In an age of shrinking compensation models and shifting regulatory landscapes, digitally driven financial plans are the future when it comes to keeping and attracting clients — or so you’d think.

But the latest Financial Planning Tech Survey suggests a growing number of advisors are concluding that financial planning software is not the silver bullet they’d hoped for and are re-evaluating the value it brings to their practices.

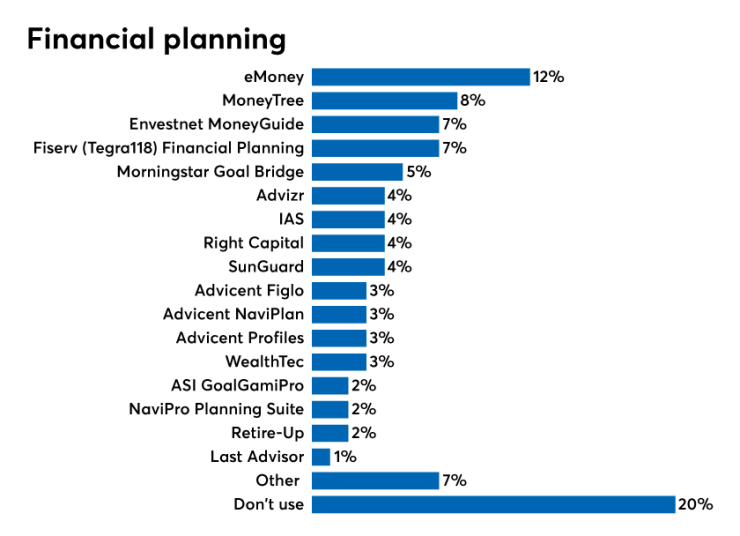

Twenty percent of advisors say they are currently not using any financial planning software, a 16-point increase from the 2019 survey. Factor in that some advisors are using in-house solutions or consumer-facing tools, and the adoption rate of dedicated financial planning software falls even lower.

“I know advisors are still using [Microsoft] Excel and a piece of paper, basically,” says William Trout, head of wealth management at research firm Celent.

Of course, an 80% user rate is very high for an industry typically slow to adopt new technology, but the decrease contradicts popular wisdom about the direction of the advice industry. It could be that planning technology is so widespread that it no longer provides a real competitive advantage for firms, Trout suggests.

“[Advisors] are understanding that financial planning is not the panacea they’ve hoped,” he says. “These tools are really playing a game of inches … they’re really not moving the needle for advisors in terms of pricing power.”

Like everything else, the global COVID-19 pandemic is impacting the tools advisors use.

Many are looking to get more hands-on with client portfolios during market fallout from the coronavirus.

Immediate advice

Clients are demanding advice that can help them in the here and now, says Erin Wood, vice president of wealth planning at Carson Wealth.

While planning tools on the market are great for long-term projections, she says, they fall short when it comes to immediate advice.

“The tools take time to update for the new rules, benefits and tax law changes. Advisors don’t have time to wait for those updates to be completed, so they end up doing a lot of the work themselves ahead of software updates.”

Rich Keltner, Tegra118’s (formerly Fiserv Investment Services) director of product management, says advisors may be focusing less on making new plans and more on portfolio management and investment products such as annuities to help current clients get through the current market volatility in the midst of the coroanvirus pandemic.

“When an advisor is under pressure to get things done, the planning process may take too much time right now,” Keltner says.

The market drop has also forced advisors to go over their budgets with a scalpel, says Nick Defenthaler, a partner with Center for Financial Planning. Some planning platforms are expensive, and advisors could see this as an opportunity to cut costs, especially if they are already putting planning on the back burner.

“I don’t agree from a practitioner’s standpoint, but at the end of the day, with so many solo advisory teams, that’s going to be a common thing that you see,” Defenthaler says.

Planning technology rose to prominence during the bull market of the past decade. Firms across the advice industry looked toward planning, once a niche offering, as a way to comply with new regulations, build stickier client relationships and justify fees as low-cost technology encroached on traditional investment management. Even wirehouses are pushing advisors to create financial plans for client accounts.

Lacking tech knowledge

But these advisors don’t always have the technical knowledge or communication skills necessary to successfully integrate planning into a wealth management practice, says Cannon Financial Institute Executive Chairman Phil Buchanan.

“Experience shows while many use [financial planning tools] just on an ad hoc basis, others use them only on significant client relationships, and a smaller percentage uses it on a client base, full-scale effort,” Buchanan says.

