An alternative investment manager’s long legal saga has entered a dramatic new stage, with potential ramifications for wealth managers that sold its products.

GPB Capital Holdings, founder David Gentile and Jeffry Schneider’s Ascendant Capital — the placement agent that pitched GPB’s products to RIAs and brokerages — face a raft of charges in multiple jurisdictions. A grand jury in New York’s Eastern District

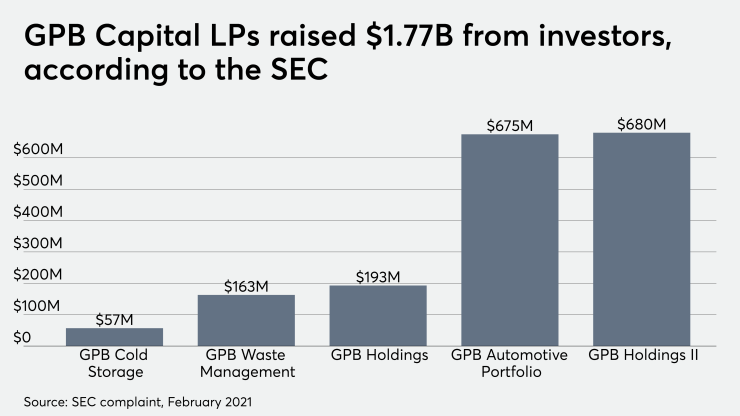

The federal indictment, unsealed Feb. 4, alleges the defendants defrauded clients who invested $1.8 billion in GPB’s limited partnerships. The indictment came the same day as

“The defendants misrepresented the holdings of GPB Capital through deceptive marketing practices, luring investors with promises of monthly distributions that would be covered by funds from the investments and not drawn from underlying invested capital,” FBI Assistant Director-in-Charge William Sweeney said in a statement. “This was all a lie. In truth, a significant portion of GPB’s distributions were paid directly from investor funds.”

Federal agents arrested Gentile, 54, of Manhasset, New York; Schneider, 52, of Austin, Texas; and Lash, 51, of Naples, Florida, after the unsealing of the indictment in federal court in Brooklyn. Ascendant and attorneys for the other defendants didn’t immediately respond to requests for comment.

“GPB has been cooperating with government investigations and is extremely disappointed by these developments,” spokeswoman Nancy Sterling said in a statement. “GPB denies these allegations and intends to vigorously defend itself in court where, for the first time, the firm will be able to present significant evidence in its favor.”

The firm, Sterling added, is confident that it “acted in good faith during many years of managing funds” and it’s working toward “increasing asset values and cash flows, while ensuring that the operating companies, their employees, and their commercial partners continue to deliver excellent value to our customers, and ultimately to our investors.”

GPB and Ascendant allegedly promised investors distribution payments of 8% a year on their investments, to be paid for completely by the cash generated from “middle-market” private businesses such as auto dealerships, IT services firms, storage facilities and waste management companies. Instead, authorities allege the businesses underperformed and GPB paid the majority of the distributions with other clients’ money, in a Ponzi-like scheme.

For example, in March 2016, Gentile sent a text message to Shneider and Lash warning them that they needed to send “cash back” to the automotive portfolio “to get the coverage ratio to 60%,” according to the federal indictment.

Schneider replied that they had “to man up and write checks which is simply giving back dollars we already received,” the document states.

In marketing, presentations to advisors and official offering documents and statements, the companies misrepresented the source of the distributions and the revenue generated by two of GPB’s funds, according to authorities. Approximately 17,000 retail clients, including 4,000 seniors, invested in the LPs, and they’re at risk of losing nearly their entire principal, the SEC says.

“These actions highlight the risks associated with investing in the private securities marketplace where the lack of transparency and liquidity makes it ripe for bad actors,” Lisa Hopkins, president of the North American Securities Administrators Association, said in a statement. “Because there is currently no federal or state review process for deals offered in this market, the private markets can be a very risky place for Main Street investors.”

Between 2013 and 2018, the defendants also allegedly diverted and misappropriated some of the clients’ investments for personal uses such as private jet travel and Gentile’s Ferrari, according to state-level civil complaints in three states. The federal charges include allegations of self-dealing, and the SEC accuses GPB of violating whistleblower protection laws

GPB suspended all redemptions and distributions to clients in 2018, and its assets “are far below its obligations,” according to the SEC. Multiple authorities have been investigating the firm since at least that year, when Massachusetts Secretary of the Commonwealth William Galvin’s office requested information about GPB

Arbitration