An ex-Triad Advisors firm scored two victories against its former independent broker-dealer by grabbing a $100 million practice and resolving the legal wrangling over a promissory note.

ACG Wealth and the Ladenburg Thalmann IBD settled

The Atlanta-based IBD, which already has 31 advisors, plans to add between $15 million and $20 million in production through recruiting this year, Millican says. Sievert’s Jacksonville, Florida-based firm, Exclusive Advisors, brings four more brokers into Arkadios’ fold.

Triad, the No. 29 IBD, added practices with $2.4 billion in combined client assets from

“The larger producers are getting restrained, just like we were,” he says. “If they haven’t left, they’re talking about leaving. Those are folks who wanting a change, and we’ve got a solution.”

A spokesman for Triad declined to comment on the arbitration case and Sievert’s departure. Sievert didn’t respond to requests for comment.

-

The investment product raises eyebrows, but the firm’s founders have pledged to act as fiduciaries.

May 11 -

Executives from Pershing and Fidelity say smaller firms can find a home in the hybrid space.

February 5 -

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

Triad filed a lawsuit alleging a breach of a promissory note and sought a temporary restraining order in Georgia state court following the October 2016 defection by ACG, according to Millican. The court rejected the firm’s restraining order request, and the company later dropped the suit, he says.

Triad then filed a promissory note claim in FINRA arbitration last year, leading to a counterclaim against Triad by ACG. Millican declined to discuss the terms of the settlement, saying only that ACG was pleased with the outcome and wishes Triad all the best.

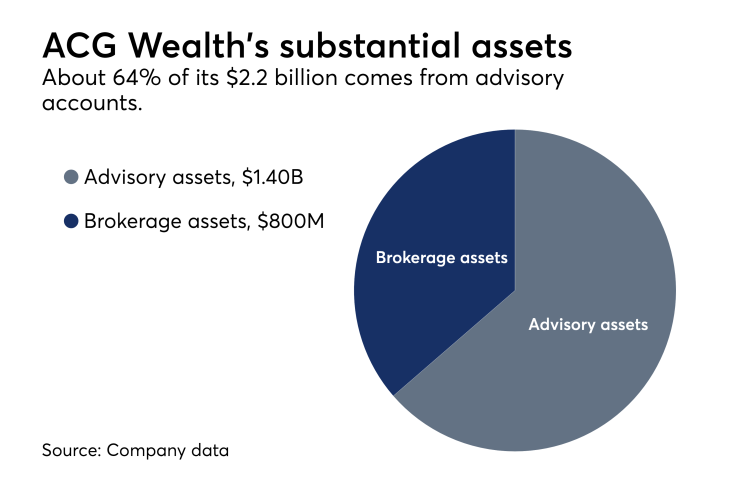

Client assets at ACG Wealth, which was once known as Atlanta Capital Group, have reached $2.2 billion across its brokerage and advisory platforms, Millican says. They had grown to $1.8 billion last year from $765 million only five years earlier.

Millican, the co-founder alongside Jody Young and Jeffrey Shaver, has said Ladenburg’s refusal to allow the firm to launch a hedge fund led to its exit from Triad. Their small- and mid-market private equity offering, the OGAo Fund, listed $17.1 million in assets under management in its last Form ADV.

The RIA and its affiliated IBD have also added teams from Merrill Lynch and LPL Financial since leaving Triad’s fold, according to Millican. ACG tapped its onetime Fidelity relationship manager, Greg Fink, to be its CEO last year.

The IBD requires incoming advisors to have a minimum of $1 million in production, and Millican says he hopes to add six or seven more offices by the end of the year. Millican is working on moving it to a new office separate from its current space in ACG’s offices, he says.

“We’re just getting started,” Millican says. “Once a lot of these things settle, we’ll be ramping it up tenfold.”