Want unlimited access to top ideas and insights?

When the

For example, a new anti-abuse rule is designed to limit the potential for individuals to misuse the new ability to make deductible traditional IRA contributions alongside qualified charitable distributions, or QCDs,

This new rule is intended to combat relatively simple potential abuses, but it is complex in practice. Worse yet, it has the potential to reduce, or even completely eliminate, any benefits provided by the Secure Act to make deductible traditional IRA contributions at or beyond age 70 ½. For these reasons, it’s essential that advisors and planners understand the potential implications and pitfalls before giving tactical recommendations to their charitably inclined clients.

QCD basics

QCDs represent one of the most tax-efficient ways to give to charity. Such distributions allow

There is no need to itemize deductions on one’s tax return for the amounts transferred as QCDs, but that’s because the distributions get the superior tax treatment of being excluded from income, despite being distributed from a pre-tax retirement account. Accordingly, QCDs increase neither an individual’s AGI nor their final taxable income. Instead, the individual simply makes an IRA’s pre-tax value automatically disappear as a pre-tax charitable contribution.

By contrast, regular charitable contributions made from a traditional IRA would increase AGI and lower only taxable income, as and when an individual reports the charitable contribution as an itemized deduction.

Given their potential benefits, it’s no surprise QCDs are favored by many qualifying taxpayers to support their charitable inclinations. This is especially true since QCDs can also count

However, a new wrinkle introduced by the legislation may complicate matters for some IRA owners, while opening up planning opportunities for others.

Defining abuse

Gaining the ability to contribute to traditional IRAs at age 70 ½ and beyond is a clear win for many older workers, but this new benefit does come with a few strings attached.

More specifically, Congress was concerned that some people would use their ability to use their post-70 ½ deductible IRA contributions to support charities via QCDs on a pre-tax basis, rather than just make a charitable contribution and claim what may or may have been an itemized deduction

That is why Congress included an anti-abuse provision that rejects any QCD, to the extent there have been any post-70 ½ deductible IRA contributions.

Per

Instead of being treated as QCDs, any amounts disallowed as a QCD via this anti-abuse provision will be treated as a taxable distribution and subsequent regular charitable contribution. This may still produce the equivalent result of a pre-tax contribution, with the income from the IRA distribution being offset by the deduction from the charitable contribution. In practice, however, some slippage often occurs where the deduction doesn’t fully offset the impact of the income Of course, this is why QCDs have typically been more appealing in the first place.

Calculating QCD amounts

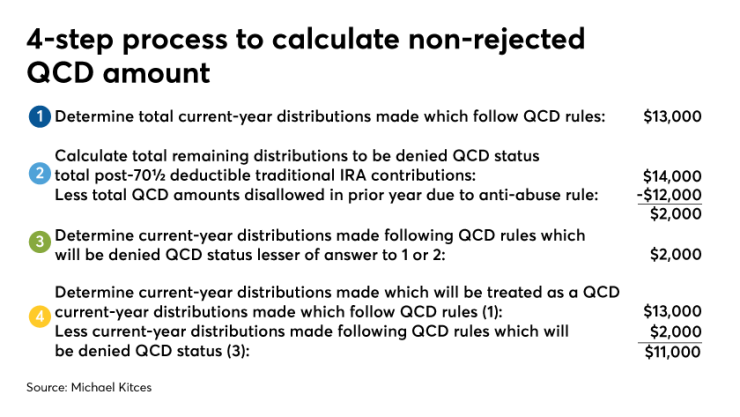

The amount of a current year distribution that would otherwise qualify as a QCD, but is rejected due to the new QCD anti-abuse rule, can be determined following four steps:

- No. 1: Determine total current-year distributions made, which follow QCD rules;

- No. 2: Calculate total remaining distributions to be denied QCD status by subtracting total lifetime rejected QCD amounts from total lifetime post-70 ½ deductible traditional IRA contributions;

- No. 3: Determine current-year distributions made following QCD rules that will be denied QCD status, which will be the lesser of the result in the two previously described steps; and

- No. 4: Determine current-year distributions made, which will be treated as a QCD by subtracting the result in step No. 3 to the result in step No. 1.

