The new tax law signed last December may affect the way advisors and clients evaluate the pros and cons of Roth conversions.

Among the biggest changes: Beginning in 2018,

Consequently, the discussion around Roth conversions has changed. Clients require more advice, and advisors must conduct more careful analysis before making recommendations.

Here are how some of the benefits and drawbacks of Roth conversions changed under the tax law.

BENEFITS UNDER THE NEW TAX LAW

The upfront tax bill is lower. Roth conversions have long been seen as beneficial for clients primarily, because they create retirement accounts that are free from future income taxes. That said, they aren’t entirely without costs.

The tax bill has to be paid upfront, after all, and that is the No. 1 stumbling block for most people.

Now that income tax rates are lower, though, Roth conversions are more attractive, because it will cost less for clients to convert their funds in a lower bracket. The standard deduction has been doubled, and many other deductions were eliminated or rolled back.

As a result, many more clients will take the standard deduction.

The combination of the higher standard deduction and lower rates may make Roth conversions less taxing. Look specifically at clients who may not be using the full effect of the standard deduction.

For example, a married couple can go up to $165,000 of taxable income before they leave the 22% tax bracket in 2018. And the 12% bracket covers income up to $77,400.

Clients who are still wary of the upfront tax bill could also consider beginning an annual series of smaller Roth conversions over the next 10 years or so, to lessen the tax impact each year.

Overall, it looks like we have hit rock bottom for tax rates, making today’s Roth conversions even more valuable for clients in retirement.

Roth IRAs are now be free of estate taxes for most clients. In addition to offering tax-free income in retirement, Roth IRAs are also free of estate taxes for most clients now that the new law increased estate tax exemptions to $11.2 million per person and $22.4 million per couple in 2018.

This means clients are able to pass more funds on to their beneficiaries tax-free.

But note: These increases may be temporary. After 2025, the law brings these amounts back to pre-2018 levels, which are half the 2018 amounts.

Clients can gift more, too. Near the end of every year, clients ask about gifting limits. The annual gift exclusion for 2018 is $15,000 per person, per year.

This amount can be gifted to anyone without cutting into the lifetime exemption. But now since the tax law has increased the lifetime gift tax exemption for 2018, the limiting of gifts to only $15,000 per person is irrelevant to most clients.

Gifts far in excess of the $15,000 annual exclusion amount won’t be an issue for clients with estates nowhere near those eye-popping eight-figure amounts.

For Roth conversions, this makes it easier to gift funds to family members to pay the tax on Roth conversions or to make Roth individual retirement account contributions, without worrying about any gift limits. This can help younger family members begin building Roth IRAs.

It can also help the other way.

For example, a high-income client can gift money to her 75-year-old dad, to help dad pay the taxes on converting his IRA to a Roth (after taking the required minimum distribution, which cannot be converted) and later leave the Roth IRA to her. This way, RMDs are eliminated for the rest of dad’s life, allowing the Roth to grow un-eroded by taxes and to pass to your higher-bracket client, income-tax free, keeping that income off future year’s tax returns.

Leave more tax-free funds to grandchildren. Lawmakers not only raised the bar for estate taxes, they also raised it for generation-skipping transfer taxes, freeing the way for more Roth IRA funds to be passed tax-free to grandchildren. As with the estate tax, the GST tax exemption is now also $11.2 million for individuals and $22.4 million for couples.

One word of caution here, though: Clients with large estates should be aware that the GST tax exemption is not portable like the estate tax exemption is. If the full GST exemption is not used, it could be lost.

Look at conversions to leave Roth IRAs to grandchildren, and take advantage of the new increased GST exemption.

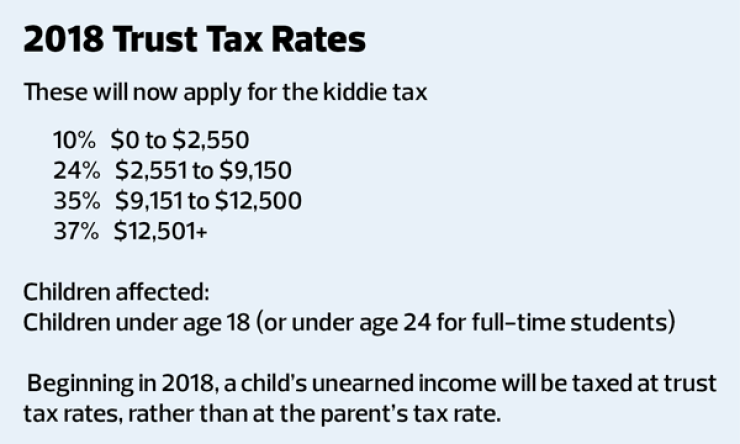

Conversions can be used to reduce “kiddie taxes.” Roth conversions are more valuable for clients who, may be subject to the new so-called “kiddie tax” rules, which apply to children under 18 and full-time college students under 24.

