Wealth managers are feeling the pinch as revenue drops and their firms' disaster plans require on-the-spot retooling.

These are just some of the signs of how the coronavirus pandemic and accompanying market volatility are taking a toll on wealth management, according to a new survey by Arizent, the parent company of Financial Planning and On Wall Street.

Roughly three-out-of-four wealth managers say they’ve seen revenue declines at their company, according to the survey. That poses a particularly thorny problem for wealth management. For years, firms from the giant wirehouses to small RIAs have been pivoting into a fee-based AUM model. Until recently, it was seen as providing a steady source of revenue. That source no longer appears quite so steady.

One advisor is expecting at least a $30,000 drop in income this year. “It's going to hurt, but we will get through it,” the advisor says, adding there is a silver lining. “My clients ... are at least following my recommendations and staying put. Nice to be so trusted. Makes my job easier going forward.”

Another financial planner notes that steep revenue declines “while not hard to accommodate over the short term, may force hard decisions over the medium term.”

In an early preview of what many companies may soon be reporting,

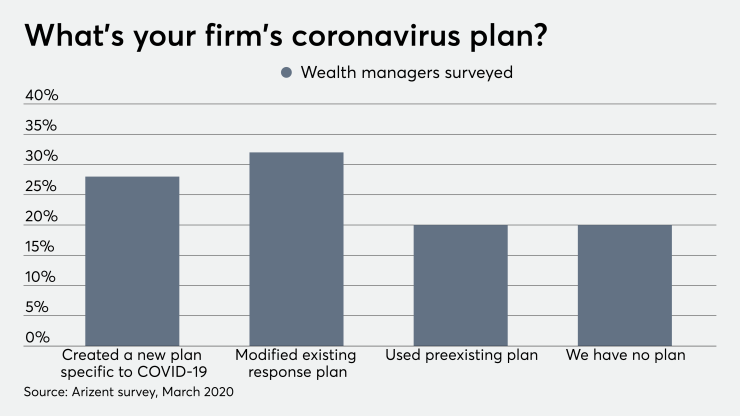

A whopping 84% of wealth managers say the pandemic has had a negative impact on their business — and the effects go beyond a shrinking top line. The virus has revealed shortcomings in company plans for coping with a disaster, according to the survey, which polled more than 300 financial services professionals.

“Although our firm had a business continuity plan in place, the plan did not cover a pandemic like this and we were not prepared to handle the extra volume of remote users,” says an advisor, who like others were permitted to submit comments without being identified.

Now that many advisors are working from home, they are stepping up their use of technology. Two-thirds of those polled say they’re increasing their adoption of video conference tools to do their work and to communicate as they forego face-to-face meetings with clients. And three-fourths say their firms are investing more in technology to facilitate employees working remotely.

Wealth management firms,

Looking ahead, advisors were split on their outlook for the U.S. economy, with about half saying their view was positive and half taking a more dour view.

But even as stress accumulates and firms are put to the test, there was one bright spot: About 80% of wealth managers credited their colleagues with responding well to the challenges of the moment.

To read the full survey results, visit our sister publication