Last August, advisor E. Martin von Känel decided to give his former independent broker-dealer, LPL Financial, a chance to win back his firm.

Von Känel, a CFP who’s the founding partner of Patriot Wealth Management, along with the firm’s director of operations, Monica Herrera, and training advisor, Elizabeth Martinez, made the two-hour drive from the Los Angeles area to San Diego for a home office visit at the IBD he left in 2009.

It wouldn’t be an easy task for LPL, which has grown to more than 16,000 advisors since von Känel first joined in 1994, to persuade him to return to the fold. “LPL [had] lost focus of who I am, along with the other [RIAs],” he says.

But after eight hours at the firm, starting with a “very tasteful and elegant” continental breakfast in a spacious, high-tech conference room, followed by a meeting with department heads and talks with upper management, the team was resold.

“Every person I met — they didn’t know who I was — but every person I met had this air of enthusiasm, and I liked that,” von Känel says. He moved his practice back to LPL at the end of October.

Not all advisors are as forgiving of former employers or affiliates.

About 9% of advisors — approximately 27,000 of them — switched firms last year, according to data from Cerulli Associates, a Boston-based research firm. That’s up from 21,000 the year before.

The fact that so many advisors were willing to uproot themselves signals how much time, effort and money companies are putting behind their recruiting efforts.

But these statistics also raise a question: Are firms doing enough to keep their former recruits happy after those first impressions have faded?

“Less than half of the advisors we surveyed are happy with their current firms,” says Charlie Phelan, vice president of practice management and consulting for Fidelity Clearing and Custody Solutions.

“Less than half of the advisors we surveyed are happy with their current firms,” says Charlie Phelan, vice president of practice management and consulting for Fidelity Clearing and Custody Solutions.

More than 33% of advisors say their current firm has not lived up to the value it initially promised, according to a recent Fidelity study on retaining talent. What’s more, a majority of advisors expressed discontent with their employers.

Before reuniting with LPL, von Känel was with Summit Brokerage Services for nine years.

He left because of instability that he hadn’t signed up for. Ownership of Cetera was handed off twice during his tenure at Summit, part of Cetera Financial Group, which was sold to Genstar and then, five years ago, to RCS Capital.

Such deals can be tumultuous for advisors who must explain these purchases to their clients.

It also can make them more likely to leave, which is what von Känel did, despite still liking the people and small-firm feel at Summit.

AVOIDING ACQUISITIONS

“I did not want to go through another acquisition, because that’s what’s going to happen every few years,” von Känel says.

“These firms sell to generate what? The commission. The fee,” he adds. “I decided to look in a different direction, and look at a company that was not going to be acquired, but maybe it was in the acquisition mode.”

LPL and Summit — like all firms, for that matter — must continuously prove their value to their planners well beyond the home office visit, because advisors are in high demand.

“The pipeline of talent in our industry is very skinny,” says Tim Kochis, special advisor at the consulting firm and investment bank DeVoe & Co.

“The pipeline of talent in our industry is very skinny,” Tim Kochis, special advisor at the consulting firm and investment bank DeVoe & Co., said at the RIA consultant’s M&A Conference in New York City in May.

“Just in terms of sheer bodies, there’s not enough of them,” he adds.

Recruiting is especially hard for small firms that haven’t established well-known brands, according to the wealth management recruiter Danny Sarch. “It’s very challenging,” he says. “It’s a tight labor market everywhere. It’s hard for them to get noticed and find people.” And once they do, it’s hard to keep them.

Willingness to move has increased across the investment management industry, according to the 2019 Annual Trends Report by the executive search firm Kathy Freeman Co.

This year, 63% of the more than 300 respondents said they were interested in switching firms, an increase of 20 percentage points from 2018.

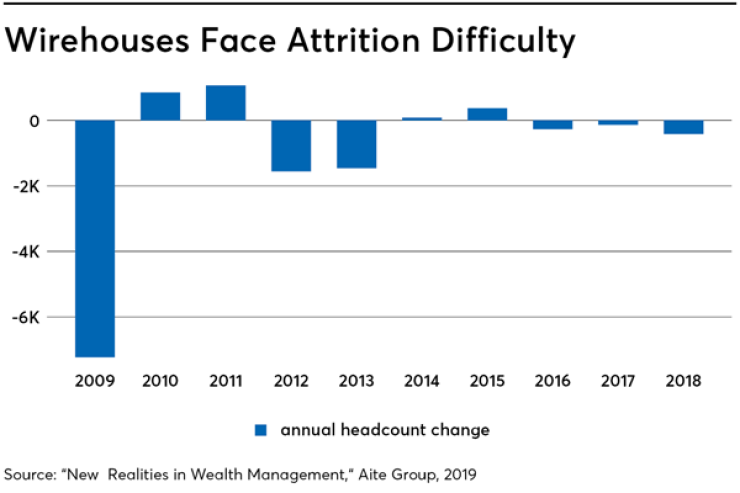

The problem has been particularly acute for the wirehouses.

Morgan Stanley, Merrill Lynch, Wells Fargo and UBS have all experienced falls in their retention rates since the financial crisis. “I think that the magic of being at the big firms is gone forever,” Sarch says.

Collectively, the wirehouse channel has lost a net 8,484 advisors in the 10-year period that ended in 2018 — almost 14% of its workforce, according to a 2019 Aite Group report.

