With the partial government shutdown moving into its unprecedented fifth week, financial advisors and wealth management firms are stepping up where federal resources have lapsed.

Military-focused firm First Command Financial Services, which has an independent broker-dealer, has provided zero-interest, zero-fee

XY Planning Network advisor Kevin Mahoney

The U.S. Chamber of Commerce and 385 business groups sent

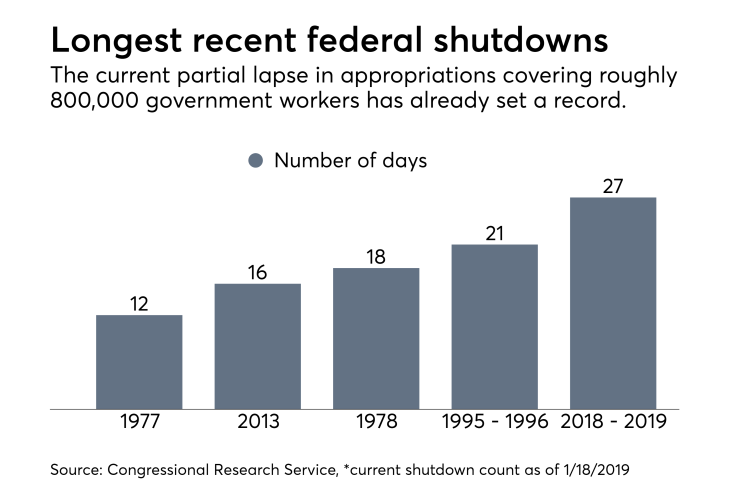

Some 800,000 federal employees have not received any pay since the partial shutdown began on Dec. 22,

In addition to the record length of the shutdown, U.S. Coast Guard Commandant Adm. Karl Schultz sent an

President Trump

Fleming, a principal with the Washington, D.C.,-based Commonwealth practice Armstrong, Fleming & Moore, has at least one client who may borrow from a retirement plan. Both he and Spiker cite federal employees’ decisions to serve the country rather than collect more generous pay in the private sector.

“I guess it would be more infuriating than difficult,” Fleming says of his 10 mostly senior-level federal employee clients. “These people are serious players in their industry, in their fields. It's insulting to not get paid for the work that you're doing and be sent home.”

-

The SEC is running on a skeleton crew that effectively halts routine oversight.

January 3 -

Offices remain open and monthly Social Security checks will go out on time despite the partial shutdown.

January 16 -

Clients may want a new plan if there have been unfavorable changes to their old plans, they want more flexibility or because of a new illness.

January 15

As the SEC furloughs workers, the consequences are rippling across the entire wealth management industry.

About 6% of 3,000 eligible First Command clients have opted for payroll advances, according to Spiker, who says the Fort Worth, Texas-based firm is also waiving penalties on early withdrawals from CDs, among other aid. First Command’s IBD has 500 advisors managing about $26 billion in client assets.

“We'd rather have them have the liquidity through a zero-interest loan so that they don’t have to go touch that money,” says Spiker, noting tax and income consequences for retirement-plan withdrawals. “They shouldn’t have to do that because the government can’t figure out how to keep running.”

XY’s fee-only planners lined up to help after Mahoney, the founder of Washington, D.C.,-based practice Illumint, came up with the idea of pro bono emergency sessions for the workers. The 850-advisor network posted a

“The shutdown is a good reminder of why financial planning is about so much more than just investments,” Mahoney said in a statement. "A financial advisor can help an impacted worker evaluate the challenging tradeoffs that come with financial decisions during income uncertainty.”

One of Fleming’s clients, an attorney with the Treasury Department, said in an email that they were “trying to look at the silver lining” of the furlough such as more time with their kids “but it’s getting really old.”

The client’s household has begun tapping their savings, but they may need to look at other options if the shutdown stretches into April. The need for cash flow may prompt others to borrow from their retirement accounts, which Fleming says is “a pain” in terms of logistics and rules.

“I think it's something that none of us who are planners like doing,” says Fleming. “It's one of the cheapest ways to access your retirement plans, fortunately or unfortunately.”

First Command’s 10-member military advisory board, which has retired and enlisted leaders from each branch, includes retired Coast Guard Master Chief Petty Officer Charles “Skip” Bowen. The Coast Guard is different from the other military services since it’s not part of the Department of Defense, he notes.

“You only need to glance at the military pay tables to see that these Coast Guardsmen do not make a great deal of money, and many live paycheck-to-paycheck,” Bowen

One of advisor Ryan Fleming's clients says they're “trying to look at the silver lining” of the furlough such as more time with family “but it’s getting really old.”

He added that many other banks and financial firms are also trying to help. AFGE, the federal employees union, has posted

The shutdown is cutting an estimated 10 basis points worth of growth in gross domestic product from the economy every week, up from earlier White House projections of 10 basis points every two weeks, CNBC

First Command has been assisting its servicemember clients through shutdowns since at least the 2013 closure, but Spiker declines to weigh in when asked if the company has any messages for lawmakers. The company’s bank, insurance, investment and planning services put it in a position to help, he says.

“Our reps are proud that our mission is such that it compels us to step into this gap and try to fill it,” Spiker says, noting the firm will simply take the proceeds from the back pay and apply it against the zero-interest loans after the shutdown. “Administratively, it's very easy to undertake.”