A former Cambridge Investment Research advisor faces prison time and the possible forfeiture of $1.05 million after pleading guilty to wire fraud.

Ralph Willard Savoie carried out a three-year scheme by using his clients’ money toward his rent, credit card bills and purchases of jewelry, among other uses, according to prosecutors. He promised two clients a guaranteed 11.4% return on their $50,000 but never invested a dime of it, investigators say.

Savoie, 70, entered

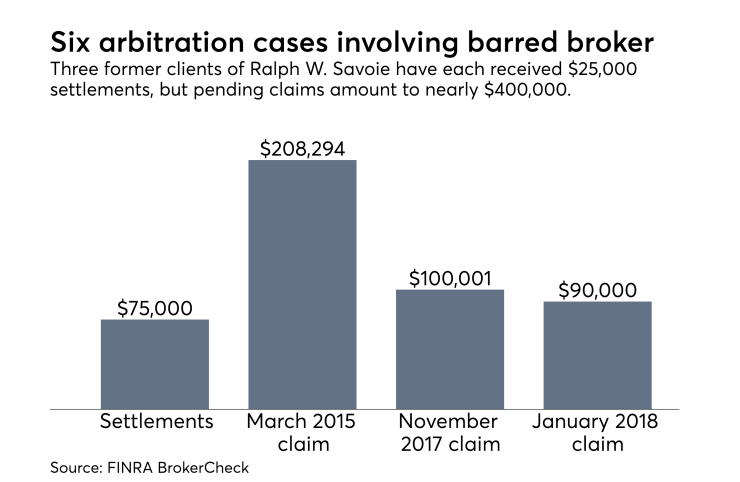

Former clients of Savoie’s have filed six arbitration claims against him, with three receiving settlements of $25,000 each, his BrokerCheck file shows. A special agent with the IRS later calculated that he defrauded his clients of more than $1 million, according to a preliminary forfeiture order.

“Relying on his association with Cambridge, the defendant, in turn, was able to convince his victims to invest their money with him,” says a factual basis submitted as part of the plea agreement with prosecutors.

“When victims began questioning their investments,” the document continues, “the defendant used his association with Cambridge to lull them into believing he was a reputable and trustworthy financial professional who had indeed invested their money as promised.”

-

The regional BD failed to properly document its own investigations in the matter, and couldn't answer some SEC questions about who knew what and when, the regulator says.

March 27 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

Massachusetts is probing whether the firm's wealth management unit steered clients toward inappropriate investments and high-cost accounts.

March 8

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

In an email, Cambridge spokeswoman Cindy Schaus noted his dismissal as an independent contractor and subsequent bar by FINRA, as well as his registrations with 11 other firms over his 39-year career. She declined further comment, noting a company policy against discussing legal matters.

Vincent Wynne, a lawyer for Savoie, declined to comment, noting he and his client were still working with authorities on the case. A U.S. magistrate judge released Savoie on March 26 on the condition that he surrenders his passport and doesn’t possess a firearm, among other requirements.

The scam by Savoie, a resident of Baton Rouge and nearby Mandeville, lasted from roughly January 2013 to March 2016, according to investigators. His clients gave him money for investments into stocks and other securities, insurance products and the development of industrial cooling towers, investigators say.

Instead, he invested their money in risky real estate ventures, withdrew it for cash, paid off other defrauded clients and spent it on his rent, credit card bills and a car note, court documents show. He also bought jewelry with the money and used his clients' money for hotel stays and restaurant outings, investigators say.

Savoie told the two clients who invested $50,000 toward the cooling towers that they were a “sure thing” with a guaranteed return and assured a 65-year-old widow with a disabled son that he would make a safe investment in insurance, according to the court documents.

Later, Savoie concealed his disbarment from his clients and warned a victim who lost $20,000 against reporting him to the authorities, investigators say. In text messages in March 2016, Savoie told him the investments would never be returned if he started a “legal battle,” the documents show.

Cambridge cited a failure to disclose and receive approval for an outside business activity as the reason for his discharge, according to BrokerCheck. The FINRA bar came after he refused to respond to the regulator’s investigation into allegations he misappropriated more than $665,000.

Two of the former clients of Savoie accused him in the now-settled arbitration claims of selling them “unsuitable, illiquid, expensive, and highly speculative private placements.” The third client alleged he liquidated their accounts and placed their money with private companies affiliated with him.

The pending disputes include claims around a life insurance policy and an unregistered security dating to Savoie’s time with ING Financial Partners, his prior broker-dealer before Cambridge. A third client accuses him of “private placements in a scheme to retrieve the customer's investment proceeds.”

In striking the agreement, prosecutors acknowledged that Savoie helped them “by timely notifying authorities of his intention” to plead guilty. Prosecutors will recommend a reduced sentence if a judge rules him qualified, reserving the right to object if he doesn’t submit a required financial statement.

Wire fraud carries a maximum prison sentence of up to 20 years, along with a fine of up to $250,000 or twice the gross losses or gains, whichever is greater. The preliminary order of forfeiture will become final at sentencing.

Prosecutors say no date has been set for the sentencing. However, Savoie will receive “a significant term of imprisonment, fines, restitution orders, forfeiture, and a term of supervised release,” the U.S. Attorney’s Office for the Middle District of Louisiana said in a

“My office, along with our federal, state, and local partners, is committed to aggressively pursuing corrupt professionals who abuse their positions of trust to fraudulently line their own pockets,” U.S. Attorney Brandon Fremin said in a statement.