Example No. 1a: Ruby is a single IRA owner who is still working, and who will be 70 ½ on January 15, 2020. Thanks to the Secure Act’s

Thus, in both 2020 and 2021 Ruby makes a $7,000 deductible contribution to her traditional IRA, giving her a total of $14,000 of deductible traditional IRA contributions from the year she reached age 70 1/2 and onward.

In 2021 Ruby calculates the RMD for her IRA to be $12,000. Being charitably inclined, Ruby follows all the regular QCD rules and has $12,000 sent directly from her IRA to her favorite charity, thereby satisfying her RMD requirement for the year.

Despite following all the regular QCD rules, however, the $12,000 will not be treated as a QCD.

Rather, since that $12,000 is less than Ruby’s $14,000 of post-70 ½ deductible IRA contributions, the anti-abuse rules require that the entire $12,000 be treated as a regular taxable IRA distribution, followed by a regular deductible charitable contribution.

The net: At the end of 2021 Ruby has $14,000 - $12,000 = $2,000 of remaining post-70 ½ deductible traditional IRA contributions that have not already been used to reject what would have been a QCD.

Notably, while contributions made after age 70 ½ can prevent charitable distributions from being treated as QCDs, they can only do so once. Charitable distributions that exceed the amount of past contributions that have disqualified QCDs in the past can still be counted as QCDs. Once prior post-age-70 ½ contributions have been used to offset QCDs, those amounts no longer apply to the QCD calculation in future years.

Example No. 1b: Fast-forward another year to 2022. Ruby is now turning 73 and must take her second RMD, which has been calculated at $13,000. Being retired, Ruby cannot make a deductible traditional IRA contribution for 2022 — not because of her age, but simply because she has no earned income to contribute once she is actually retired.

She continues to be an active supporter of her favorite charity and as such, Ruby once again follows the regular QCD rules and has her $13,000 RMD amount sent directly from her IRA to the charity, satisfying her 2022 RMD requirement.

As was the case in the previous year, Ruby will not be able to treat the full amount of her distribution as a QCD. However, unlike the previous year, some — in fact, most — of her distribution will receive that favorable treatment.

As illustrated in the graphic above, only $2,000 — the excess of Ruby’s post-70 ½ deductible traditional IRA contribution amount that has not already offset an earlier QCD — of the $13,000 gross IRA distribution will be denied QCD status. Instead, it will be treated as a regular taxable IRA distribution, followed by a regular deductible charitable contribution. However, the remaining $13,000 - $2,000 = $11,000 will be excluded from income and still be treated as a QCD.

QCDS and LIFO

Congress worded the QCD anti-abuse provision essentially to function in a last in, first out — i.e., LIFO — manner, whereby all an individual’s post-70 ½ deductible traditional IRA contributions must come out first, rejecting any would-be QCDs before any actual QCDs can be made.

Given this restriction, it’s reasonable to wonder just how fair the anti-abuse rule is, particularly for those with existing IRA balances at the time they turn 70 ½. Such individuals who would like to make both QCDs with RMD dollars, as well as contribute to a deductible traditional IRA after 70 ½, may find themselves forced to pick one or the other.

Example No. 2: In 2021 Vance turns 72 and will have to begin taking RMDs from his retirement accounts. Vance has substantial assets in an old 401(k), which are more than enough to fund all of Vance’s spending needs. He also has an IRA that reflected a 2020 year-end balance of $179,200.

While Vance plans to keep his 401(k) dollars for personal use, he has long planned to give his IRA RMDs to charity via QCDs. As such, Vance’s intention is to give his $179,200 account balance ÷ 25.6 life expectancy factor = $7,000 IRA RMD for 2021 to charity.

However, suppose that Vance becomes bored with retirement and decides to take a part-time job that will earn him $20,000 in 2021. Vance doesn’t need the money, so he’d like to take advantage of the Secure Act’s provision to make a deductible traditional IRA contribution.

Unfortunately, Vance cannot accomplish both of these goals. Instead he must decide to make either a deductible traditional IRA contribution or make a QCD with his $7,000 RMD.

Despite the fact that Vance has a $7,000 IRA RMD at the start of 2021 and nearly $180,000 of existing IRA dollars before he makes any post-age-70 ½ deductible traditional IRA contributions, as soon as he makes one such amounts will reject an equivalent amount of distributions that would have otherwise qualified as a QCD. Suppose now that Vance does not make a deductible traditional IRA contribution for 2021. His 2021 RMD of $7,000 consequently can be directed toward charity and treated as a QCD.

