Another top executive has left HighTower Advisors.

Michael LaMena, a seven-year veteran of the Chicago-based RIA and its president since 2013, has left the firm to become president and COO of Bronfman Rothschild, a $5 billion RIA based in Rockville, Maryland.

LaMena says the split was amicable and that Bronfman, which has aggressive growth plans, is "the right place for me to navigate the next stage of my career." Previously, he also spent 14 years at Morgan Stanley.

A spokesman for HighTower said the firm "is deeply appreciative of Mike’s many contributions to the firm’s success and wishes him all the best."

Earlier this year, managing director Mike Papedis, a seven-year veteran of the firm who headed RIA acquisitions, abruptly left HighTower. Michael Parker stepped down as chief development officer and is now strategic adviser for business and relationship management.

HighTower has not yet named a replacement for LaMena, the spokesman said. When initially contacted about LaMena's exit, HighTower referred to the firm's announcement of

NEW PIECES TO THE PUZZLE

Susan Krakower, who formerly worked for Anthony Scaramucci and CNBC, is now chief brand strategist for HighTower. George Fischer, a 10-year E*Trade veteran who ran the firm's wealth management business, is now a managing director at HighTower. Kyle Okimoto, former head of marketing at E*Trade, is responsible for growing the firm's platform business as a strategic consultant.

HighTower has

"They've changed the pieces of the puzzle," says Jeff Spears, CEO of platform provider Sanctuary Wealth Services, which is winding down its business this year. "It's a huge job to integrate all of the firms at HighTower and will be an intriguing opportunity for the next person after LaMena."

HighTower upped the ante for its breakaway business last week, offering wirehouse teams who want to start their own business start-up cash. And the RIA jump-started its acquisition business in the spring when it

BRONFMAN ON FAST TRACK

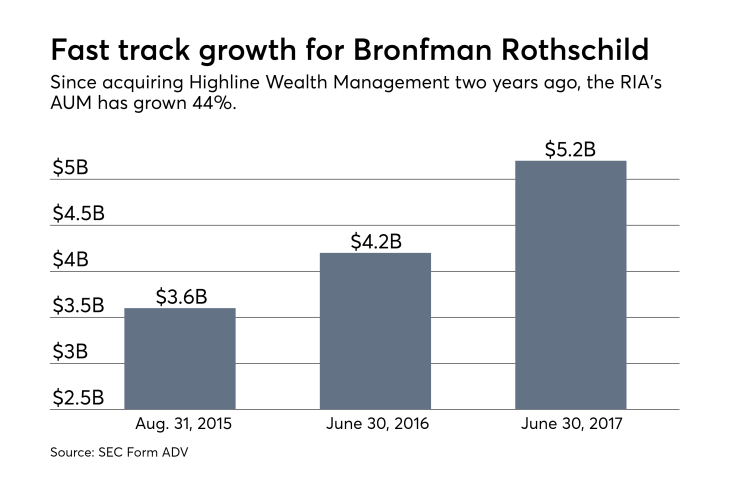

Bronfman Rothschild, meanwhile, has been similarly ambitious.

The RIA

Bronfman Rothschild has

Simon estimates that 40% of the growth has been organic, with the rest split evenly between increased assets from the markets and acquisitions. He anticipates future growth will break down along the same lines, and says Bronfman is targeting firms with $200 million or more in AUM.

Bronfman offers sellers of advisory firms a combination of cash and equity. Teams who are lifted out from larger firms receive forgivable loans, Simon says. Key valuation metrics are run rate EBITDA after management compensation and revenue, he adds.

Asked about the highly competitive M&A market, Simon says he thinks the peak of the seller's market may be over. "It feels like there are more sellers out there now and more opportunity for buyers," he explained.

Bronfman hopes to double its AUM in the next few years, according to Simon.

"We need a deeply skilled management team to do that and adding Michael gives us the depth and experience we need," Simon says.