One of the biggest trends in the investment industry is the explosive growth in variety, availability and use of ETFs. These vehicles are more tax-efficient, have more flexible trading and are typically less expensive than most mutual funds, which has made them popular tools in passive investing strategies — even among advisors who otherwise actively manage client portfolios.

And yet the overwhelming majority of advisors still use mutual funds as well, which raises the question: How exactly do advisors choose between mutual funds and ETFs?

Recent years have borne witness to a rise in net outflows from actively traded mutual funds to ETFs. In fact, some have begun to raise the question of whether mutual funds themselves are dead or at least dying. Nearly a half-trillion dollars flowed into U.S. ETFs in the past five years and a half-trillion flowed out of U.S. mutual funds, according to Lipper.

Yet a deeper dive into advisor investing trends suggests that what is actually occurring is far more nuanced than just a shift from active to passive — or from mutual funds to ETFs.

While a whopping 87% of advisors use ETFs, 73% of advisors are using mutual funds as well, according to the latest

From the broader historical data, the biggest shift for advisors hasn’t actually been from mutual funds to ETFs, but from variable annuities into ETFs — and to a lesser extent, from individual stocks and bonds to ETFs — along with a rise of investing in private equity funds. In fact, mutual funds showed remarkably little decline in adoption rate over the past decade until just the past year.

In other words, ETF adoption rates have been rising dramatically even as mutual fund adoption has fallen only slightly, which suggests that advisors are not abandoning mutual funds en masse, and instead are merely being more selective about when and where mutual funds are used versus just

So when the FPA asked, “Which type of management style do you think provides the best overall investment performance?” a mere 22% reported being purely passive (which really was no different from the 25% reported five years ago) while just 12% of advisors reported that they think active is best, which again was negligibly lower than five years ago.

Instead, the overwhelming majority of advisors practiced a blend of the two. Barely one-quarter of advisors reported having eschewed full-active for full-passive, while approximately three-quarters of ETF users espoused the blended approach.

-

With stock selection pegged to 10-year Treasury sensitivity, can these ETFs work when short-term rates rise?

July 18 -

Almost all young investors polled by Schwab expect the funds to be their primary investment vehicle in the future.

June 12 -

Some funds that were in the black still turned in a poor performance — it’s all relative.

July 24

Stated more simply, advisors don’t appear to be abandoning mutual funds or active management entirely, just the active funds they no longer believe are adding value over a passive ETF alternative.

The trend was affirmed in the recent

That also helps to explain why advisors are much more likely to hold targeted stock or fixed-income ETFs than hybrid or asset-allocation ETFs — because again, most advisors are using ETFs and mutual funds selectively, not as an all-out replacement for mutual funds to construct entire client portfolios.

SELECTION CRITERIA

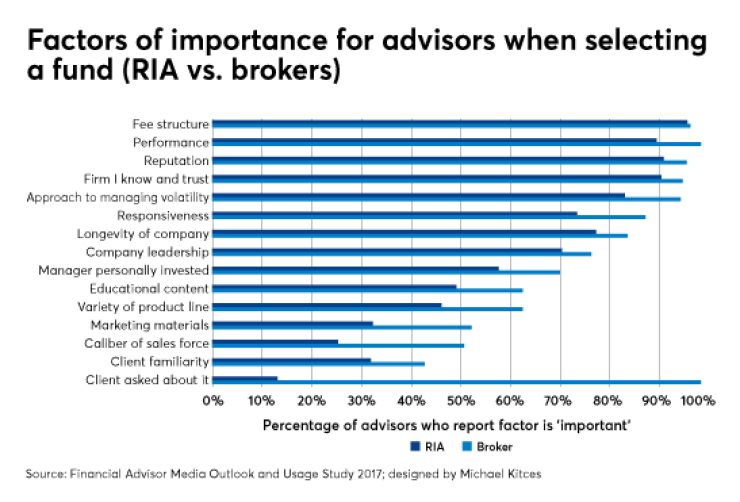

Erdos & Morgan identified three core factors that determined when and how advisors would select ETFs and mutual funds: results, process and trust. Respectively, these manifested in how advisors’ consideration of the fee structure and performance of the fund; the fund’s approach to managing volatility; and the reputation and deemed trustworthiness of the fund provider themselves.

Perhaps even more notable though was a significant gap between what RIAs used to evaluate fund companies versus what advisors in brokerage firms focused on. Specifically, RIAs were slightly less focused on performance — and ostensibly were at least slightly more forgiving of recent poor performance — while at the same time giving slightly more weight to the company’s fee structure and reputation/trustworthiness.

On the other hand, when it came to company-specific factors, RIAs were more skeptical and less likely to consider the funds. And where other fund provider value-adds were concerned, from educational content to marketing support to the company’s wholesalers, the majority of advisors said they were unimportant, with a whopping three-quarters of RIA respondents stating that the caliber of the company’s wholesalers hardly mattered at all.

