Multibillion-dollar GenXFinancial has purchased Boston Partners Group, creating the largest office of supervisory jurisdiction at one of Advisor Group’s largest firms.

Andover, Massachusetts-based Boston Partners brought 53 financial advisors and $4.5 billion in client assets to its new parent firm. The influx boosted Nashville, Tennessee-based GenX’s OSJ, Innovative Financial Group, to $9 billion in client assets under 180 registered representatives.

While the parties didn’t disclose the size of the

GenX, which also owns virtual service software MyRemoteFA and succession planning website SellMyFinancialPractice, is focusing on the industry’s expected wave of retirements in coming years, according to Heapps. He’s

“The super OSJ community is an industry that needs to have a system for the nextgen advisor to come in and be successful,” Heapps says. “That's part of our strategy.”

In fact, three younger planners from the newly acquired firm are already negotiating with an older existing advisor from Innovative Financial to purchase a practice, he notes. For Boston Partners, succession was “one of the primary attraction points” to the deal, along with the fact that there’s no transition to another custodian or BD for clients and a relationship with Heapps spanning two decades with the former John Hancock unit, Marroni says.

“It all kind of fell into place,” Marroni says. “I really wanted to have more time to devote to two things primarily: My family and my clients.”

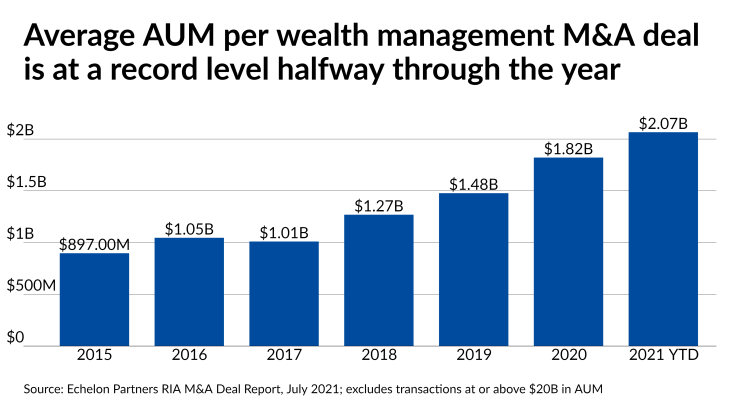

The industry’s succession challenge remains a key driver of the record level of M&A deals across wealth management in recent years. After the first half of the year, wealth management M&A is on pace to reach a new high of 260 transactions, with 110 involving sellers that have at least $1 billion in assets under management,

Though it’s normally more well known in the industry as an RIA platform for wirehouse breakaways, Dynasty Financial Partners has provided capital from its balance sheet for 24 transactions spanning $8.7 billion in AUM since 2018. Many of the purchases are “effectively sunset deals” for RIA owners aiming to exit the business, says Harris Baltch, the firm’s head of M&A and capital strategies. He mentioned a recent deal struck by an RIA CEO whose health was declining with another advisor who had known him for 30 years.

“He was able to successfully acquire and integrate the RIA of his mentor that he worked with who was a family friend for his entire life, and that was a very emotional transaction,” Baltch says. “Being an advisor to a process like that, you really need to keep your emotions out of it and help advise above board of both teams because, in this case, the seller didn't have an advisor. We were just trying to make the deal as friendly as possible so that the transition could be smooth for the employees and for the clients.”

Other wealth managers are building out their consulting for succession-oriented deals like that of GenX and Boston Partners. Advisor Group’s succession and acquisitions team under Senior Vice President Todd Fulks “was instrumental in helping us to put the deal together,” according to Heapps. Unlike Dynasty’s deal extending its own capital for financing, though, Heapps says GenX didn’t require any from Advisor Group.

Outside financing from Advisor Group or a PE firm could be a possibility at some point for GenX, he says, noting “a substantial pipeline” for future deals that may demand more capital.

“We're continuing to look at everything from independent RIAs to other OSJs,” Heapps says. “I wouldn't rule it out in the future.”