The more successful your clients, the more they need complex tax considerations incorporated into their overall financial plans. Whether you’re timing charitable contributions, harvesting tax losses, preventing a bump to a higher tax bracket or planning a 199A deduction for flow-through entities, a fluent understanding of a plan’s tax ramifications adds tremendous value to a financial planning relationship.

As Justin Harvey, founder of Quantifi Planning in Philadelphia points out, sometimes planners just need to know what they don’t know. “People will always need advice around taxes, and you need to know enough to know when you’re out of your depth,” he says.

But if you’re not a certified public accountant, you may not be comfortable giving tax-planning advice. “It’s a skill set apart from investing,” says Charles Adi, a planner at Blueprint 360 in Houston. “You don’t want to open yourself up to the possibility that things might go awry. You don’t want to get sued because you offered inaccurate information, and maybe you’re not making much money from providing this service.”

In fact, depending on your broker-dealer relationship, you may be prohibited from giving any tax advice, even in areas where you might be knowledgeable.

A solid sixth man for the Milwaukee Bucks built his family's wealth after his playing days. Here's what financial advisors and investors can learn from his example.

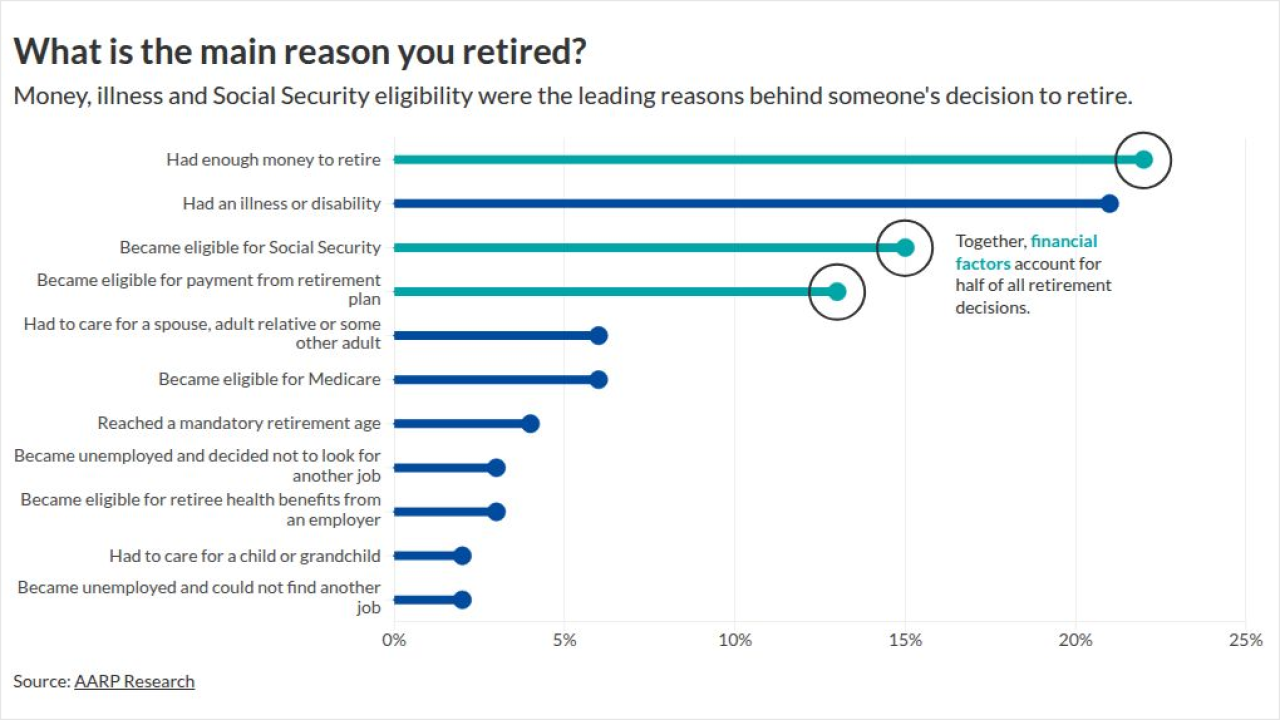

Default assumptions based on nonexistent children can lead to overaccumulation and unnecessarily delayed retirement.