The moment Vance decides to make a deductible traditional IRA contribution of $7,000 for 2021, the nature of that distribution changes, as the first $7,000 of Vance’s distributions that would otherwise qualify to receive QCD treatment is rejected, and no longer able to be treated as such.

This is especially important for Vance if he does not benefit from itemizing his charitable donation due to the standard deduction amount exceeding what he would be able to claim as itemized deductions in the first place. The $7,000 charitable donation he would make from his RMD consequently would benefit him neither as a tax-free QCD nor as an itemized deduction. And even if Vance does itemize, the rejection of the QCD would still result in higher AGI — followed later by an itemized deduction for a charitable contribution — which could impact Vance’s other deductions, credits, Medicare Part B/D premiums, etc.

The fact that Vance had plenty in his traditional IRA is irrelevant, as such funds are essentially ignored until the total amount of post-70 ½ deductible traditional IRA contributions has been distributed as a would-be QCD.

It seems somewhat unfair that Congress would choose to ignore all the other dollars in an individual’s traditional IRA until all post-70 ½ deductible traditional IRA contributions have been used to reject a QCD — especially when Congress has applied pro-rata formulas to traditional IRA distributions in other circumstances, e.g., when determining how much of a distribution comes from non-deductible IRA contributions. But as they say, it is what it is.

Why include it?

Given the outcome described above, it’s only natural to wonder if the anti-abuse rule was really necessary. The answer is, “probably.”

When it comes to the Internal Revenue Code, it’s fair for Congress to assume that where a so-called loophole or other gap in the tax law exists, taxpayers will attempt to drive a proverbial Mack truck through it. Finding, using and maximizing those gaps is the principal job of many tax professionals and a significant component of the role many advisors play, after all.

Bearing this in mind, one can begin to understand why Congress crafted its anti-abuse rule. Without it an individual could make a deductible traditional IRA contribution, as well as make QCDs, and skirt the limitations of regular charitable contributions by using a deductible traditional IRA contribution essentially to make a charitable contribution.

Interestingly, Congress only seems to take issue with post-70 ½ deductible traditional IRA contributions, as such a contribution made in an individual’s age-69 year could be used to make a QCD without fear of running into the QCD anti-abuse rule in future years.

Regular charitable contributions only provide a benefit — at least for federal income tax purposes — if an individual has enough total itemized deductions to exceed their standard deduction ($24,800 for joint filers and $12,400 for single filers in 2020, plus an additional standard deduction amount of $1,300 for individuals 65 and older).

Even when itemized deductions exceed the standard deduction, charitable contributions are considered below-the-line deductions that have no impact on AGI, to which most income-related benefits — e.g., credits phased out at various income levels and/or additional costs such as Medicare Part B/D income-related monthly adjustment amounts, or IRMAAs — are tied.

By contrast, the deduction for an IRA contribution is considered above the line. It is therefore available whether the taxpayer itemizes deductions on their return or not, and has the power to reduce not only taxable income but AGI as well, thus potentially decreasing AGI-based costs.

As such, absent the anti-abuse rule individuals could use a traditional IRA deductible contribution and QCD “combo” to artificially depress AGI, or even to receive a potential reduction in taxes for a gift to charity when one would not have otherwise been available.

Example No. 3: In a hypothetical alternate reality, a bill almost identical to the Secure Act passes into law. The sole difference is that the hypothetical one contains no QCD anti-abuse provision.

Johnny, a single IRA owner who is still working, will be 74 on June 12, 2020. He does not typically contribute to his traditional IRA but makes roughly $2,000 in annual charitable contributions.

Prior to making any contributions for 2020, Johnny has $6,000 of itemized deductions, and as such — even after making $2,000 of charitable contributions — would use the standard deduction and not actually receive any benefits from his itemized charitable deduction.

However, if Johnny uses the hypothetical combo described earlier, Johnny could make a deductible IRA contribution of $2,000 to his traditional IRA, which would serve as an above-the-line AGI reduction, and then immediately turn around and distribute $2,000 from his traditional IRA as a non-income-generating QCD. The result? The IRA distribution is excluded from taxable income.

