HD Vest Financial Services’ new recruiting and retention approach has pushed down the firm’s headcount by 11% year-over-year while boosting its productivity by more than a quarter.

The Irving, Texas-based independent broker-dealer has shed a net 507 advisors in the past year under a stated plan

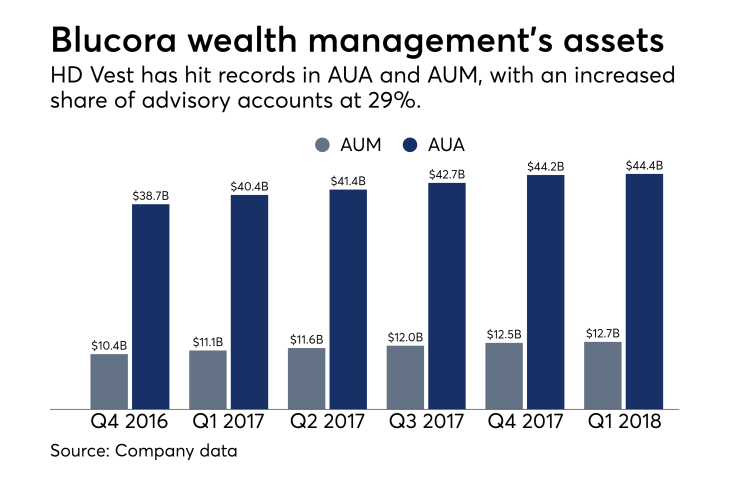

HD Vest’s leaner group of 3,920 advisors drove at least the fourth straight quarter with records in assets under administration — $44.3 billion, up 10%; and assets under management — $12.7 billion, up 15%. The No. 19 IBD’s net income also rose 10% year-over-year to $13.1 million on revenue of $92.1 million.

In remarks Wednesday morning on first-quarter earnings, Blucora CEO John Clendening in part credited the recruits for a record in-flow of $625 million in AUA. HD Vest’s partnership with B2B tax firm Drake Software has already resulted in 700 leads and a few recruits

HD Vest expects to convert more tax pros into advisors that way as the dust settles on last month's Tax Day. Other incoming advisors identified under the firm’s new predictive modeling are passing their securities examinations at rates 20 points higher than the firm’s historical averages, Clendening says.

-

CPAs and enrolled agents who added planning services generated an average of $1.7 million in incremental revenue over five years, a survey shows.

May 4 -

CEO Bob Oros says the firm is focusing on recruiting more experienced advisors, among other changes at the No. 19 IBD.

March 1 -

The CEO of the firm’s parent says it expects to trim hundreds more advisors from its ranks over coming months.

February 20

A majority of affluent Americans are likely to adjust their financial plans under the new law, according to the AICPA. Here's how advisors can help.

With the firm carrying out modest requirements for advisors of at least $1 million in AUA by this month and $2.5 million by 2019, the new recruits tapped through the assessment tool are reaching their initial rolling gross commission benchmarks in roughly 120 days, compared to a prior average of 800.

“While it is still a relatively new process and the dollar volumes are still small, it is a good indication that we are bringing the right new recruits on board and better enabling them to engage their clients on wealth management,” Clendening said.

HD Vest’s annualized revenue per advisor has grown 27% year-over-year to $84,000, which is still far below several IBD competitors. No. 2 IBD Ameriprise’s advisors

However, CEO Bob Oros, the former RIA head at Fidelity Clearing & Custody Solutions, has described 2017 as a “

The transfer of assets from the new four-advisor practice helped fuel the record in-flow of AUA, Clendening said. Additional major recruits should follow, thanks to the firm cutting down a lot on direct mailing campaigns which leave prospects “a little numb,” in favor of its new approach, he says.

“The focus is to upgrade our efforts in targeting and then getting advisors on board,” Clendening said in response to an analyst’s question about changes to its pitch from three- to five-years ago. “People are taking notice around the work that we’ve been doing to upgrade our interactions with prospects.”

The parent firm boosted its profits by 48% year-over-year to $45.3 million on revenue of $206 million. Its adjusted earnings per share of $1.20 easily beat analysts’ expectations of $0.97, and the price of Blucora’s stock soared by nearly 17% to $29.55 per share on the results.