That leaves you with several choices. You can become a CPA, a route that some planners choose. (Some CPAs also add a certified financial planner designation to their professional credentials.)

Alternatively, you can add one or more CPAs to your firm. That’s what Jon Ten Haagen, who owns the Ten Haagen Financial Group in Huntington, New York, is doing in his succession planning.

Ten Haagen has hired two financial professionals who have both CPA and CFP designations. They work as planners and advise on tax-related issues now, while Ten Haagen is still running the firm. When he retires, they will take over the practice.

“The other day, I had a client come in to talk about how to invest an inheritance. Having someone here with a deep knowledge of taxation was really helpful,” Ten Haagen says. Without these employees, he adds, he would use a CPA for tax issues and nothing else. “I don’t want to share my income with them,” he says. “I’m not going to get in your pocket, and you’re not going to get in mine.”

The third option for financial planners in need of tax advice, of course, is to partner with an outside CPA. Most advisors are happy to work with a client’s existing CPA. If clients don’t already have an accountant, smart planners should be prepared to recommend one. “Not everyone needs a new CPA, but when someone does, I like to pass them to a professional who I know will take good care of them,” Harvey says.

Ten Haagen points out one of the problems with this approach: the question of how each party will get paid. Here, too, a variety of models exist.

At San Francisco’s Citrine Capital, partner Jirayr Kembikian works closely with two independent accountants in the course of his work, though he would like to find more. “We want CPAs who are competent, proactive and responsive, and that’s unfortunately not a common combination,” Kembikian says.

If clients come to Citrine with an already established CPA relationship, Citrine works with those accountants. Otherwise, they direct clients to one of the two accountants in whom they have confidence.

Because clients often have stock options and delayed compensation, Kembikian says, “our clients tend to have tax issues that are more complex than those of the average person.” The two CPAs Citrine recommends charge a flat fee of $500 to $1,000 to prepare clients’ taxes, with additional fees for identifying any errors in past returns. The CPAs handle their own billing and clients pay them directly.

Because Citrine sends them so much tax-preparation work, neither accountant bills Citrine or its clients when planners call and ask about a proposed financial plan’s tax ramifications.

In the longer term, Citrine plans to hire a CPA on staff. “That will make us a one-stop shop,” Kembikian says. “Keeping it in-house will make it both more profitable and easier to coordinate. Clients would be able to choose to work with someone on the outside or with our person. We would also choose someone who talks well with clients in plain English.”

Not every CPA is willing to trade advice for tax preparation work. Matthew Bowden, a planner at RFC Financial Planners in Ann Arbor, Michigan, says his firm has strong relationships with perhaps three or four outside CPAs. They’ll talk about generalities with planners for free, but for specifics, he says, “they want to get the full story and have the client become their client as well before they give advice.”

When he wants to know about a plan’s tax implications, Bowden talks to the client’s CPA, gives the advice that he’s allowed to give as a non-tax professional, or encourages the client to have a CPA look at the plan. “The CPAs we work with don’t typically give away free advice,” he says.

Ruth “Robin” Delaney, a wealth manager at Concierge Financial in Tampa, Florida, works with two outside CPAs. Delaney and the first CPA refer clients to each other. “I don’t charge the CPA’s clients for my time when they don’t become clients of mine, and the CPA doesn’t charge for conversations about the tax implications of this or that financial plan,” Delaney says.

Delaney shares a broker-dealer with the other CPA she works with. “We have a split rep code, so any fees paid to the broker-dealer are shared when I use the CPA’s services,” she says. “I don’t like sharing revenue, but part of the loaf is better than none at all.”