This would essentially give him an above-the-line deduction for a charitable contribution in a scenario where he could not have otherwise claimed a below-the-line charitable deduction. As an added benefit, the $2,000 would count toward satisfying some or all of Johnny’s RMD requirement for the year.

In the real world, the QCD anti-abuse provision included in the Secure Act prevents this sort of thing from happening.

Of course, the counterpoint to the argument is that the only way an individual can run into the rule is by giving money to charity via their IRA. And if everyone could always fully claim their charitable contributions for full value as a below-the-line deduction, QCDs wouldn’t produce any net benefit. This means encouraging such behavior, where a QCD is used in lieu of an itemized charitable deduction, is precisely why the QCD was created in the first place.

So, is the possibility that someone might receive a relatively small tax benefit when one otherwise may not have been available — for what ultimately amounts to a charitable contribution — really worth introducing a complicated, burdensome anti-abuse rule that could potentially discourage amounts from being given to charity in the first place?

Congress apparently thought so.

Planning strategies

Regardless of which side of the debate you fall on, the rule will now be enshrined as

Potential options to consider should include both those designed to help individuals who may have already made transactions that will subject them to the QCD anti-abuse rule, as well as strategies designed to help those who may want to contribute to retirement accounts later in life and make QCDs to work around the anti-abuse rule, such that they can have their cake and eat it too.

Advisors should also be certain to understand how to identify who will be adversely impacted by the rule, and who won’t. Indeed, some taxpayers will already be able to itemize their charitable contributions as deductions anyway, so their net impact will be limited.

If an individual wishes to make QCDs with existing IRA money, one option would be to remove traditional IRA contributions to the extent possible by using the excess contribution rules. While these rules generally apply to contributions that cannot be in an IRA or another retirement account, they may also be called on to voluntarily remove legally permissible contributions that the account owner no longer wants there.

The deadline to voluntarily remove an unwanted excess contribution is October 15 of the year following the year for which the contribution was made. Thus, if an individual makes a post-70 ½ deductible traditional IRA contribution on March 5, 2020, and later determines that such a contribution is not in their best interest because of its impact on a potential future QCD, the contribution, along with any earnings or losses, can be voluntarily removed up until October 15, 2021.

Burn rate

The ability to make post-70 ½ contributions to traditional IRAs was only first allowed beginning for the 2020 tax year. Thus, until October 15, 2021, any unwanted traditional IRA contributions impacting future QCDs can be fixed by removing them from the account using the excess contribution strategy discussed above.

However, beginning October 16, 2021, any IRA contributions made for 2020 will no longer be able to be voluntarily removed. What, then, is the next best thing?

For many charitably inclined individuals, the answer may be to make rejected QCDs. By doing so, such individuals would be able to burn through their QCD-rejecting post-age-70 ½ deductible traditional IRA contributions to eventually get back down to the IRA money that can be used to make QCDs — i.e., everything other than amounts attributable to post-age-70 ½ deductible traditional IRA contributions.

And even though initial, QCD-like distributions will be rejected and won’t actually be treated as QCDs until an individual has burned through all via previous post-70 ½ deductible IRA contributions, a plain reading of the anti-abuse statute, created by the Secure Act, would seem to indicate that the only way to burn through such amounts and return to the untainted IRA money is to make such rejected QCDs.

Recall that Section 107(b) of the Secure Act states in part:

“Add at the end of section 408(d)(8)(A) of such Code the following: ‘The amount of distributions not includible in gross income by reason of the preceding sentence for a taxable year (determined without regard to this sentence) shall be reduced…’”

Restated in plain language, the above provision implies, “If something was going to be treated as a QCD, don’t treat it as such,” until the amount of cumulative rejected QCDs is equal to the cumulative amount of post-70 ½ deductible traditional IRA contributions.

It would stand to reason then that if something were not treated as a QCD, this particular provision would not come into play. Thus, an individual never would burn through any amounts attributable to deductible traditional IRA contributions. Therefore, the ability to make a QCD would continue to be impacted in the future.

Viewed another way, the QCD anti-abuse rule causes the QCD to be deemed an IRA distribution, followed by a separate charitable contribution. This of course is something an IRA owner can simply do anyway. However, for those who have RMD obligations and make charitable contributions, it can still be valuable to knowingly do the disallowed QCD for substantively the same tax outcome, because doing so burns through the disallowed QCD amounts and gets closer to permissible QCDs in future years.

