Rebalancing client portfolios is a strategy most advisers embrace wholeheartedly. Yet sometimes even this seemingly obvious technique takes a measure of courage to implement.

Imagine this scenario: A client comes to the adviser’s office and expresses unhappiness with the funds in her portfolio that have not performed well. The adviser suggests that a rebalancing be done.

“Great, what does that involve?” asks the client.

“Well,” says the adviser, “we take some money out of the funds that you have been happiest with [the ones that have performed well] and put that money into the funds that you are unhappy with. How does that sound?”

See where the courage may be needed?

Rebalancing the various components of a portfolio does not improve performance 100% of the time. However, it does improve the outcome often enough that it’s worth teaching your clients the ins and outs of this investment technique.

TEACHING CLIENTS ABOUT REBALANCING

While most planners understand the value of portfolio rebalancing, it’s not something clients are always savvy about. One way to describe the strategy to clients might go something like this: Rebalancing a portfolio keeps the various ingredients at their assigned allocations as the years go by.

Rebalancing may seem counterintuitive, but it’s exactly how we achieve the basic mantra of investing, which is to buy low and sell high — only the order is reversed: You sell high and buy low in the process of rebalancing.

By building a diversified portfolio in the first place, we are openly admitting we don’t know the future.

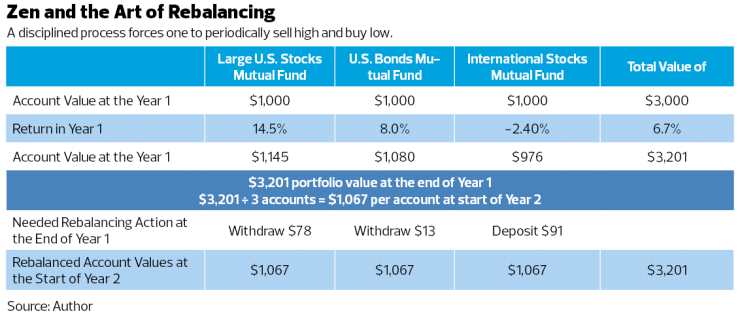

The logistics of a rebalancing process are illustrated in the graph below, Zen and the Art of Rebalancing. As can be seen, this strategy forces an investor to periodically sell high and buy low. The portfolio illustrated here equally allocates money between large-cap U.S. stocks, U.S. bonds and non-U.S. stocks.

The three separate assets had different returns in year one. The process of rebalancing at the conclusion of the first year required that $78 be withdrawn from the large-cap U.S. stocks account and $13 from the U.S. bond account and invested into the international stocks account, thus equalizing the amount of money in each asset at the beginning of year two.

To avoid the burden of taxation associated with selling the surplus out of the best-performing assets, this approach is best-suited for tax-deferred accounts, such as IRA’s, 401(k) or 403(b)s. If the account is not tax protected, the rebalancing can be achieved with new investment dollars. That is, the new money will be invested primarily into the funds that did poorest in the prior year, thus bringing their balances up to the needed allocation percentage.

LONGER VIEW

Let’s now consider how rebalancing has played out over the past 46 years, from Jan. 1, 1970, to Dec. 31, 2015. Specifically, we will examine the performance of a seven-asset portfolio that includes large-cap U.S. stocks, small-cap U.S. stocks, non-U.S. developed stocks, real estate, commodities, U.S. bonds and cash. Each asset class was equally weighted with an allocation of 14.29%.

One version of the seven-asset portfolio was never rebalanced, and the other version was rebalanced annually at the end of each year. The big question: Did rebalancing produce a performance advantage? To determine this, we measured the performance of both seven-asset portfolios over 27 rolling 20-year periods to control for time-period bias. Taxation was not considered, which implies that the accounts in this analysis were tax-sheltered.

The first 20-year period was from Jan. 1, 1970, to Dec. 31, 1989. A total of $7,000 was invested into each seven-asset portfolio at the start of each year (representing $1,000 into each). The ending value of the non-rebalanced portfolio on Dec. 31, 1989, was $776,509, compared to $786,952 for the annually rebalanced portfolio, producing a rebalancing advantage of $10,443.

-

Raw performance grabs headlines, but highlighting the benefits of diversification is more beneficial for those who react poorly during periods of market volatility.

August 24 -

Patience is a virtue, but advisers can suggest it as a portfolio diversifier that clients can actually control.

