Two LPL Financial advisors sold their coaching firm to the private equity-backed advisor marketing firm FMG Suite, in another sign of how independent broker-dealers and third-party vendors are looking to expand their professional development services.

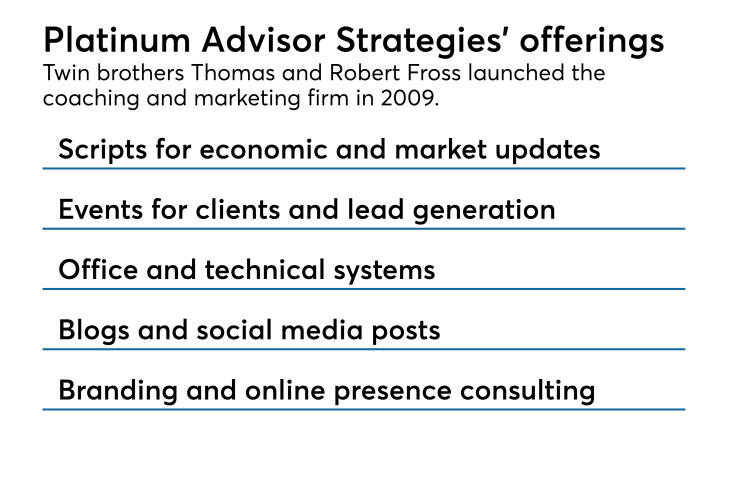

Twin brothers Thomas and Robert Fross, the partners of Fross & Fross Wealth Management, remain on the board of Platinum Advisor Strategies after its acquisition by FMG. The acquiring firm and the Florida-based coaching and marketing firm did not disclose the terms of the deal, which was first

The Fross brothers launched Platinum in 2009, well before IBDs began rolling out help for advisors around client outreach, social media posts and tailored content. For example, Advisor Group

Coaching services have also grown in popularity, with Northwestern Mutual

FMG opened a strategic partnership with Platinum by adding its services to the platform in 2012, and Platinum now works with about 3,000 advisors, Thomas Fross says. The brothers say they are excited to keep roles at the firm they founded while getting more time to spend with clients of their practice, which is based in The Villages.

“It’s a lot like watching your child go to college,” Thomas Fross says. “We’re not just some marketing firm. We have a true grip on what advisors are dealing with on a day-to-day basis, and FMG didn’t want to lose that connection.”

Platinum’s service include scripts for videos and conference calls on stocks and economic trends, event-planning strategies for clients and lead generation, consulting on office systems and online branding and marketing assessments and plans. The coaching and marketing firm's staff of 17 or 18 employees will continue to operate from its separate office from the practice in central Florida.

FMG, which lists more than 10,000 advisors on its platform, integrated Platinum into a new suite called Elevate it started offering on Aug. 1. Advisors can continue to get Platinum-only memberships following the deal, which is FMG’s fourth acquisition in the past two years, according to CEO Scott White.

-

The IBD’s parent has increased its investments in advisory services while other insurers exit the space.

January 9 -

As lure, the firm deploys a $52 million technology platform that is the “best that I've seen.”’

February 8 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2

White declines to say which PE firm backs FMG, describing it only as a $4 billion fund. The company knew Platinum well because of the earlier strategic partnership, he says, praising the firm’s content marketing services as “phenomenal” and noting how FMG can automate advisors’ marketing for them.

“We’re trying to be the advisor’s marketing department. They can basically set it and forget it, and they become a marketing superstar overnight,” White says, adding that the Platinum deal will allow advisors to get the full FMG platform, plus a marketing specialist for further support.

The Fross brothers

“The challenge that independent advisors have is they’re independent, right?” he says. “If you decide to become independent, then you’re on your own. So we rolled this out as a solution for independent advisors.”