Perhaps not surprising in this context, the study also showed that RIAs were by far the least likely to rate any fund company favorably when it came to their reputations.

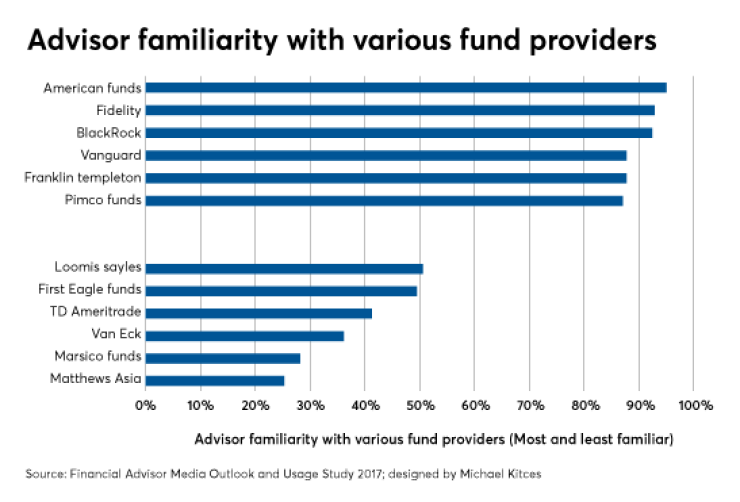

One of the most notable parts of the Erdos & Morgan study is an evaluation of how familiar advisors are with various fund providers, and among those who are familiar with the company, how they perceive the reputation of the company. Also not surprising is that many fund industry stalwarts are the best known, as the following graphic illustrates.

And the fund companies that were most familiar to advisors were also deemed the most trustworthy; as the saying goes, familiarity breeds trust. That correlation is appreciable in the following graph.

In the context of broader industry trends, a key takeaway from Erdos & Morgan’s fund provider scores was the relative trust gap between fund providers and RIAs. Virtually every asset manager — with the exception of ETF providers Vanguard & State Street, RIA custodian TD Ameritrade and RIA niche mutual fund player Matthews Asia — had a materially lower reputation in the RIA community than the rest of the advisor brokerage community. The implication is clear: The perception that RIAs are more cynical really is true.

WHAT ADVISORS WANT

Given the ongoing growth of the RIA channel, the data presents a daunting outlook for fund providers. So what, then, do advisors actually want from these providers?

Some additional perspective on the issue comes from an in-depth focus group study with advisors

However, the APV study also found that advisors were looking at more nuanced factors than just Lipper or Morningstar ratings. And while those tools were frequently used to analyze and screen funds, the ratings themselves were relatively unimportant. Instead, advisors were doing their own deep dives, from evaluating relative performance over time horizons of one, three, five and even 10 years to

This finding raises the potential for fund companies to both better differentiate themselves on a wider range of relevant performance factors — such as

Fees were nearly half the price of the top-performing active funds.

For instance, while advisors continue to cite expenses as a key factor in fund selection, advisors surveyed by AVP were split on whether it was best to eschew high-cost funds altogether or focus on net returns — thereby giving higher-cost funds a chance to show better net performance.

Similarly, many advisors were less intent on gauging year-to-year outperformance and more focused on consistency of performance as a factor to differentiate luck from skill. Advisors also showed a far greater interest in looking beyond the quantitative results of a given fund, and more deeply at the intangibles — e.g., the investment manager’s philosophy, process and outlook.

Perhaps most significant was the study’s insights into advisors’ communication preferences. The researchers found that advisors did not like TV and print advertising at all (digital advertising was not separately mentioned), and were increasingly turned off by the overwhelming volume of emails and direct mailings from fund companies.

Additionally, while a subset of advisors reported finding value in educational opportunities from fund providers, “practice management” ideas were rated the least valuable —despite the rising popularity of fund wholesalers trying to add value with practice management insights. Instead, advisors preferred more fund-relevant market-outlook and economic information; commentary from the fund manager on current market forecasts; and product-specific research insights.

In other words, advisors don’t actually want fund providers to help them with their business. Instead, advisors want fund companies to demonstrate their own investment expertise and value-add.

MANAGING THE SHIFT

Historically, advisors were primarily in the business of selling investment and insurance products, including and especially mutual funds, through the independent broker-dealer model. Yet as technology has commoditized

For fund providers, the good news hidden in this shift is that, as the data affirms, advisors are actually quite unlikely to simply abandon an entire investment vehicle class like mutual funds altogether. Rather, the current flows from the mutual fund industry are less about an industry-wide shift to ETFs — which helps to explain the

The bad news is that this shift suggests advisor scrutiny of mutual funds and their fund company providers will only increase. Trustworthiness and other reputation factors do still matter, but only to the extent that the fund company

So what do you think? What are your most important factors when selecting fund providers? What value-added services are you looking for from wholesalers? Do you clients want diversification not only in asset class but in approach as well? Please share your thoughts in the comments below.