The new tax law changes the rules, where children will now have their unearned income (like interest and dividends — not wages) taxed at trust tax rates instead of at the parent’s rate. The 2018 top trust rate of 37% applies when taxable income exceeds just $12,500.

There is no change if the parents are already at the top tax rate, but if the parents are not at the top tax rate, the child’s unearned income can quickly become taxable at higher rates than the parents’ own income.

This could affect say a grandchild who inherits a large IRA held by a trust. The RMDs are unearned income and could trigger the kiddie tax.

A Roth conversion could eliminate the trust tax on those RMDs when the children inherit, because Roth IRA RMDs will be tax-free, even if they are held in the trust. Also, excluding that RMD income could keep the child’s other unearned income from reaching the top rates.

In addition to the new kiddie tax benefit, Roth conversions have always been a good strategy to eliminate trust taxes for any beneficiary when a trust is named as the IRA beneficiary.

ROTH CONVERSION DRAWBACKS UNDER THE TAX LAW

Conversions can no longer be undone. As mentioned earlier, lawmakers did away with a key provision that previously allowed Roth conversions to be reversed. Given that new limitation, clients should probably hold off on conversions until later in the year when they have a more precise estimate of their 2018 income and tax burden.

This will involve coordination with the client’s CPA or other tax advisors.

Unless the client is sure about having the funds to pay the conversion tax, I suggest not doing a Roth conversion until after Thanksgiving, but before Dec. 15, because after that, the financial institutions that have to process these conversions will be swamped with end-of-the-year transactions. Last year, some of the biggest custodians cut off year-end transactions as early as Dec. 21.

The timing coincides with a raging bull stock market. The roaring stock market complicates the timing of a Roth conversion in 2018. Some clients may be worried about converting their funds when values are high, without the ability to undo a Roth conversion.

This is something that advisors must address with clients and document those conversations.

But advisors also need to remind clients that retirement is a long-term plan and the value of tax-free compounding also has to be factored into the equation.

-

Advisors should contact every client who did a Roth conversion in 2017 to discuss a key change in tax regulations, Ed Slott says.

December 4 - FP magazine

It’s the Roth’s 20th birthday. Where is everyone?

November 20 -

IRA balances are up, and so are divorces, particularly among baby boomers. These so-called gray divorces have roughly doubled over the past 25 years, according to the Pew Research Center.

August 31

A conversion increases income. Although tax rates are lower, Roth IRA conversions nevertheless increase income in the year when they take place, resulting in one-time tax hit. Roth conversions are not subject to the 3.8% net investment income tax, but adding the conversion to their income could trigger the tax on other income subject to the 3.8% tax, for the year of the conversion.

Again, remind clients to look more at the long-term tax benefits.

Can I trust the government? That is still the No. 1 question that consumers ask me at every program. They want to know that if they pay the tax upfront, will the government keep its promise and never tax these funds again?

No one knows, and anything can happen when Congress gets hungry for revenue, but my answer is “Yes, the tax-free Roth IRA is here to stay.”

Why am I so sure? It brings in money for Uncle Sam!

Over the years, Congress has expanded the use of Roth IRAs as a revenue-raiser to pay for other parts of the tax bills. That is why in 2010, Congress removed the income limitation and filing status restrictions for converting to Roth IRAs.

This alone opened the floodgates for the largest Roth conversions and brought in a fortune of tax revenue.

In their latest negotiations, lawmakers tipped their hand by proposing to increase revenue by reducing maximum deductible contributions to 401(k)s while pushing savers toward nondeductible Roth 401(k)s. So-called Rothification has yet to become reality, but you can be sure it will be proposed again as Congress looks at any and all immediate revenue sources.

In conclusion, the big message is that the tax law affects all clients and advisors can be instrumental in providing the planning advice to help them maximize the benefits.