Dramatic shifts at tax-focused independent broker-dealer HD Vest Financial Services are taking place over varying stages of progress on multiple fronts, according to the CEO of its parent firm.

“The degree of change we achieved cannot be overstated, and with change comes a degree of initial variability and uncertainty,” said Blucora CEO John Clendening on a Feb. 14 fourth-quarter earnings call. Admitting service problems, he described an ongoing

Blucora’s wealth management arm

The Irving, Texas-based IBD is operating under an interim CEO from Blucora’s tax software and preparation service TaxAct as it searches for a replacement for onetime Fidelity executive and

Oros cited proximity to his mother’s home to attend to her medical care as a factor, rather than dissatisfaction. HD Vest is still “moving full steam ahead tackling all of the initiatives that we feel are important for our growth and success,” COO Crystal Clifford said in an interview last month.

“Our advisors appreciate that change is necessary to advance the business,” Clifford said, declining to state any specific timelines for the process or whether she’s in the running. “Certainly there was concern when Bob left. I think our advisors understand the reasons, which were very personal to him.”

Blucora didn’t provide any additional updates after fourth-quarter earnings, but Clendening did break down HD Vest’s evolution into three categories: Unequivocal progress, line of sight and ramping. In the latter category, the firm is deploying a tax-smart investing software platform that is currently in beta testing.

-

The executive must attend to a close family member who has recently learned of significant health challenges, a spokeswoman says.

October 31 -

Blucora CEO John Clendening says the cuts to head count should taper off by next year, when the firm will have dropped as many as 1,000 reps in 16 months.

August 1 -

The tax-focused planning IBD is shedding low-producing advisors while retooling its pitch to prospects.

May 9

Advisors report what they love — and hate — about tech at companies holding client assets.

Advisor productivity and the three-way conversion to Fidelity’s National Financial Services, eMoney and Envestnet stand in the middle stage — where Clendening acknowledges there is work to be done. The firm has shown the most success in its recruiting and advisory growth, he said.

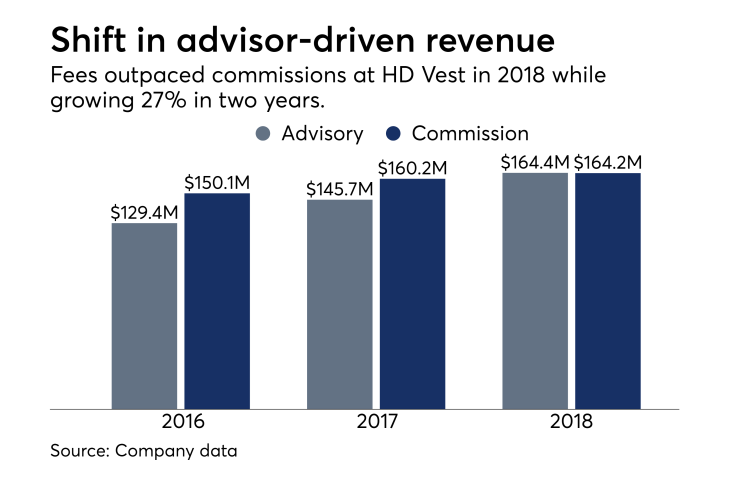

HD Vest took in a record $957 million in net advisory asset flows in 2018, pushing up fee-based assets under management to a new high of nearly 30% of its client assets, or $12.6 billion out of $42.2 billion. Some 175 experienced advisors and other recruits also brought more than $700 million in assets.

Recruits identified through new predictive models are reaching early milestones in only 120 days on the job, compared to the 800-day average, according to the firm. HD Vest also remains in the “early stages” of boosting productivity while focusing on the “high potential, middle group of advisors,” Clendening says.

Moving to NFS from Wells Fargo’s First Clearing — which happened alongside the eMoney and Envestnet integrations in September — will boost HD Vest’s net income by an estimated $120 million over the next decade, the firm has said. These technology shifts caused short-term challenges, though.

The transition prompted more home-office requests, which took longer to process in turn and reduced other transactions in the fourth quarter, Clendening says. To reach 99.9% conversion, the company tapped additional contract support teams while also getting extra resources from its vendors, he says.

Lower sales and increased expense during the migration — along with a higher advisor payout and a $450,000 legal reserve — led to net income slipping by 1% year-over-year to $14.1 million, according to CFO Davinder Athwal. The firm expects to pay higher costs with potential for continued lower transactions through the first half of 2019, Clendening says.

“On balance, we’ve taken a small step back in the immediate wake of the conversion for the opportunity to take three steps forward,” he said. “The majority of our larger advisor offices are fully past the transition and are 100% focused on growth. This gives us strong conviction around getting rest of our advisors to the same spot.”

The proprietary software for automated tax strategies in investments has reached 150 advisors in its beta phase, according to Clendening. He classifies it in the “ramping” stage under a larger push the firm is calling its “tax-smart innovation incubator” aimed at giving advisors “an incredible edge.”

Tax-loss harvesting and asset location methods have launched in the pilot program on HD Vest’s advisor portal, Clifford said in the interview last month. The company will add more capabilities throughout the year, including optimized election tools for Social Security withdrawals, she said.

“Part of our value proposition for our advisors is that tax knowledge that they bring, and many of them right now are doing this in a very manual way,” she said, adding that the firm is considering other enhancements aimed at “really value-added tools that will help them achieve tax alpha.”

HD Vest’s quarterly revenue of $97.2 million beat the forecast of $96.4 million, but its net income missed the projected total of $16.9 million by $2.8 million, William Blair analyst Chris Shutler said in a note after the earnings announcement, attributing the lower profit to fourth-quarter equity volatility.