FINRA will raise five of its membership fees in an attempt to cut annual losses, according to a regulatory filing the regulator filed with the SEC earlier this month.

The organization’s costs have

The proposed fee increases, which would be fully implemented in 2024, would generate an additional $225 million per year for the self-regulatory organization.

FINRA’s request to the SEC comes as the commission’s Office of Compliance Inspections and Examinations is increasingly reliant on FINRA to regulate the brokerage industry.

In 2016, Marc Wyatt, a former OCIE director,

Indeed, the SEC’s enforcement department had only

FINRA — in comparison — is solely responsible for broker-dealer and market regulation and

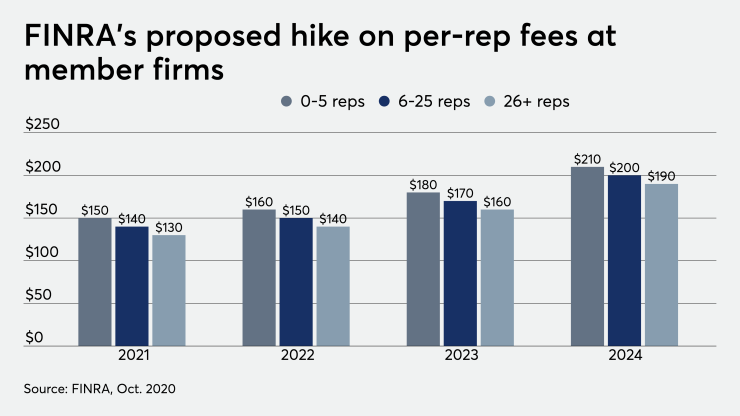

FINRA’s fee proposal to the SEC would boost member firm fees from gross income, trading activity, number of reps, registrations and qualification exams, according to the SEC filing.

The fee hikes would occur gradually, starting in 2022 and grow incrementally over a three-year period.

FINRA says that with the increase, fees in 2024 would cost the industry approximately .22% of total 2019 revenue.

For operations, FINRA is most reliant on the gross income, trading activity and personnel fees, which are used to fund exams, financial monitoring, policymaking and rulemaking, as well as enforcement, according to the SRO.

The regulatory organization hasn’t made any significant changes to its member fees for the last decade, although it did

In 2010, the regulator doubled its personnel fees and adjusted its gross income fee calculation.

FINRA, which has been

“All case deadlines will continue to apply and must be timely met unless the parties jointly agree otherwise,” FINRA said.

The SEC launched an office to regulate FINRA, dubbed the FINRA and Securities Industry Oversight group, in 2016. It followed a

FINRA’s fee proposal will be published in the Federal Register. The SEC will accept comments thereafter.