A former MassMutual representative and financial wellness entrepreneur spent millions of dollars of his clients’ money on homes, cars, cruises and other personal uses, authorities say.

Isaiah L. Goodman misappropriated more than $2.25 million from at least 23 clients over a four-year period in which he steered it towards luxury items, Ponzi-like payments and his other business, an app called MoneyVerbs, according to

The federal rap — which came the same day the SEC accused Goodman of three violations of antifraud laws — charged the startup founder who once wrote on his now-removed

Goodman “lied to prospective and existing clients about his use of their money, the security and profitability of the financial accounts he claimed to administer on his clients’ behalf, the status of the funds they provided to Goodman, and the historical investment and trading performance of his clients’ funds,” according to federal investigators.

He didn’t respond to requests for comment through MoneyVerbs or his website, but Goodman’s attorney said in an email that his client had turned himself in to authorities.

“Mr. Goodman reported himself to the Department of Justice,” said Joe Dixon of Fredrikson & Byron. “He takes full responsibility for his actions and is doing what he can to make amends.”

Representatives for MassMutual didn’t respond to requests for comment. Goodman had been affiliated with the firm’s independent broker-dealer, MML Investors Services, for nearly two years before he launched his RIA, Becoming Financial Advisory Services, in 2018, according to FINRA BrokerCheck. He spent the prior five years with Northwestern Mutual.

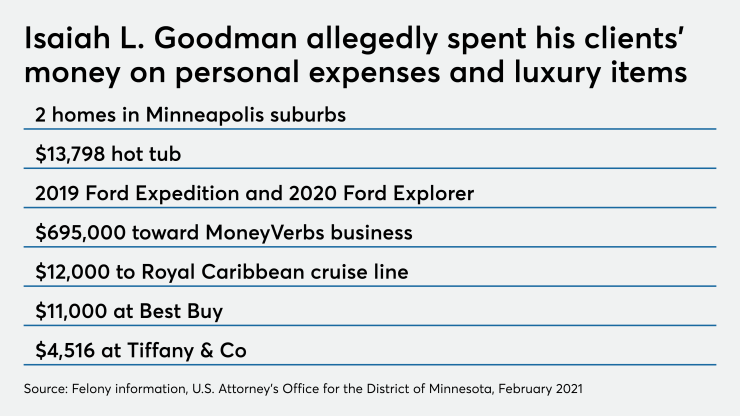

The RIA’s last SEC Form ADV showed $5 million in assets under management from 26 accounts. Goodman spent clients’ money on two homes in the Minneapolis suburbs, including one featuring a hot tub he bought with their purported investments and a separate $1.7-million residence, according to the federal charging documents.

He also used their money in purchases of a 2019 Ford Expedition, a 2020 Ford Explorer, Royal Caribbean cruises, $4,500 worth of Tiffany & Co. jewelry and nearly $200,000 toward credit card payments, debts, and loans, the feds say. Goodman spent another $695,000 of clients’ money on MoneyVerb’s payroll and other services for the wellness app, according to investigators.

In one example cited in the SEC’s complaint, two clients wired Goodman $372,000 “for investment in low-risk securities for their retirement savings” in June 2019. He later sent them computer screenshots that showed their account value had grown to $402,000, the SEC says. In fact, he spent nearly all of their money within two to three months, according to investigators.

Goodman’s “dream of helping as many people as possible has led him to create MoneyVerbs, a financial wellness app that allows users to practice getting rich — the safe way,” according to the “about” section of Goodman’s website. A cached version is visible after the site was deleted.

The app is still available from Apple and Google Play, and the MoneyVerbs

After the announcement of the federal and SEC cases against Goodman, a former MoneyVerbs employee

“I truly believed in the mission of the startup, but it's incredibly sad and ironic how things turned out,” the ex-employee wrote. “As of the last week, he's still operating MV so please do not support it or get involved with any of his other businesses (uninstall the app, unfollow his accounts, warn your mutuals who follow his pages, etc.).”

In November, the Minnesota State Department of Commerce suspended Becoming Financial’s registration as a result of the allegations, according to the SEC. Goodman is slated to appear in federal court on Feb. 17 for his arraignment and a plea hearing.