performance reporting is always time-period dependent, so to be fair to our clients, it makes sense to report performance over a range of time periods, particularly for funds or indexes that have a growth tilt.