Example No. 4: In November 2022 Charlie — age 75 and, since 2021, a retiree — is planning to take his RMD for the year. In 2020 and 2021 Charlie made deductible contributions of $7,000 each year to his traditional IRA for a total of $14,000 of post-70 ½ deductible traditional IRA contributions.

After calculating his RMD for 2022, Charlie determines that he must take a distribution of at least $10,000. Furthermore, Charlie has always been charitably inclined, and has decided to use his annual IRA RMD to satisfy his charitable intent.

Suppose that Charlie learns of the QCD anti-abuse rules. Even if he follows them, his distribution of $10,000 will not be eligible to be treated as a QCD because it is less than the $14,000 of post-70 ½ deductible traditional IRA contributions that have not previously rejected a QCD. Given this limitation, Charlie might be tempted to take his RMD per the usual, and then write a check of $10,000 to his favorite charity.

Doing so would result in the exact same tax treatment for that year as if he had followed the QCD rules, but had been denied that treatment by virtue of the Secure Act’s QCD anti-abuse rule. In each case, the $10,000 distribution would have been added to Charlie’s gross income, and Charlie would have been eligible to claim a $10,000 charitable contribution as an itemized deduction.

But by not following the QCD rules in 2022 — even knowing the QCD treatment would not be received that year — Charlie limits his planning opportunities in future years. More specifically, since Charlie has yet to make a rejected QCD, he has yet to burn through any of the post-70 ½ deductible traditional IRA contribution amounts he must exhaust before being able to make an actual QCD.

To see how this limits Charlie’s tax planning opportunities, suppose that in the following year, 2023, he once again has a $10,000 RMD amount, which he again decides to donate. This time, however, Charlie follows the QCD rules.

Unfortunately, this distribution will also fail to receive favorable QCD treatment. Though Charlie has already used $10,000 of IRA distributions to fund charitable contributions in the previous year, that distribution was not made following the QCD rules. Consequently, Charlie has yet to burn through any of his total of $14,000 of post-70 ½ deductible traditional IRA contributions.

Thus, while Charlie’s 2023 RMD would reduce that $14,000 amount down to $4,000 due to the $10,000 rejected QCD for that year, it would still be treated as a distribution includable in gross income, followed by a $10,000 charitable contribution includable in itemized deductions.

By contrast, if Charlie had followed the QCD rules with respect to both the 2022 and 2023 distributions, the 2022 distribution of $10,000 would have reduced the $14,000 total of post-70 ½ deductible traditional IRA contributions down to $4,000.

The subsequent $10,000 distribution in 2023 furthermore would have wiped away the remaining $4,000 — treated as a distribution includable in gross income, followed by a $4,000 charitable contribution includable in itemized deductions — and still would have been eligible to be treated as a $10,000 - $4,000 = $6,000 QCD.

Couples can conquer

Recall that QCDs are only reduced by “the aggregate amount of deductions allowed to the taxpayer under section 219.” That’s critical, because while couples may plan for their retirement together, IRAs and other retirement accounts can only be owned by a single individual. And only that individual, i.e., the taxpayer, can receive a deduction for a contribution made to their traditional IRA, even if that deduction is reported on a joint income tax return.

Some couples who would like to make QCDs and post-70 ½ deductible contributions to a traditional IRA may choose to keep things simple by using a divide and conquer approach, where one spouse makes post-70 ½ deductible contributions to their traditional IRA and the other makes all the couple’s QCDs from their traditional IRA — with perhaps Roth IRA or non-deductible traditional IRA contributions being made to their accounts as well. The end result is that the spouse making QCDs would not be impacted by the Secure Act’s anti-abuse rule, because the other spouse made the disallowing post-70 ½ deductible IRA contributions.

It may not be perfect, but it’s simple. And it’s still one more deductible traditional IRA contribution that can be made each year than would have been allowed before the Secure Act.

Clearly, it behooves advisors to speak to clients who are still working and 70 ½ or older, and who may wish to make QCDs now or at some point in the future. What follows are potential strategies to avoid the anti-abuse rule altogether.

Non-QCD donations

Perhaps the easiest way to avoid the QCD anti-abuse rule is simply to avoid making QCDs. Instead, other tax-efficient methods of giving to charity can be considered, such as

For those who already itemize deductions on their income tax return prior to making any charitable contributions — or are, at least, close to being able to do so — this may be a viable alternative to consider.

