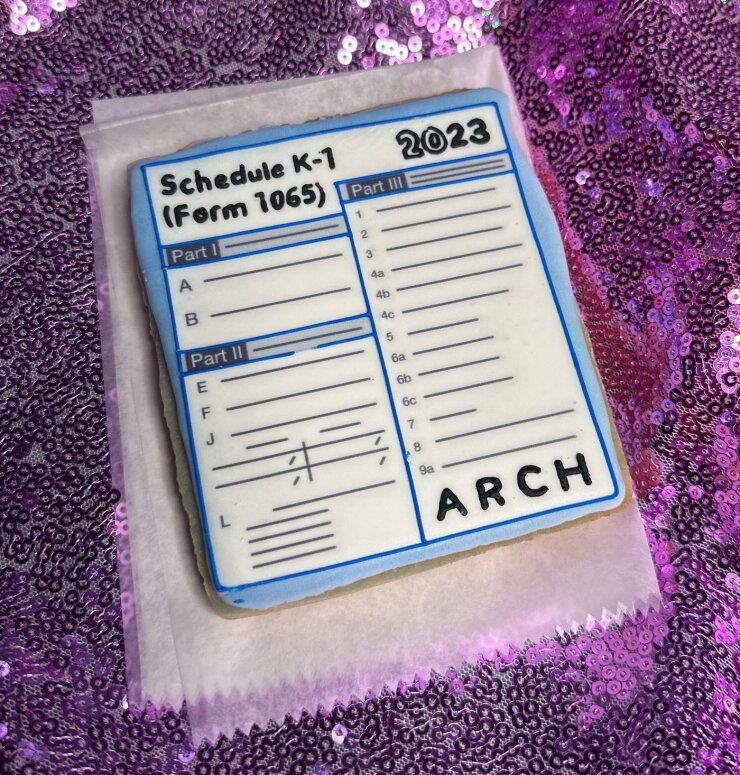

Arch's growth to $100 billion in private market assets on its platform can't solely be credited to cookies — the treats, mailed to clients during tax season, were decorated to look like K-1 tax documents — but its dedication to maintaining human connections has certainly helped the AI-backed platform.

Arch started in 2018 digitizing and organizing K-1 documents primarily for accountants. It has since expanded to analyzing and summarizing many types of documents used in the private markets investment space for hundreds of different clients. The firm this year launched new AI-powered tools, like one that can provide an easily downloadable, shareable instant summary of investor letters.

Sharing the K-1 cookies, however, was part of the extreme emphasis that Arch's co-founder and CEO Ryan Eisenman places on the firm to keep a finger on the pulse of its clients. Last month Arch moved to a new office space in the former New York Times building, part of Eisenman's goal to bring employees into the office, instead of remote.

"We just want to show our clients that we are thinking creatively. We want to spend a lot of time either on Zooms or in the office," he said about the cookies and on-site requirement. "We want to focus on not just being a company that hits the minimum threshold of what you need to do to be a client, but to think about how we turn you into a raving fan and advocate of Arch."

This tech vendor profile is among a

Name: Arch

Website: arch.co

Size of Arch: Following a capital raise in 2021, Arch grew its platform handling $1 billion in private market assets and eight employees to now more than $100 billion in private market assets and 100 employees, Eisenman said.

Products and services offered: Arch dubs itself the "digital admin for private investments" because its automated system collects and analyzes tax documents like K-1s and other critical investment paperwork, manages cash flows and provides reports used by advisors, partly through AI tools that can instantly summarize investor letters, for example.

READ MORE:

Who Arch aims to serve: Arch targets a wide range of clients in alternative investments, private equity hedge funds, real estate, venture capital, credit funds and other investments.

It has roughly 270 clients who span from investment advisors, private banks and family offices to the institutional space like pension funds and foundations. Arch serves four of the top 20 global investment banks.

What problems Arch tries to solve: Eisenman said Arch aims to fix "systematic fragmentation," which means the ability to take hundreds or thousands of documents across different platforms and streamline them onto one platform, powered with AI analysis and summary tools.

"Sometimes it's kind of this wild goose chase to find your documents. You get notified that the document's available but it actually doesn't post on the platform until 45 minutes later. Or a K-1 is supposed to be there, but it's not there," he said. "So we basically take all these different portals, all these different workflows, all the things that are happening across the ecosystem and centralize it and standardize it into a single platform."

How Arch is different from competitors: Eisenman said Arch was one of the first platforms to launch their own API and open data program that essentially allows it to build and export data across platform eco-systems so it better integrates with the various systems that their clients are using.

"The other really big thing is the client experience across the board," he said. "We've invested really heavily into the digital client experience of our platform — making it so the platform isn't just for an operations user of a firm, but fits their role, fits the advisor's role, fits the client's role, the treasury team, the outside CPA — allowing the permission ability of Arch to fit these different user types."

READ MORE:

What does it cost: Since there are different types of services that Arch offers, the price varies based on the number of investments and contract type (annual, for example). Eisenman said the price can range from a few thousand dollars to a few million per year for larger clients.

What's new for Arch: Earlier this year, Arch launched an AI-powered summary that can be used, for example, as a summary pop-up window of investor letters so the user can easily see the key points of the letter without having to go into each one.

"You might be getting hundreds of pages of commentary to read. We take that commentary and essentially pull out the key insights and put it into highly structured paragraphs," Eisenman said. "It's summarized so that you can, in 20 minutes, digest 40 to 50 updates. Where before, it would take 10 to 20 minutes to digest a single update."

More recently, the platform rolled out a version 2.0 of its AI summaries that essentially allows the user to talk to the AI and customize the summary output that can be used in a daily or weekly Arch digest email.

"It allows each user to specify their own settings around the information that's most important and most timely to them," Eisenman said. "You might need different summaries depending on what role you're in, so we're trying to allow a lot more customization."

The biggest challenge(s) going forward: When Eisenman was asked about his biggest lesson learned in growing Arch, his answer was nearly identical to his answer when asked about the challenges ahead:

"Patience and focus, and spending time with customers is, we think, the most important thing," Eisenman said. "Our customers really guide us in the direction of where their business is going, allowing us to skate where the puck is going."

What does that look like, exactly? Eisenman said it involves doing deeper dives into how various clients are using the Arch platform. And what it looks like from the user perspective, rather than Arch's POV.

"It's really interesting to see someone who might be working with us for years, and you watch them use the software. And you learn new things about the software and what capabilities it has," he said. "And you also learn, here's a faster way for you to work. So there's one part that really informs the product and the product development by deeply understanding our customers' behavior."