Advisors need not fear robo advice, as long as they understand how technology can help them do their jobs better.

That was the takeaway from three executives who spoke Tuesday at SourceMedia’s InVest conference in New York. Current tech tools like customer relationship management systems, portfolio accounting programs and online client portals, they said, make planning more efficient while also boosting advisors’ value.

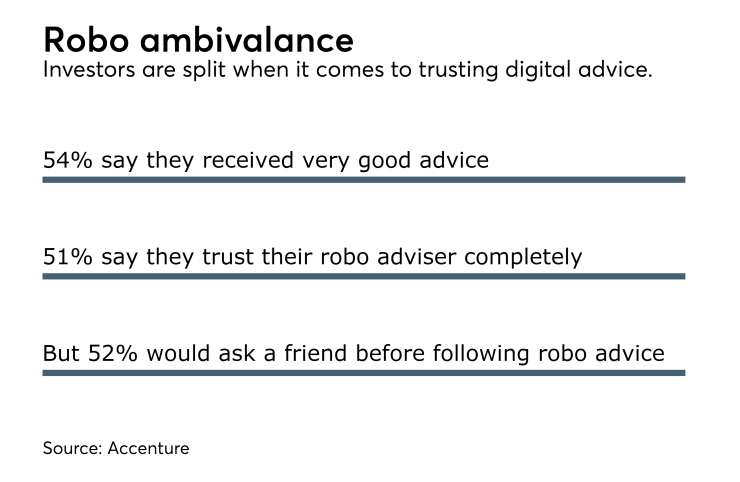

Concerns about

“It’s really thinking about how you can seamlessly meet the needs of your clients by just enabling the advisor to focus on what they do best. And that’s one of the reasons why I think ‘robo advice’ is actually a contradiction in terms,” said Edelman Financial Services CEO Ryan Parker.

“The robots, if you will, are enabling our advisors to focus on the things that create the emotional connection, that allow them to understand how to influence behavior,” he said. “And those are actually better linked to investment outcomes.”

-

Automate mundane tasks to concentrate on the personalized service that a client values the most, industry experts say.

June 12 -

Popular microinvesting apps targeting novice investors are charging total fees well in excess of other options, says an industry observer.

July 5 -

"This space is getting more diverse, and change is coming from all directions," says Alois Pirker, research director for Aite Group's Wealth Management practice.

May 17 -

Exclusive: The personality-driven RIA, backed by private equity money, plans to 'move quickly' to make acquisitions in existing markets.

April 5

TOWARD A HYBRID INDUSTRY

When Edelman launched its robo advice service in 2012, the Washington, D.C.-area RIA found that nearly all of its first robo customers wanted to speak to a human planner within six months, Parker reported.

Traditional and robo advice will merge in the future, panelists agreed.

“Regardless of what business model you have, the one that wins in the hybrid space is the one that can focus on the messy conversations,” said Ben Jones, managing director for intermediary distribution at BMO Global Asset Management.

“The tangible value that advisors deliver to clients doesn’t happen in discussions about their allocation,” Jones said. “I think of conversations with my mother or my sister. Different generations, neither of them care about ETF versus mutual fund. They want to know that they’re going to hit their goal.”

Better integration among the range of tools currently roiling the market will allow advisors to home in on such topics in coming years, said Jones and Parker. Even popular apps like Skype and FaceTime help save time, said Paul Duval, president of suburban Boston-based Genesis Wealth Advisors.

“If you think about it, the advisors attention span is limited,” Duval said. “The client’s attention span is limited. The more quickly I can work through iterations as his situation or her situation changes, the better we can be at giving advice. It does make us better advisors, absolutely.”

Parker agreed, citing JPMorgan’s use of artificial intelligence to interpret commercial-loan agreements. The company’s program, according to JPMorgan, completes in seconds what used to take 360,000 hours of labor by lawyers and loan officers each year. The change means lawyers must now offer more valuable skills, Parker said.

“I think the advice industry is headed in the same direction,” said Parker. “It’s going to force practitioners to get better. If not, they’re going to get wiped out, frankly. And those who are still there will understand how to actually deliver at the next level, by deploying the best of those types of tools.”