Unfortunately though, when

Consider a married couple, both spouses aged 72. In 2020 they have $10,000 of itemized deductions before making any charitable contributions for the year. Such a couple’s standard deduction would be $24,800 + $1,300 for the first spouse over age 65 + $1,300 for the second spouse over age 65 = $27,400. Thus, it would take more than $17,400 of charitable contributions before the couple would see any tax benefit in the form of a higher deduction.

Few couples in similar situations are likely to be so charitably inclined, regardless of whether the source of the contribution is cash or appreciated stock. And as such, the QCD remains exceedingly valuable in the post-tax-legislation world.

But for those who do have enough deductions to get over the standard deduction line — or can

This is especially true given that with highly appreciated securities, the tax benefits of donating investments with significant capital gains can actually be worth more than the QCD for some taxpayers, thanks to both the charitable deduction and the foregone capital gains.

Employer-sponsored plans

The anti-abuse rule requires that QCD amounts be reduced by “the aggregate amount of deductions allowed to the taxpayer under section 219.” And notably, IRC Section 219 provides for the deduction of contributions made to traditional IRAs.

Consequently, one logical option for individuals 70 ½ or older who want to lower their taxable income via contributions to a retirement account is to make those contributions to a retirement account that is not a traditional IRA

Those individuals 70 ½ or older who work for a company over which they exercise no control will be at the mercy of the company when it comes to whether income-lowering employer retirement plan contributions can be made. If there isn’t a 401(k) or similar option provided by the company, there’s simply not much if anything they’ll be able to do about it.

However, if the employer offers such a plan, workers 70 ½ or older can feel free to contribute to the plan without running afoul of the IRA QCD anti-abuse rules.

Of course, many older individuals who are still working are business owners who have complete control when it comes to offering a retirement plan — and if so, the type of plan. If such individuals have thoughts of making QCDs at some point or would like to retain the flexibility to do so, then any deductible contributions should be channeled first through an employer-sponsored retirement plan.

In general, small business employer retirement plan options include not only 401(k)s and other qualified plans, but also SEP IRAs and SIMPLE IRAs. Notably though, SEP and SIMPLE IRAs follow many of the IRA rules, such as there not being any exception for working beyond age 72. However, they do not receive deductions under IRC Section 219, instead coming from various other locations in the Internal Revenue Code.

Contributions to such plans consequently will not subject an individual to the IRA QCD anti-abuse rules, and thus are effectively treated more like non-IRA employer retirement plans.

Roth IRA contributions

What if no employer retirement plan option is available, or contributions to those plans have already been maxed out? In such cases it’s necessary to turn to IRAs.

Thankfully, the new anti-abuse rules don’t apply to just any old IRA contributions. Rather, as noted previously, QCDs are only be reduced by “the aggregate amount of deductions allowed to the taxpayer under Section 219.”

As a result, one easy way to avoid having to deal with the QCD anti-abuse rule is to avoid taking a deduction for an IRA contribution. To that end, while contributing to a traditional IRA and just not claiming the deduction is an option, contributions to Roth IRAs are never eligible for a deduction — and therefore will never result in an individual running afoul of the anti-abuse rules. The other obvious benefit for the Roth IRA is that the

Roth IRAs, however, continue to have income limits that can prevent an individual from making such contributions. As such, high-income individuals 70 ½ and up will need to explore other alternatives.

Skipping the deduction

While contributions to Roth IRAs may only be made by those with compensation but whose total modified AGI is below an applicable threshold, anyone with compensation can make a contribution to a traditional IRA. The AGI limits for traditional IRAs merely determine whether the contribution is deductible or not.

Generally, a deduction is available for any contribution made to a traditional IRA — though as noted earlier, that deduction is phased out for individuals with income that exceeds an applicable threshold, and who actively participate and/or have a spouse who actively participates in an employer-sponsored retirement plan.

But while such a traditional IRA contribution deduction may be available, there is no rule that requires an individual to claim it. Instead, an individual can opt not to claim a deduction for such a contribution and classify the amount as a non-deductible IRA contribution, reportable on

In general, claiming a deduction for a traditional IRA contribution is the right move. However, given the introduction of the anti-abuse rule, individuals 70 ½ and up have some incentive to buck conventional wisdom, and consider not taking the deduction — voluntarily.

