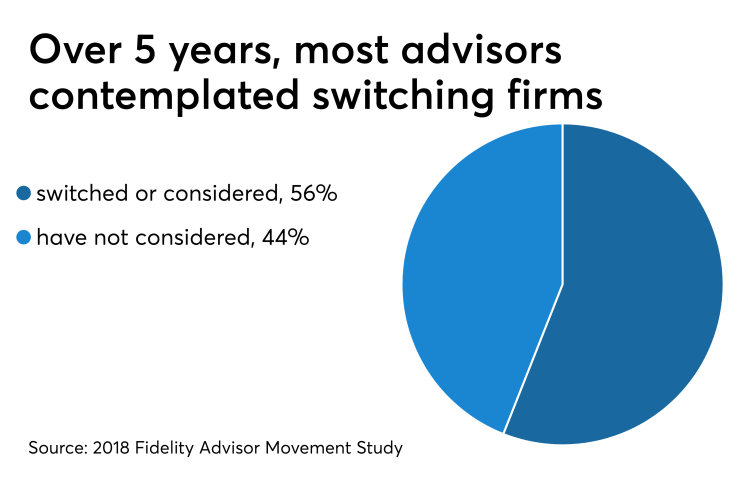

As the shortage of advisors worsens due to retirement, firms are recruiting new, and younger, talent. But they may first want to evaluate whether they’re keeping their existing advisors satisfied.

“Less than half of the advisors we surveyed are happy with their current firms,” says Charlie Phelan, vice president of practice management and consulting for Fidelity Clearing and Custody Solutions.

Unhappy advisors have proven a willingness to leave. Since the beginning of this year, at least 222 advisors managing nearly $47 billion in assets have switched firms, according to recruiting data collected by Financial Planning.

Not keeping new, or existing, planners happy could be costing firms millions of dollars in assets. “Keeping the advisors that you have is less expensive than recruiting new advisors,” says Phelan.

So what keeps an advisor content?

It starts with providing the basics: competitive salary, technology, management support. “Where you get the higher level of engagement is with teamwork,” says Phelan, citing Fidelity’s

Employees want to get to know their peers and be recognized for their work, the study says. They also want to hear how they’re doing, and what progress they are making.

Training programs, support for licensing and credentials, and marketing and business licensing support can also help.

For younger advisors, it helps to lay out a career plan and mentorship opportunities, according to Patrick Dougherty, president of a five-person RIA in Texas and a college professor for next generation planners. “We need to come up with a serious and legitimate career path. When they join, we need to keep them interested, train them, offer a decent benefit package.”

But be careful of overcommitting. More than 33% of advisors said their current firm did not live up to the value it had initially promised, according to Fidelity’s study.

“Part of it is probably that [the advisor] had higher expectations than they should have,” says Dougherty.

-

One custodian is testing the technology in its marketing efforts and anticipates its advisors may — eventually — decide to follow.

May 1 -

Independent Financial Partners aspires to be a “very, very small agent for change.”

April 30 -

The regional BD adds two teams with $373 million in assets.

April 26

Young advisors coming out of school with financial planning degrees know there’s a shortage of young talent, Dougherty says. “They’re really in demand, and they know it. They have high expectations. We as employers are starting to find out that we have to up our game to attract and keep them. And it’s not just about money. It’s about enjoyment, flexibility and things we didn’t even think about.”

But sometimes employees may be asking for too much, Dougherty says.

“I’ve actually had people come in to an interview with me who asked when they could expect to have equity in the firm,” he says. His response? “Show us what you can do, then we’ll talk about equity.”

Some wealth management firms are

A little extra effort to set up a strategy may prove cost-effective.

“At the end of the day people are a firm’s most valuable asset,” Phelan says.