The first time a client walks into your office you might take one look and think “I know exactly what they want and how they’ll invest.” It may be involuntary, but making generalizations about people on first sight is a flaw everybody shares.

How can advisors shake away this universal trait in order to bring in a more diverse group of clients and drive their businesses towards greater success? It starts with redefining the word investor, says Morningstar senior research analyst Jake Spiegel.

His new white paper underscores the misconception about investors being older, white and male can carry important consequences for clients, financial advisors and policymakers alike. Conscious or not, advisors could end up forming recommendations based on cursory characteristics.

“We kind of picture investors as being this high-flying executive guy, [with a] starched white collar, who has a financial advisor and talks about trading stocks,” Spiegel says. “But that’s just not who the typical investor is.”

Investors fit into three broad categories, the report suggests — engaged, disengaged and non-investors. Those who are engaged invest in something beyond just their employer-provided retirement account and have a different planning mind-set and a greater risk appetite.

About 21% of U.S. working households fall into this bucket. Disengaged investors invest only through tax-advantaged retirement accounts and this is about 40% of U.S. working households. Non-investors, as the name suggests, don’t invest. About 39% of U.S. working households fit into this category.

The survey found that at least 55% of investors work in industries outside of those typically associated with a white collar investor. Consequently, advisors should be more broadminded about the fields their potential clients are working in.

-

The asset manager and custodial giant found positive correlations in several metrics for companies that focus on inclusion.

September 27 -

Nearly three-in-four advisors (73%) do not have a succession plan in place.

June 5 -

Wealth manager Kobby Okum shares his expereince on challenges faced by newcomers to the planning profession.

October 2

Indeed, investors are stereotyping themselves too without realizing it, the report says. By having that common image of the white-collar Wall Street guy in their heads, some potential clients are out there thinking “an advisor isn’t for me.”

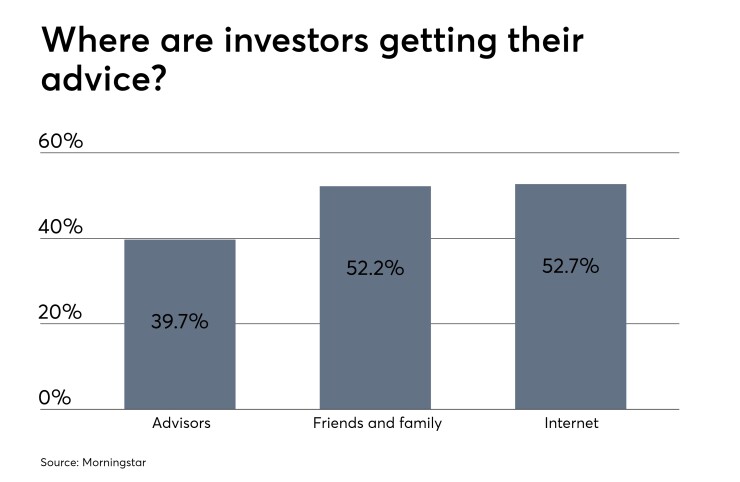

To be sure, some investors seek out the expertise of advisors. But even more do not, according to the report. Over half of investors in the poll said they are not using financial planners and instead rely on the internet (52.7%) and family and friends (52.2%).

So what does this mean for advisors? First, it showcases the need for personalized advice, the report says. As a result, it can become an opportunity for planners to reach out beyond your current client pool and bring in a new crop of investors.

The survey also cites prior research by university professors that shows advisors have in fact made recommendations on a client’s “shallow visual characteristics.”

“Advisors play a very important role in that ecosystem,” Spiegel says. “Perhaps the [investor], however well-meaning they are or how smart they are, might not necessarily be getting the best advice or looking in the right places … there’s a very clear role for financial advisors.”