Although Focus Financial Partners’ stock price has taken a battering in recent weeks, the RIA aggregator keeps piling up acquisitions.

After snagging a New York-based family office and adding a tuck-in to partner firm Buckingham Strategic Wealth in mid-December, Focus has added two more sub-acquisitions to its growing roster.

Partner firms Colony Group and Gelfand, Rennert & Feldman will fold in two smaller firms in their markets. Aurora Financial Advisors in suburban Boston will team up with Colony. Los Angeles-based WG&S will join Gelfand.

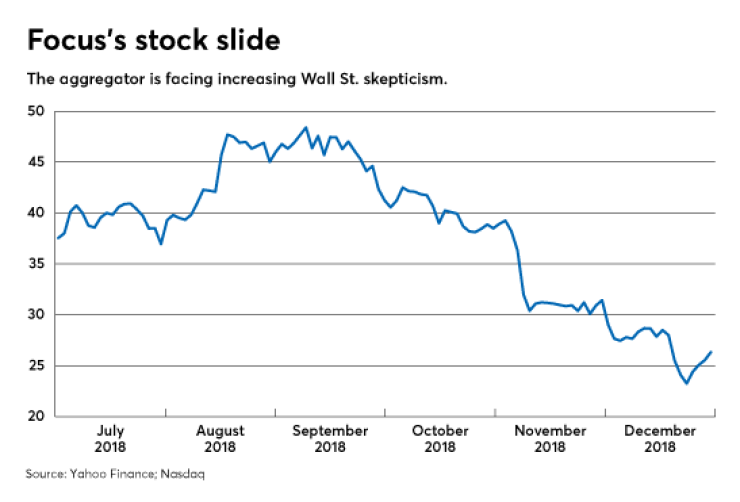

Focus — which went public last year — owns equity stakes in 58 firms. But the holding company has come under increasing criticism for counting acquisitions as organic growth. Its stock, which was offered to the public at $33 in July and rose to $49, is now trading at around $26.

Focus management has justified including acquisition assets as organic growth by citing broker-dealers who include advisor recruiting in their organic growth rates, according to analyst Matthew Crow, president of Mercer Capital.

That’s a “risky justification” Crow says, “because the economics of broker-dealers has been eroding for decades and many see the practice of paying to poach advisors as a sign of an industry in distress.”

Focus’ stock slide “clearly suggests the market is losing interest in the issue,” according to analyst Matthew Crow.

Focus did not respond to a request for comment.

Focus’ stock slide “clearly suggests the market is losing interest in the issue,” according to Crow. The market is increasingly troubled, he says, by the aggregator’s insistence on relying on adjusted net income to reach its goal of 20% growth.

“The problem is that word ‘adjusted,’” Crow explains. “Adjusted means they can grow by acquisition, but they’ll be expending cash and equity to fund that growth.”

Nonetheless, Crow thinks Wall Street may be applying a double standard to Focus.

Since its initial S-1 filing last spring, Focus made clear its principal business is acquiring preferred cash flow stakes in RIAs, Crow writes in a recent blog post.

While Wall Street wanted to see Focus as the ultimate RIA, “it was never that,” says Crow. The aggregator doesn’t exert operational control over its partner firms, doesn’t rebrand acquired firms nor require those firms to sell Focus-branded investment products.

Instead, “Focus is a complex feat of financial engineering,” Crow writes, “which demonstrates, above all, how difficult it is build a consolidation model in the investment management community. We think it’s inappropriate to fault management for doing what they said they do in the S-1.”

-

The New York aggregator’s performance to date “will make it easier for other RIAs to go public,” says industry analyst Chip Roame.

November 13 -

The IPO price was lowered, but long-term performance is considered key.

July 26 -

A public offering will be a landmark for the advisory business. But the aggregator will face unprecedented scrutiny from investors.

June 8