May 26 -

The freedom to choose a more conservative retirement model is predicated on using a lower withdrawal rate.

August 9

Over the next rolling 20-year period (from 1971 to 1990), annual rebalancing produced a $36,749 advantage over the non-rebalanced portfolio (see graph, Rebalancing by the Numbers).

We observe a rebalancing advantage in 78% of the 27 rolling 20-year periods. The average advantage was $13,722. The largest rebalancing advantage was $36,749 over the 20-year period from 1971 to 1990. The largest rebalancing disadvantage of -$24,631 occurred during the period from 1980 to 1999.

The argument for this investment approach looked weak in the first half of 2016.

In other words, the seven-asset portfolio was $24,631 better off by not being annually rebalanced over that particular 20-year period. It is instructive to note that two of the six periods in which rebalancing produced the largest disadvantage (1979 to 1998 and 1980 to 1999) were periods that ended at the high point of the tech bubble in the late 1990s.

LETTING AN ASSET RUN

When an asset class (U.S. equity in this case) is experiencing unusually large returns year after year, it is better not to rebalance and instead to let the asset run. In this specific time period, the S&P 500 had the following returns: 37.58% in 1995, 22.96% in 1996, 33.36% in 1997, 28.58% in 1998 and 21.04% in 1999. By not rebalancing, the gains in the running asset class are allowed to compound on themselves, thus producing a better outcome — for a while.

The non-rebalanced portfolio allowed the percentage allocation in the large U.S. stocks component to escalate during the late 1990s. In fact, during the 20-year period from 1980 to 1999, the portfolio allocation in large-cap U.S. stocks had grown to 25% by the end of 1997, and was 31% of the portfolio by the end of 1999.

It’s a logical idea to let winners run by not rebalancing, but it is short-sighted.

The original allocation to large-cap U.S. stocks (and the other six asset classes) at the start of the 20-year period was 14.29%. Thus, the non-rebalanced portfolio had disproportionately large percentage allocations to large-cap U.S. stocks based on its performance toward the end of these particular 20-year periods that ended in the late 1990s. Those large allocations were rewarded with large returns the next year — and the next year. Thus, the non-rebalanced portfolio outperformed the rebalanced portfolio.

But all that changed in 2000, 2001 and 2002, when the tech bubble burst and the performance of U.S. stocks and non-U.S. stocks crumbled. The S&P 500 had returns of -9.1% in 2000, -11.89% in 2001 and -22.10% in 2002. Non-U.S. stocks had large negative returns in 2000, 2001 and 2002, and small-cap U.S. stocks lost 3.02% in 2000 and 15.94% in 2002.

RISKS OF NOT REBALANCING

Sadly, these negative returns were applied to large allocations because the portfolio had not been rebalanced. Big ouch.

Witness the large rebalancing advantages that immediately followed the 1980 to 1999 rolling period. The 1981 to 2000 rolling period had a rebalancing advantage of over $15,000, followed by a $20,557 rebalancing advantage over the period from 1982 to 2001, and a $32,862 rebalancing advantage from 1983 to 2002.

It’s a logical idea to let winners run by not rebalancing, but it is short-sighted. The problem comes when the outperforming asset class suffers a correction (which they all do) and their large losses are experienced by a larger than originally specified portion of the portfolio.

Moreover, how is anyone capable of knowing how long an asset class will continue on a hot streak? No one has that foresight, which is why rebalancing makes sense. And for the record, rebalancing less often is better than more often. Annual or quarterly rebalancing is advisable, monthly is too often.

Consider this very basic premise, which clients often forget: By building a diversified portfolio in the first place, we are openly admitting we don’t know the future. If we knew which asset class would outperform, we surely would not diversify; we would simply invest in the asset class that would be the best performer going forward.

But alas, advisers are not clairvoyant. The blunt reality is that rebalancing is a protocol that makes sense each and every year, because we cannot predict the future with any accuracy. As a result of greed or fear, this simple reality is often lost on clients. Because we don’t know how long a certain asset class or mutual fund will stay on a hot streak, we rebalance all the portfolio ingredients periodically.

Because rebalancing is emotionally counterintuitive, it is not a milquetoast portfolio management protocol. Rather, it takes courage on the part of the adviser to sell high and buy low. As shown in “Rebalancing by the Numbers,” it usually pays off over time.