Investors with brokerage accounts inside their employer-sponsored retirement plans at Charles Schwab saw a solid increase in account balances last year, but underperformed the S&P 500.

A

Self-directed brokerage accounts (SDBA) are tucked into employer-sponsored retirement plans. They let owners invest a portion of their retirement money in stocks, bonds, funds and ETFs that aren’t part of their formal plan’s core offerings.

Schwab’s SDBA Indicators Report, released March 2, showed that investors rode out multiple waves of volatility over 2020.

Markets fell sharply in February and March last year on concerns about the economy’s recovery. But the subsequent bounce back to all-time highs last December, amid swings in earlier months, allowed average account balances to finish the year up 31% from their lows at the end of a depressed first quarter.

The S&P 500 rose over 16% last year. That the Schwab investors’ average account gains were three percentage points below that level underscores that investors kept some money in lower-earning cash and bonds.

Schwab said that investors held the bulk of their assets (35%) in equities, followed by 31% in mutual funds, 18% in ETFs, 14% in cash and 2% in bonds and other fixed-income securities.

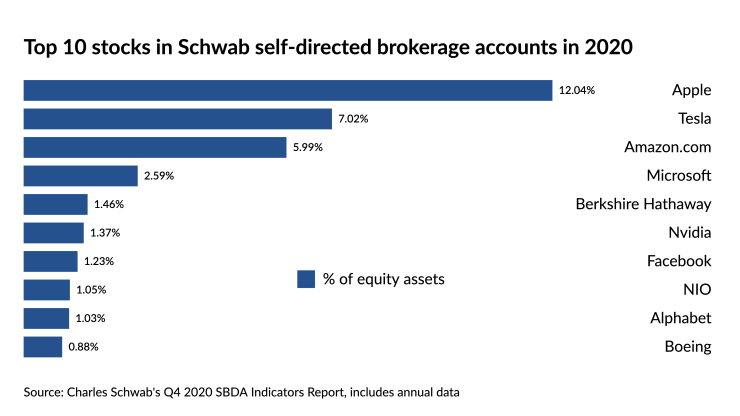

Three in 10 stock holdings in the fourth quarter of 2020 were concentrated in information technology companies, with Apple the top holding (12%), followed by Tesla (7%), Amazon (6%), Microsoft (3%) and Berkshire Hathaway (1%). Another electrical vehicle company, China's NIO, made the top 10 equity holdings.

Account holders didn’t go wild trading during the rally at last year’s end. They made an average of 13.9 trades in the final quarter of 2020, up only slightly from 13.6 trades in the prior quarter. Most trades were for stocks, followed by ETFs and mutual funds.

The report said that Gen X comprised the bulk of self-directed account holders (44%), followed by Baby Boomers (34%) and Millennials (16%). Gen X used advisors for their accounts more frequently than other age groups — 47%, followed by Baby Boomers (38%) and Millennials (12%).