Three former LPL Financial recruiting executives have launched their own firm, aiming to tap their many contacts while helping financial advisors address important questions often overlooked during outreach by prospective employers.

Bridgemark Strategies CEO Jeff Nash, who spent 14 years at the No. 1 independent broker-dealer, opened the firm with fellow LPL business development division veterans Chris DeFrank and James Sorey. The Boston and Charlotte, North Carolina-based firm held a soft launch in September before officially announcing the new company this week.

Nash had operated his own consulting firm for about five years, but the new company enters the space as IBDs

A typical goal of a firm recruiting an advisor is “not to get in the weeds” during the hiring process, but that approach may obscure burdensome platform fees, ticket charges or other issues that could grate on advisors down the road, Nash said last week.

-

The firms dominate the space, but they face headwinds in a changing industry, Cerulli says.

October 31 -

As RIAs and regulations reshape the industry, the concern is real, a new Cerulli report says.

October 10 -

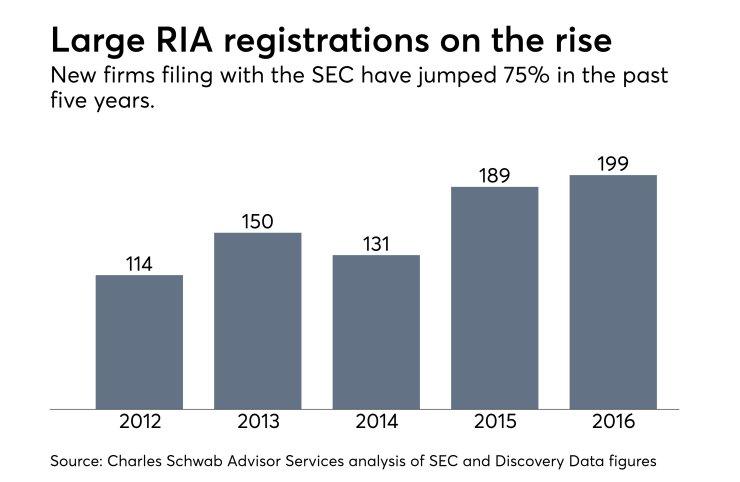

New firm registrations have soared by 75% over the past five years, according to Schwab.

November 2

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

“Those problems can be as simple as product availability. It can be further details around pricing structure that weren’t discussed,” Nash says. “We all know payout is only a small part of the economic story. There are a lot of other factors that play into that.”

Between Nash, the co-founders and Vice Presidents Victoria Printz and Sean McMaster, the team brings 55 years of collective experience at LPL. Nash, DeFrank and Sorey each served as senior vice presidents in the firm’s business development division, while Printz and McMaster had been regional directors.

Bridgemark’s consultants work out of the same metro areas as two of LPL’s three main corporate offices. The team expects to complete “a decent amount of LPL moves,” as LPL loses advisors through attrition and frustration with

A spokesman for LPL declined to comment. The firm’s

Bridgemark has already begun working with several practices that manage client assets of $1 billion or more, as well as a few with more than $3 billion, according to Nash. The new team hopes to set a new course away from a traditional “transaction-minded” approach to recruiting services, he says.

“There’s a huge opportunity to help advisors really holistically, in the same way that advisors help their clients,” Nash says.