The breach of privacy wrought on a global scale by the so-called Paradise Papers calls a key benefit of offshore assets into question, experts say.

The objectives of secrecy, asset protection and tax avoidance attract high-net-worth and ultrahigh-net-worth clients to offshore planning methods.

The International Consortium of Investigative Journalists, which

-

The UHNW world is jolted by unwanted offshore disclosures and prominent executives are finding themselves in an uncomfortable spotlight.

November 9 -

The accounting method can deliver attractive savings, along with protecting nature or farmland.

April 7 -

The IRS is about to get an unprecedented look at bank accounts and investments U.S. citizens hold abroad, through a law that is making it harder to hide assets from the tax collector.

July 1

Equifax's data breach may be the most serious, given that it covered 143 million consumers and involved reams of confidential information, but it wasn't the largest. Following are the biggest to date.

Offshore shelters remain attractive to wealthy clients, despite steep reporting requirements and expenses, says Justin Miller, a national wealth strategist with BNY Mellon Wealth Management. The Paradise Papers should caution HNW and UHNW clients and their advisors, he says.

“It does highlight the risk of using offshore structures. One of those risks is that those offshore financial institutions are not subject to the same regulatory requirements as, say, a U.S. financial institution,” Miller says. “In the last several years, we’ve already seen a tremendous drop in U.S. persons using offshore structures for several reasons.”

WHAT’S LEGAL, WHAT’S NOT?

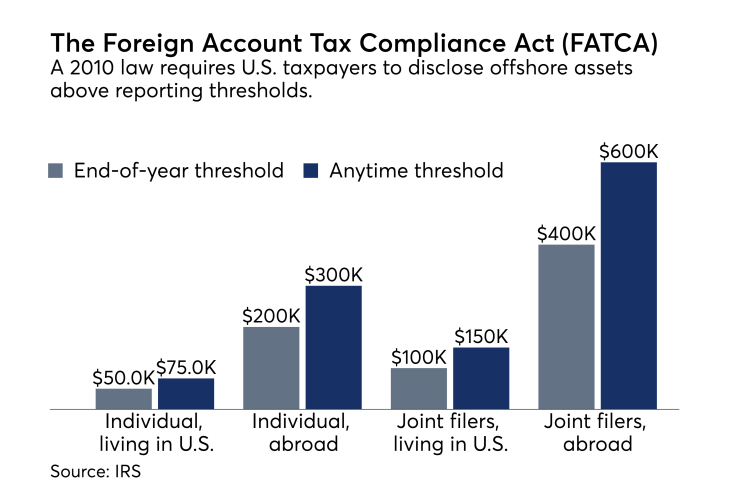

Bulked-up disclosure under the Foreign Account Tax Compliance Act and mandatory Reports of Foreign Bank and Financial Accounts drove much of the reduction, according to Miller. Failure to report offshore assets “could lead to substantial monetary fines and even potential criminal liability,” he adds.

Several breaches of ultrawealthy clients’ offshore information have divulged the offshore holdings of celebrities, politicians, major companies and business figures. The latest one included the Queen of England, Madonna, Justin Timberlake and U2 frontman Bono. The offshore assets of Trump administration officials

Clients with offshore assets who disclose them appropriately and pay their taxes have done nothing illegal, however. Neither NAPFA nor FPA takes an official stance on offshoring, and a spokesman for the CFP Board says the certification and standards-setting organization doesn't directly address it.

In a series of statements, Appleby has apologized to its clients.

“We take client confidentiality extremely seriously and we are disappointed that the media has chosen to use information which has emanated from material obtained illegally,” the firm said. “This has very little to do with accurate and fair reporting, and everything to do with the pursuit of a political agenda.”

KEY TAKEAWAYS

The most recent data dump won’t prompt the industry to back away from offshore methods, says attorney Christopher Denicolo of Clearwater, Florida-based estate planning practice Gassman, Crotty & Denicolo. He too says he has seen a drop-off in the use of offshoring, though.

Domestic asset protection in states like Nevada, Alaska, Delaware and South Dakota provides U.S. families with much of the same advantages, Denicolo says. Offshoring demands a good but expensive team including an advisor, tax attorney and an accountant, plus they carry big risks.

“Domestic trusts have become more popular. I find that it’s easier to convince a client to go to domestic asset protection rather than go offshore,” he says. “It’s just becoming extremely difficult to preserve confidentiality.”

Clients exposed in a breach must immediately try to shut down their accounts or get a new account number, says John Ceparano, an Inverness, Florida-based partner with Modera Wealth Management. The Paradise Papers present more of an issue of data security than one of legality, he writes in an email.

“I believe people will begin to ask more questions about the security of their data. As long as individuals are involved there will be leaks. All it takes is one disgruntled employee on the day they resign, wanting to make a statement and we get, most recently, President Trump’s Twitter account being shut down,” he says. “When this incident dies down people will still be looking for ways to reduce their ‘global taxes’ by finding lower taxing jurisdictions or offshore accounts.”