This potential strategy is enhanced somewhat by QCDs only being made with pre-tax dollars — an exception to the

Example No. 5a: Mason is a 73-year-old single taxpayer with $150,000 of AGI from employment, Social Security benefits and other sources. This is prior to making any traditional IRA contributions, and prior to taking his RMD of $10,000 for the year from his traditional IRA consisting entirely of pre-tax dollars. Due to his income, Mason is prohibited from making a Roth IRA contribution.

Suppose that Mason decides to make a $7,000 deductible IRA contribution for 2020. In addition, Mason decides to use his $10,000 RMD to support his favorite charity. As such, he has his $10,000 RMD transferred directly to charity and follows all of the QCD rules.

Although Mason’s AGI will be reduced by $7,000 due to his deductible traditional IRA contribution, the anti-abuse rule will negate an equal amount of his RMD distribution from QCD treatment, thus causing it to be included in his AGI. As a result, Mason’s ending AGI is $150,000 - $7,000 contribution deduction + $7,000 denied QCD = $150,000, i.e., the same as it was before making the contribution and attempted QCD.

the QCD anti-abuse rule causes the QCD to be deemed an IRA distribution, followed by a separate charitable contribution.

Even with the $7,000 denied-QCD amount counting as a charitable contribution, if we assume that Mason claims the standard deduction, the result is taxable income for the year of $150,000 - $13,700 (standard deduction for single over 65) = $136,300, meaning the pre-tax value of the QCD is lost. Additionally, since all of Mason’s traditional IRA money was pre-tax and he claimed a deduction for it this year, all of Mason’s remaining balance is still entirely pre-tax.

But what would have happened had Mason simply chosen to forgo the deduction for the IRA contribution he made?

Example No. 5b: Sylvia is Mason’s twin sister, and therefore also 73. She too is single and has an identical $150,000 of AGI from work, Social Security benefits and other sources prior to making any traditional IRA contributions, and prior to taking her RMD of $10,000 for the year from her traditional IRA consisting entirely of pre-tax dollars. Due to her income level, Sylvia is prohibited from making a Roth IRA contribution.

Suppose that Sylvia decides to make a $7,000 traditional IRA contribution for 2020. Unlike her brother though, Sylvia voluntarily decides to forgo taking a deduction.

This is the only difference between them, as Sylvia also decides to use her $10,000 RMD to support her favorite charitable organization. As such, she has her $10,000 RMD transferred directly to charity and follows all the QCD rules.

Sylvia’s AGI is not reduced by any amount for her $7,000 non-deductible IRA contribution, but because Sylvia did not take a deduction for that contribution, she is not subject to the Secure Act’s anti-abuse rule. Thus, her entire $10,000 RMD is treated as a QCD and does not increase her income. Sylvia’s AGI is, therefore, $150,000 — the same as Mason’s.

Like her brother Sylvia also claims the standard deduction. As such, her taxable income for the year of $150,000 AGI - $13,700 (standard deduction for single over 65) = $136,300, i.e., the same as Mason. But recall that Sylvia did not take a deduction for her traditional IRA contribution, and therefore she now has $7,000 of after-tax non-deductible money in her traditional IRA that will be distributed back to her over time, tax-free.

It seems odd that one might benefit in such a manner by rejecting an otherwise allowable deduction. But as these examples show, it is precisely what can happen. If such contributions are made continuously over a number of years, and perhaps even by both spouses of a married couple, the cumulative tax savings by forgoing the otherwise allowable deductions could reach well into the tens of thousands.

Ultimately, the Secure Act’s repeal of the maximum age for making traditional IRA contributions should be welcome news for the roughly 30% of workers today who continue to work beyond age 70. And while the anti-abuse provision introduces difficulty in some situations — and impossibility in others — planning strategies exist that can help individuals mitigate the rule’s impact.

Even by simply forgoing allowable deductions in the first place — an approach that in just about any other situation would amount to a tax planning sin — the reward for understanding the new QCD rules can show up right in the client’s portfolio.

Jeffrey Levine, CPA/PFS, CFP, MSA, a Financial Planning contributing writer, is the lead financial planning nerd at