Tom Bradley, the new face of Charles Schwab’s sub-$100 million RIA base, says his phone lit up a few days before Thanksgiving — soon after Schwab

On the line was Bernie Clark, head of Schwab Advisor Services. About two weeks later, “I owned [a] property in Dallas, Texas,” Bradley said in an interview with Financial Planning in Schwab’s New York corporate office Wednesday. “It all happened very quickly.”

Nearly two months into the new role, Bradley is in charge of what he calls Schwab’s “core group” of advisors. He will also oversee the combination of Schwab and TD Ameritrade’s custodial divisions. His biggest challenge? Convincing small advisors that Schwab does indeed care about their business, he says.

On its platform, Schwab has approximately 4,500 RIAs that manage less than $100 million in assets — advisors Bradley says he hesitates to call “small.” Should its acquisition of TD Ameritrade, still pending

Schwab has “a very specific strategy around how we service these advisors,” he says.

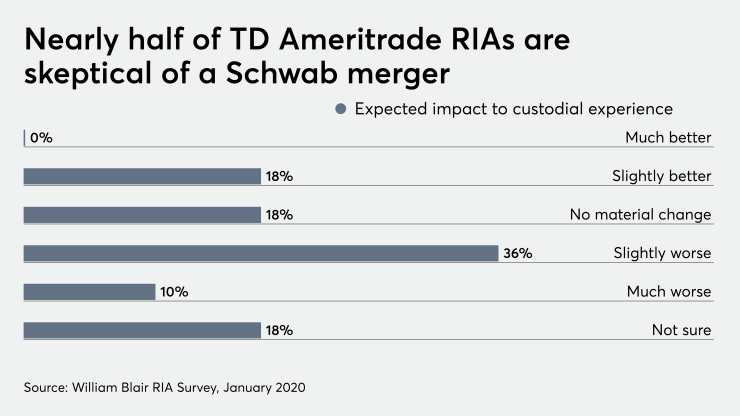

Advisors have expressed worry about the acquisition, citing concerns over

Still, what may have been advisors’ greatest fear was squashed when TD Ameritrade’s Tom Nally said clients will

Bradley has his sights set on growing Schwab’s client base and is harnessing sales teams to attract teams from wirehouses, captive firms and independent BDs. He declined to provide a numeric annual aim, but said that Schwab “raises our goals every year.”

He also defends Schwab from those who say Schwab is disinterested in smaller RIAs, adding that the company is improving service to small advisors. Yesterday the firm

When asked which advisors are directed to general call centers, rather than being assigned specific service representatives, Schwab’s custodial executive Clark, who was also in the interview, said this was a better solution for smaller advisors.

“When you're ... calling four or five times a week, it makes no sense for you to wait to talk to the same person,” Clark says, noting it was more efficient to speak to someone who could help immediately. “Generally, you don't really seem to care who you get on the phone. You just want your question answered and you want to go back to your business.”

Larger RIAs, who tend to have more complex businesses and clients, need to call more often, Clark says. “I had one advisor tell me they think they called us a hundred times a day.”

Bradley has built a reputation as an

“He decided he wanted to go a different direction, so he did, and I left the company,” Bradley says, referring to Hockey, but not naming him specifically. He has spent the last two years working with private equity firms, he says.

Now Bradley intends to use his TD Ameritrade experience to lead its integration with his new employer, a custodian he says shares “very important similarities in culture” in terms of putting the client first and moving quickly.

But while the discount brokerages and custodians may serve similar client needs, they’re two separate companies.

“If you want to pull a difference out of me, I would say it would be the focus on trading,” he says, noting that retail clients tend to be active traders and more advisors use derivatives.

Most of all, Bradley wants to reiterate what he says has long been a focus.

“The smaller advisor will be taken care of,” Bradley says.