An ex-financial advisor received a sentence of 17.5 years in prison after a federal judge said the former registered rep “lied through his teeth” during his trial on fraud charges.

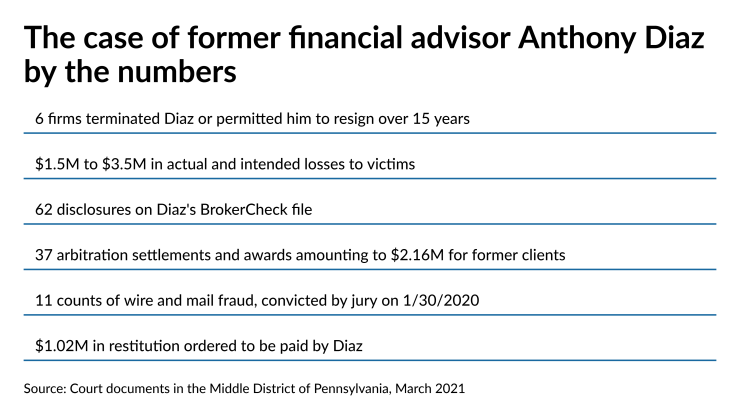

A jury had convicted Anthony Diaz, 53, on 11 counts of wire and mail fraud after a two-week trial in January 2020,

Calling Diaz a “sophisticated criminal” showing no remorse for racking up

Attorneys representing Diaz didn’t respond to requests for comment.

Diaz was remanded to begin his prison term immediately after his March 26 sentencing hearing at the federal courthouse in Scranton, Pennsylvania, authorities say.

In a sentencing memo arguing that he should receive 30 to 37 months, Diaz’s attorneys questioned the credibility of witnesses such as an employee of his practice who had a “physical relationship” with him. The attorneys also claimed in the memo that Diaz had informed clients of the costs and risks of the investments, and they cited an audit that showed “only” 12 out of 800 to 1,000 clients accused him of fraud.

“The victims in this case have stressed the need for restitution, and Mr. Diaz wishes to provide it,” the memo says. “If Mr. Diaz were sentenced within the advisory guideline range (capped by the statutory maximum), he would not be released until his early seventies. At that point, his age, health problems and life expectancy would make it nearly impossible for him to make any restitution.”

Some clients entitled to 37 arbitration settlements and awards for $2.16 million have received compensation from the 11 brokerages that employed Diaz over his 14-year career,

Former clients testified that Diaz made false representations about the alternative products between 2008 and 2015, promising them guaranteed rates of return with little risk and full liquidity. In addition, they alleged he instructed them to sign blank documents and told them he switched firms for their benefit. Ex-employees of East Stroudsburg-based Financial Planners Group further said he told them to fill out documents with false information.

“Spouting a legion of lies, he convinced his clients to invest their money not in their own best interests, but in risky ways that generated Diaz himself millions of dollars in commissions,” Michael Driscoll, special agent in charge of the FBI’s Philadelphia office, said in a statement. “The harm done here was significant — retirement delayed, tuition money lost, lives turned upside down — all in service of one man’s greed.”

The sentence orders more than $1.02 million in additional restitution and three years of supervised release. At least 12 victims testified during the trial, out of 30 people who filed victim impact statements in the case, the Associated Press

“Let him rot in hell,” Kilby said, according to the Associated Press.