At least three wealth managers — and 388 other publicly traded companies — have pledged to end an employment practice that critics say is harmful to victims of sexual harassment.

The number has soared from just five firms in September 2019, when Rachel Robasciotti of

Employers including at least 15 wealth managers listed in the Force the Issue

“Because it's such a common practice and yet so harmful, it was a unique issue where we felt really comfortable in our methodology saying that,” says Robasciotti. “I think they just really didn't want to see their name next to that harmful practice.”

By the numbers

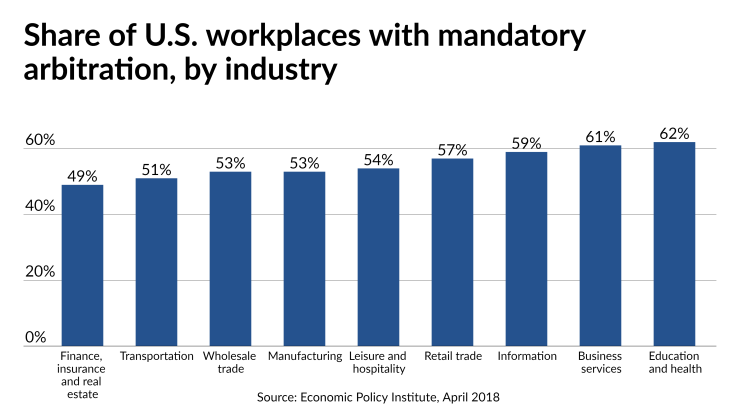

The available data about forced arbitration is striking. More than 60 million American workers are subject to forced arbitration,

In an email, American Arbitration Association spokeswoman Victoria Castelbuono noted that its rules don’t “impose any confidentiality requirements on parties or their representatives.” The organization’s Employment Due Process Protocol governs the guidelines, Castelbuono says.

“The protocol was developed by a task force composed of individuals representing management, labor, employment, civil rights organizations, private administrative agencies, government, and the American Arbitration Association,” Castelbuono says. “The goal,” she adds “is to provide fairness and equity in resolving workplace disputes.”

Representatives for the second largest provider of private arbitration forums, JAMS, didn’t respond to a request for comment.

FINRA administers the arbitration cases that are most familiar to advisors. Representatives for the regulator sent

“In the absence of an agreement to arbitrate a statutory employment discrimination claim at FINRA, the individual broker can pursue these claims in a court of competent jurisdiction or as otherwise specified by federal and state law,” Cook wrote. “As a result, we do not believe that our arbitration data is necessarily indicative of the prevalence of discrimination in the financial industry.”

Arbitration provisions of employment contracts often include waivers of class action rights as well, removing that option for victims, according to advocates. Filing a complaint with the Equal Employment Opportunity Commission represents another potential route; still, 54% of the more than 78,000 sexual harassment cases that reached

For victims often subject to “subtle but destructive” retaliation by firms after reporting sexual harassment, the available statistics on outcomes of cases “clearly show poor odds” for employees in arbitration, according to Jennifer Schwartz, a partner with employment law firm Outten & Golden.

“It deprives employees of power and leverage and reduces their chances of winning at trial,” Schwartz said in an email. “Arbitrators frequently hold in favor of employers, who are the parties often paying the bulk of the fees for arbitration. Moreover, arbitrators are far less likely to award substantial damages for the emotional distress caused victims of sexual harassment.”

Wealth management reckoning?

At least 391 firms with 10.3 million workers told Force the Issue they “definitely” have stopped requiring arbitration or never did so for sexual harassment claims, according to the database. Out of 20 public wealth managers and other listed firms active in the sector, only

The dearth of wealth managers joining big technology firms that banned the practice in the wake of the #MeToo movement doesn’t surprise Robasciotti, she says. In

“Our industry is so full of sexual harassment,” Robasciotti says. “Finance has its own reckoning to do around this issue in particular ... I’m really looking forward to having other large financial companies follow that leadership.”

Force the Issue could prompt such changes in multiple sectors, after bringing together investors with a combined $54 billion in assets in its campaign urging companies to cease the practice. The group of investors that signed

“This is a really basic thing that employers can do that creates a safe and inclusive environment for all employees, and especially for the women who are typically the victims of sexual harassment,” Robasciotti says.

The movement is gathering momentum after far-reaching federal

“Courts have upheld forced arbitration clauses in many, many instances where nothing was ever signed by the employee,” Flegel says, noting examples like employee manuals, onboarding materials or even email blasts to workers. “There are many instances where employees are not aware that they're bound by this.”

Big data

Although her organization seeks to ban mandatory arbitration for all types of claims, Flegel praises Force the Issue as “an interesting and important database” showing the level of secrecy and the importance to investors interested in understanding the potential liability to firms.

The site also fills in “a big piece” of missing data that’s still undisclosed by many public firms, says Marypat Smucker, the principal for research and content of gender-lens investment research firm Parallelle Finance. Pay gap data and supplier diversity figures would help publicly traded gender lens equity funds add two more screens to their models. The funds had more than $2.67 billion in assets under management at the end of 2020, according to Parallelle.

Force the Issue has “some of the data that really is needed to get a complete picture of a company's gender equity,” Smucker says. “Most of the funds have stated criteria that go beyond the cornerstone criteria of women in leadership. The gap is whether there's data on that.”

Robasciotti and the collaborators added notably to the available data the same month as her wealth management practice

“When I first started hearing back from companies, I kinda got the chills,” Robasciotti says. “It was such a wonderful and somewhat overwhelming experience to start seeing the change happening.”