A financial planner who admitted to defrauding his client out of nearly $1 million through a signature-forging scheme received a prison sentence of four-and-a-half years.

William P. Carlson Jr. pleaded guilty to mail fraud in the U.S. District Court in Chicago and agreed to pay restitution of $911,000 in connection with the five-year scam, the U.S. Attorney’s Office for the Northern District of Illinois said this week.

Carlson, a former partner with suburban Chicago-based RIA Forum Financial Management, carried out the scheme by drawing checks from the client’s account and intercepting them in the mail when she wasn’t home, court documents show. He later enlisted a friend, who Carlson says didn’t know about the scheme, to help, investigators say.

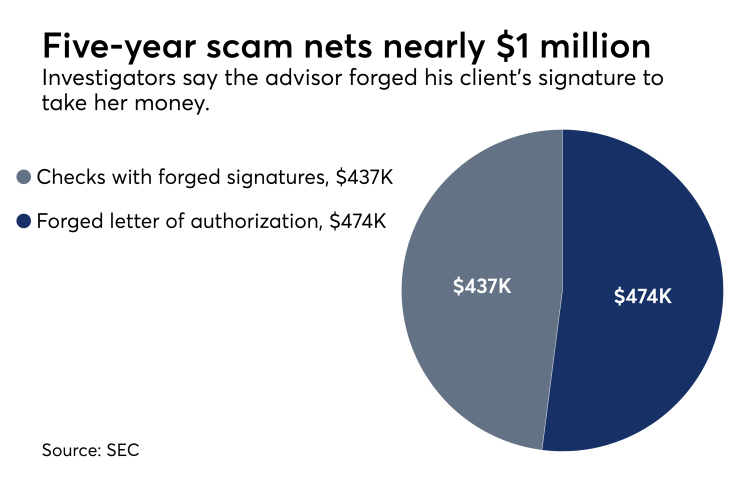

Carlson forged the signature of the client, a medical assistant in her 60s who had invested her divorce settlement, on checks signing her funds over to him and a letter of authorization allowing her funds to go to his friend, investigators say. He pleaded guilty in August to the felony charge, court records show.

In a memo outlining their support for a prison term within the federal guidelines of 51 to 63 months, prosecutors said Carlson had lied to his firm for years before confessing to the scheme earlier this year. The memo includes statements from former colleagues calling for strict punishment, including jail time.

“The defendant was an investment advisor, which adds weight to the need for general deterrence. The SEC cannot look over the shoulders of every individual who acts as an investment advisor,” prosecutors wrote in the memo.

“When an investment advisor steals money and lies to his client and his firm, the system is compromised. A term of imprisonment is necessary in this case for purposes of general deterrence of other individuals who are acting as investment advisors, who may be tempted to commit crime.”

-

“It starts out small,” the advisor told his compliance officer, authorities say. “You think you are going to pay it back.”

February 24 -

A 75-year-old widowed retiree allegedly lost nearly half of her $3 million investment in the scheme.

November 15 -

The wire fraud charge came nearly four years after the CFP Board revoked his certification.

November 17

Regulators have revealed what kind of issues advisors must address if faced with a review.

Carlson’s lawyer declined to comment on the case. The defense submitted six letters to U.S. District Judge Robert Gettleman attesting to Carlson's admission of the scheme and efforts to change his ways. Carlson serves as a volunteer each morning at a food pantry in Carpentersville, Illinois, and he now works in sales for an electrical engineering firm, according to the letters.

“Every day he does the best he can to come to grips with and make up for his criminal conduct,” his lawyer, Kent Carlson, wrote in a sentencing memo for the defense. “Every day he strives to lawfully come up with a way to make his victims whole.”

The client alerted the firm, which started the investigation when she reported that her account with Forum’s custodian had only $48 left, according to the federal criminal complaint in the case. Under questioning from the firm’s chief compliance officer, Carlson revealed the scam and the firm immediately provided her a refund, prosecutors say.

“We are satisfied to see that justice has been served with the sentence that has been handed down,” Forum Co-managing Partner Jonathan Rogers, said in an emailed statement. “We hope this serves to reinforce the significance of what it means to be a fiduciary and to always put clients’ interests first.”

The firm fired Carlson in February. Representatives for the SEC didn’t immediately respond to a request for comment on whether he could be banned from the industry or face additional penalties. No one else has been charged in connection with the case, according to the U.S. Attorney’s Office.