Still, the departures have steadied some. Merrill Lynch expanded its headcount by 1% in 2018 from the previous year. UBS was able to grow by 0.4% during the same time frame.

On the other hand, Morgan Stanley’s ranks decreased by 18 brokers (0.1%), while Wells Fargo’s headcount fell by 4%, or 576 brokers.

At the same time, many regional BDs and large IBDs are growing.

Edward Jones’ headcount grew by 1,520 advisors — over 9%. LPL grew by 899 advisors, nearly 6%.

All firms — wirehouses, BDs and RIAs — face an oncoming retirement wave. The average age for a financial advisor is 52, according to Cerulli Associates’ latest data. About 47% of CFPs are older than 50, according to 2019 CFP Board research.

There are as many approaches to recruiting as there are firms, but some tactics work better than others.

Some, for example, look to M&A to expand their ranks. Thirty-one RIA deals were struck during the first three months of 2019, according to research by DeVoe & Co.

“It’s [often] a succession strategy for firms if they don’t have the right next-gen leaders in their organization,” says Kathy Freeman, the executive recruiter.

It’s also, she says, a way for leaders to “liquidize the profits they’ve built over the many years.”

Focus Financial acquired five firms in the first four months of 2019. Its partners purchased 14 new firms. Genstar Capital-backed Mercer Capital inked three acquisitions in the first few months of the year, according to DeVoe. Practices at LPL are acquiring, too, including von Känel’s, which is in the market to buy.

“We just had a visit from [LPL’s] business development department and they’re now looking for firms [planning] to retire or sell their book for whatever reason,” von Känel says. “They’re looking for assets for us to take on.”

He plans to manage these new relationships with Martinez and eventually pass them over to her and Carly Shafik, who joined Patriot in November and is also pursuing a CFP.

Acquisitions can come with their own challenges. Some deals, after much fanfare, fall apart. New leadership causes uncertainty. Ownership changes may mean disruption for the advisors and possibly clients.

For many advisors, playing an active role in the practice is important.

“Everyone wants to feel like an owner, like they have a seat at the table,” says Scott Hanson of Allworth Financial.

“Everyone wants to feel like an owner, like they have a seat at the table,” says Scott Hanson of Allworth Financial, a private-equity backed $3.5 billion RIA, which he says has brought on 21 new advisors in the past two years, some through acquisitions.

“As humans, we all need to feel like we are participating in something bigger than ourselves,” he says.

Allworth invites advisors to focus groups, including them in the decision-making whenever the firm is considering making changes.

“Being a financial advisor — it’s hard work, and if an advisor can spend a little bit of their week time doing something else, it gives them energy, vigor and more excitement in their career,” Hanson says.

IMPROVING ENGAGEMENT

Firms that had employees with high engagement experience 24% to 59% better turnover results, according to Fidelity’s retention study.

Freeman’s own research backs that up. “As long as [employees are] engaged in what they do, they’re feeling like they’re challenged and there’s a culture there that values their contribution, that’s all they can ask for,” Freeman says.

Some firms have opened new business arms to keep advisors in their network. Wells Fargo launched an RIA channel earlier this year, its second offering in the independent space alongside its IBD, FiNet.

“I think it creates a really compelling offering in the RIA space that people want,” says David Hohimer, one of the first advisors to join Wells Fargo’s new channel, offered through the wirehouse's custodian, First Clearing. The channel allowed him to operate under a fiduciary standard.

Advisor Michelle Cortes-Harkins and her husband, Rick Harkins, affiliated with Commonwealth Financial Network, a San Diego-based IBD, earlier this year. She says a sense of community played an integral role in their decision to leave LPL.

Commonwealth hosted events for female advisors to meet one another, Cortes-Harkins says, noting in particular its three-day women’s conference.

“There are so few female advisors in the industry overall,” she says. “Just being able to connect with others … and see how they’re running their practice, or talk to them about different things, is a big deal.”

To attract young advisors, firms can stand out by laying out a career plan and mentorship opportunities, according to Patrick Dougherty, president of a five-person RIA in Texas and a financial planning college professor.

“We need to come up with a serious and legitimate career path,” he says. “When they join, we need to keep them interested, train them, offer a decent benefit package,” he adds.

Hanson agrees. He has developed a five-year advisor training program for his new hires at Allworth who are just out of college.

Some wealth management firms are getting creative in their strategies to keep employees engaged, offering happy hours, unlimited vacations or even on-site dry-cleaning and shoe shine services, according to Fidelity’s study. Specialization can help, too.

Michelle Cortes-Harkins and Rick Harkins, for example, were attracted to Commonwealth’s socially responsible and ESG investing resources and portfolio models.

Small gestures can also made a real difference. Commonwealth sent the husband-wife duo “extra-strength transition relief” bottles during their transition that included treats such Hershey’s kisses.

“So many kisses,” Michelle says.

“It was just a little pick-me-up if you’re working 12, 14, 15 hours a day, and working at night and at home, too,” Rick Harkins adds.

The duo also appreciated lunch with one of the founders of the IBD during their home office visit.

Ultimately, Fidelity’s Phelan says, extra effort to add value and set up a retention strategy will be cost-effective.

“At the end of the day, people are a firm’s most valuable asset,” he says.

The good news for firms is that many advisors won’t want to make a move — it’s a lot of work.

“Monica [Herrera] said if I do another broker-dealer change, she’s leaving me, so I’m not leaving LPL,” von Känel pledges.