A former Baird executive joined a fast-growing independent firm in a bid to help it grow even more.

Jarrett Kovics will serve as head of Business Development for U.S. Capital Advisors, which has added about 50 advisors overseeing approximately $6 billion in assets since its founding in 2010.

Kovics, who is based in Houston, previously served as western divisional director for Robert W. Baird’s Private Wealth Management business from 2010 to 2017. He's known U.S. Capital Advisors founder Pat Mendenhall for several years and wanted to join the firm in part because it could offer more flexibility and freedom for advisors, he says.

"When firms grow they tend to make scale-driven decisions, and they ultimately find themselves making decisions like the firms they have recruited away from," Kovics says. "U.S. Capital Advisors hasn't done that."

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

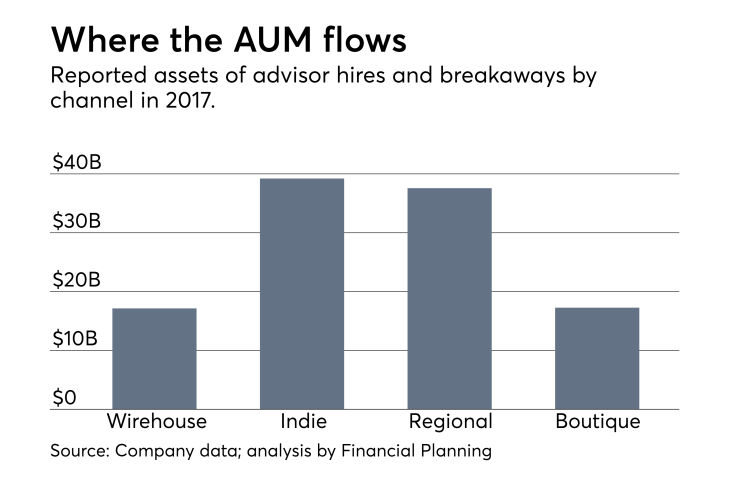

Wirehouse advisors have been increasingly leaving the big firms for regional brokerages or independent firms in recent years. In 2017, advisors managing about $40 billion in client assets went to independent firms. By comparison, advisors managing about $17 billion joined wirehouses amid recruiting cutbacks at Morgan Stanley, Merrill Lynch and UBS.

In recent years, Houston-based U.S Capital Advisors has been a beneficiary of that trend, recruiting a number of wirehouse brokers and opening new offices in Dallas and Austin. Mendenhall, who worked at UBS prior to founding the firm, expects more recruits to join the firm this year.

"We have some excellent opportunities in Texas. It's easier structurally to recruit and supervise within the state of Texas. But because of Jarrett's reach, there are some perfect teams for what we want to accomplish outside of Texas," Mendenhall says.

Kovics, who had a one-year non-compete with Baird, spent the interim year since leaving the regional firm with his family. He also learned Spanish.

A spokeswoman for Baird was unavailable for comment on his departure.

On recruiting for U.S. Capital Advisors, Kovics is most interested in advisors striving to grow.

-

In a concession to the advisor, he can still respond to client emails and calls, even though he may not initiate contact.

December 13 -

Breakaway uncertainty is forcing the RIA to re-evaluate its growth strategies.

December 10 -

Despite Merrill Lynch’s recent decision to stay in the Broker Protocol, Greg Fleming sees a long struggle ahead.

December 6 -

Morgan Stanley and UBS's exit from the accord spurred a number of advisors to move up their planned career changes.

December 6

"In the absence of that trajectory, you could ultimately end up with a practice that ultimately goes sideways and may end up decretive. It ends up not making sense to invest in those practices," he says. "So we look at individuals and teams who have significant growth goals."

U.S. Capital Advisors expects to be able to continue recruiting despite recent changes in the hiring landscape following the departure of Morgan Stanley and UBS

The firm has upped its legal budget ― Morgan Stanley in particular

"It's an awful tactic that you have to sue people to prevent them from leaving," he says, adding, "If you're running a good program and platform, then your advisors should want to stay."