An ex-LPL Financial advisor accused of misappropriating millions from clients faces up to 7 ½ years in prison if a plea deal with prosecutors receives approval in federal court.

James K. Couture steered $2.9 million from at least seven clients he defrauded between 2009 and 2020 by convincing them to place their assets in a fake sub advisor he controlled and used for his own purposes, according to the

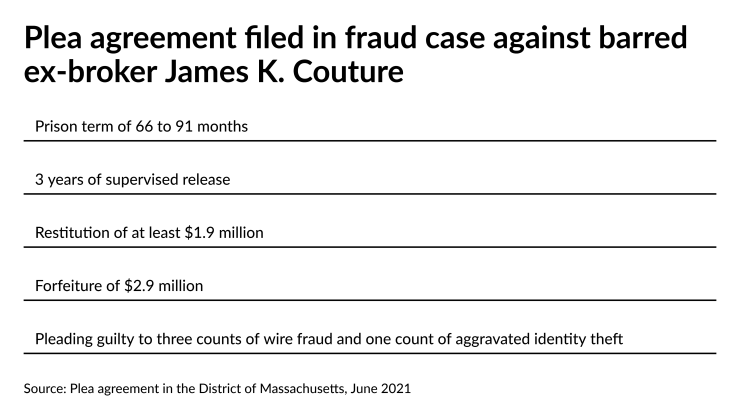

Prosecutors filed the agreement June 1 — the same day as a criminal information document charging Couture with three counts of wire fraud and one count of aggravated identity theft. The plea deal sets the possible term of incarceration at between 66 and 91 months, plus restitution and forfeiture up to $2.9 million. The agreement awaits approval from U.S. District Judge Nathaniel Gorton.

“Defendant admits that he committed the crimes specified in these counts and is in fact guilty of each one,” the agreement states.

Couture’s attorney, Brad Bailey, declined to comment on the allegations or the plea agreement. “Because formal proceedings have not yet been scheduled in the [Justice Department] case, it would be premature for me to comment on either that case or the SEC matter,” Bailey said in an email.

Representatives for LPL didn’t respond to a request for comment.

Couture’s practice, The Private Wealth Management Group, had eight employees with its main office in Worcester, Massachusetts and a second office in Springfield, according to the SEC. The practice had $150 million in assets under management in December 2019, the SEC says.

Couture was affiliated with LPL from February 2009 to June 2020, when the firm terminated him citing allegations Couture “altered identifying information, account balances and distributions in [a] customer account statement; maintained comingled customer funds; and [used] an unapproved email address,”

Through Legacy Financial Group, the fake sub advisor established by Couture in New Hampshire in September 2009, he misappropriated the clients’ money using it, among other things, to purchase another advisor’s book of business in 2013 and to pay others he defrauded, the criminal charging documents show.

Besides the shell firm, Couture set up a third-party retirement plan administrator and trust company accounts and, in one case, liquidated two of a client’s variable annuities for more than $900,000 and then steered the funds to another victim, prosecutors say.

In addition to the prison term, the plea deal calls for three years of supervised release, a fine and an assessment of $400. If the agreement receives approval, Couture would then waive the right to appeal his conviction or sentence. If the judge rejects any part of the plea agreement, the feds can opt to void it and Couture could withdraw from it, the document states.

The only client claim filed against Couture was denied in February. Fraud cases involving wealth managers like LPL often result in

LPL’s regulatory charges ticked down by $4 million in 2020 to $29 million,