Count Larry Roth, the former CEO of Cetera Financial Group and AIG Advisor Group, among those relieved that the two firms didn’t combine after Cetera

“I’m happy that they’re independent of one another because it gives advisors more choice,” Roth says, arguing it’s better to have more large independent broker-dealers. “I think you’re going to have a lot of choices and a lot of competition, and I think that’s good for everybody.”

The non-involvement of Advisor Group parent Lightyear Capital in

Roth, 60, declines to name clients of the New York-based firm bearing his initials, though he notes he has a “full complement” of them. He

The firm’s clients include fintech companies, asset managers, RIAs, RIA aggregators and private equity firms either active in wealth management or considering a pivot into the space. Roth’s experience in the industry spans “some really great times and some difficult ones,” he says.

-

"Given all of the turmoil there, you need to have some consistency in leadership and [Roth] was it," one expert says.

September 1 -

Is Roth on his way out?

August 29 -

Edmond Walters is seen as bringing deep fintech expertise to rebranded company.

June 16

The combined amount across the top 10 firms has jumped 37% to $385.3 million over the past three years.

“It’s a really great time to be in the business as an advisor or as an owner-operator of these businesses,” Roth says. “The biggest firms are in better shape than ever. The smaller firms, if they’re unable to re-invest properly in their business, it will be more difficult for them.”

“Something very strange is going on,” however, with the small IBDs, he adds. “Even though they should technically be under pressure, their valuations are continuing to increase.”

Roth helped Advisor Group navigate the financial crisis while AIG nearly went into bankruptcy, and he led Cetera’s restructuring after

The IBD networks now have a combined 12,778 advisors, and they generated nearly $3.2 billion in revenue last year, according to Financial Planning’s annual

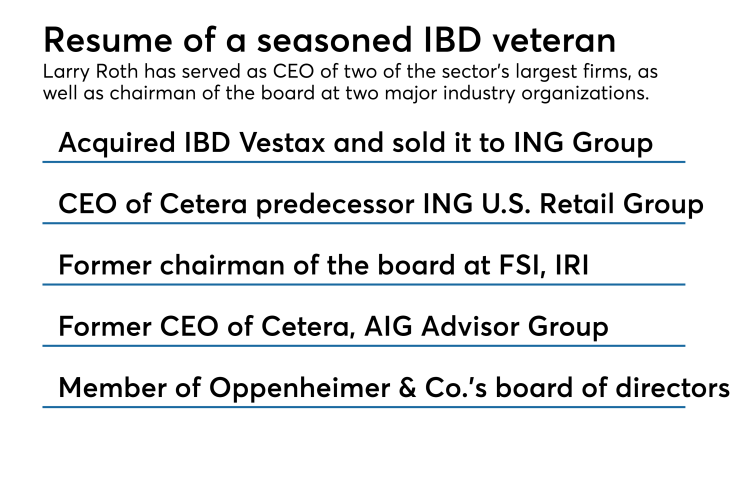

He has also served as the chairman of the board at FSI and IRI, and he broke into wealth management when he purchased an Ohio-based IBD named Vestax Securities in the 90s. Roth built the firm up to 700 registered representatives and sold it to ING Group, where it was part of the forerunner to Cetera.

Berkshire first tapped him to be a partner at the middle-market investment firm between 2001 and 2006. In April, he came back to the firm as a senior advisor. Roth also serves on the advisory board of content marketing software company Vestorly and regional BD Oppenheimer & Co.’s board of directors.

His consulting firm’s strategic partnership with Berkshire will allow Roth to connect his clients with both equity capital and M&A advisory support, according to the firms.

“The intellectual firepower and network of relationships that Larry Roth brings to the table through our alliance with RLR Strategic Partners comes at an opportune time, just as interest in the independent financial advice space further escalates among strategic and financial buyers across the board, including private equity firms of all sizes,” Berkshire partner Bruce Cameron said in a statement.