“We’re asking people to change their business practices and to incorporate planning, and it goes back to the confidence in what to do and how to execute upon that. It can be a big challenge,” he adds.

Digitizing and automating the heavy workloads involved in planning is supposed to make it easier for these firms to offer the service. That premise propelled some fintech startups into industry powerhouses. Two of the largest commanded nine-figure price tags, with eMoney Advisor selling to Fidelity for $250 million in 2015 and Envestnet buying MoneyGuide in 2019 for $500 million.

Mind the skills gap

Yet advisors still struggle with how to value the technology in their own firm, and how to express that value to clients. Clients are more aware of fees than ever before, and commercials advertising zero trading commissions aren’t doing advisors any favors.

Portfolio gains are easy to talk about, while the benefits of a long-term plan remain “ephemeral or elusive,” says Trout. “I think there has been some disillusionment, or maybe a reality check, around the ability to charge for advice.”

Advisors end up only using a fraction of the available capabilities, even though they are paying for the whole product.

Even leaders at top financial planning vendors agree this is a challenge facing advisors. Envestnet MoneyGuide President Tony Leal knows there are advisors who bought into planning despite being uncomfortable with some of the topics of conversation. While he hopes the next generation of planners coming out of graduate programs will change things, there will always be those who are better at helping people make money than at long-term life planning.

“There is no doubt in my mind that there are certain RIAs who struggle with that,” Leal says. “It’s just not how they were successful previously.”

Jessica Liberi, eMoney Advisor’s head of product, is trying to address the issue with enhancements to the technology. The eMoney Advisor’s platform includes a “planning road map,” she says, that quantifies the value-add for a client over the course of the plan.

But as these products expand, so does the learning curve and data entry burden on advisors, Wood says. Advisors end up only using a fraction of the available capabilities, even though they are paying for the whole product.

Keltner agrees. “Sometimes you only need a Ford and you’re getting a Ferrari,” he says.

Easier to use

The vendors say they’ve heard this criticism and are investing toward making the products easier to use. MoneyGuide is developing its myBlocks program, which breaks down a plan into small pieces.

Using a Netflix-style menu, clients can complete the steps at their own pace and eventually build a comprehensive plan.

EMoney is investing in easier-to-use experiences and advisor training, Liberi says. Advicent also wants to encourage advisors to leverage its entire NaviPlan platform by easing the learning curve without sacrificing any of its sophistication.

Vendors, however, say they don’t have any internal indication that advisors are pulling back on planning technology. Both Liberi and Hussain Zaidi, president of Orion Planning (formerly Advizr), say that, on the contrary, they are seeing steady growth.

“EMoney is pretty well positioned as a technology to better engage with existing clients,” Liberi says. “People need to have a solid and updated financial plan.”

Marketing strategies

Advisors may be worried about keeping their clients, but Advicent chief operating officer Anthony Stich says they can use market volatility to build business with the right marketing strategy.

“There is increased demand around the concerns of financial certainty,” Stich says. “Now is the time people are actually looking online, Googling topics around saving more money and rainy day funds.”

But Michael Garry, chief compliance officer of Yardley Wealth Management, is doing so much rebalancing, tax-loss harvesting and fielding client questions that he doesn’t have time to find new clients or undergo the lengthy process of creating a new financial plan.

We’ve spent so much time doing outreach, talking to clients and responding to their calls and emails that we haven’t done nearly as much planning as we ordinarily would do.

“We’ve spent so much time doing outreach, talking to clients and responding to their calls and emails that we haven’t done nearly as much planning as we ordinarily would do,” Garry says.

Nor is he revisiting plans for current clients, saying this market drop is the kind of scenario he’s planned for.

“I have only opened the software up a couple of times, and not really making any changes,” he says.

While Garry, a planning-centric advisor, isn’t considering cutting back on his technology, he suspects other advisors who don’t offer much planning to begin with could see it as a place to cut costs.

Stephen Cavagnaro, director of private clients at Anchor Capital Advisors, agrees that planning tools are more likely to be set aside during the current environment.

The conversations he’s having with clients tend to be more emotional than strategic. That doesn’t mean advisors should abandon planning altogether.

“While volatility can quickly skew the results in the short term, investors need to be reminded that the plan is a long-term solution,” Cavagnaro says. FP

Editor’s Note: Craig Iskowitz, founder and CEO of strategy consulting firm Ezra Group, contributed to this year’s survey and analysis.