With wealth management M&A on pace for another record year, the CEO of one of the largest RIA consolidators says annual volume could rise by 200 to 400 more deals based simply on the demographics of an aging base of financial advisors.

Focus Financial Partners has a “war chest” of $1.8 billion to deploy toward “about 1,000 firms in the U.S. alone that have the potential to be partner firms and another 5,000 that could become mergers for our partners,” CEO Rudy Adolf said in an earnings call with analysts after the firm

- The company earned net income of $5.2 million, or adjusted EBITDA of $107.8 million, on revenue of $425.4 million in the second quarter. Higher wealth management fees stemming from having a net nine additional partner firms from the year-ago period and rising equity values boosted the firm’s revenue by 36% and its adjusted EBITDA by 44%.

- Kohlberg Kravis Roberts, which, alongside fellow private equity firm Stone Point Capital, had been one of the two largest shareholders in Focus,

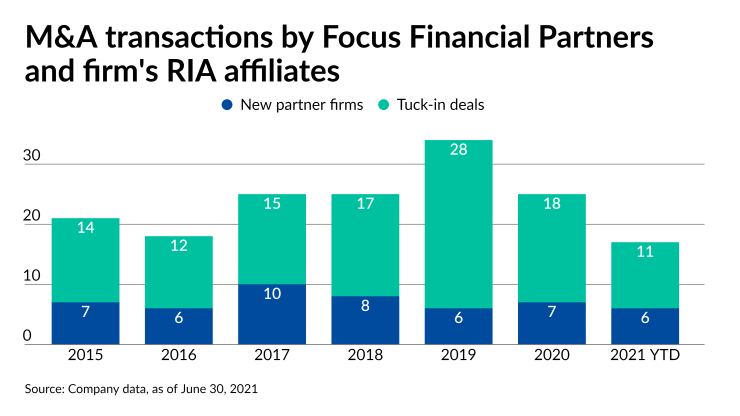

issued a secondary offering of its remaining 7,144,244 shares in the firm on June 21. In other corporate finance news, Focusgained more capital to make deals on July 1, when it closed on the addition of a 7-year, $800-million tranche to its existing first lien term loan. The company has a net leverage ratio of 3.54x compared to its EBITDA, which is elevated butfar less than several privately held rivals that are majority-owned by PE firms. - So far this year, Focus has completed 17 transactions, with six new partner firms and 11 M&A tuck-in deals by existing practices owned by Focus. The company had 76 partner firms as of Aug. 1, according to Adolf. Focus usually spends between $300 million and $625 million per year on an average of 27 deals, with two-thirds of them being mergers executed by its existing partners. Adolf anticipates investing even more in 2021 due to “strong deal momentum and with attractive multiples and growth profiles,” he said in his remarks,

according to a transcript by Motley Fool. “The strong secular tailwinds driving growth and consolidation in the wealth management industry haven't changed irrespective of the short-term dislocations such as COVID or the potential change to the capital gains tax rate. The fiduciary model increasingly resonates as the broader shift to fee-based services and the demand for greater transparency continues.” - In fact, Adolf cited as “one of my favorite statistics” a study finding that there are 45,000 advisors who are at least 65 years old managing a combined $3 trillion in client assets that will be changing hands over the next decade. He’s bullish based on the company’s track record of 225 transactions in its history and its three-pronged value proposition based on the fact that the company is a holding company for its partner firms rather than a management layer, the services it offers to the practices and the permanence of its capital. He noted that most consultants say there are about 200 deals a year in wealth management currently. “You could justify an industry deal momentum of 300, 400 deals a year or more simply when you look at the demographics of this industry,” Adolf said. “So what it basically means is there is a backlog of opportunity that's building up. And we are starting to see this more and more, which, by the way, is another reason why we can be so disciplined from a multiple and capital deployment perspective. So the industry is consolidating. And whenever this wave of consolidation comes through, we are simply better positioned than anybody else to take advantage of it.”