Linda-Eling Lee believes the core audience of people engaged in environmental, social and governance investing issues has changed drastically over the past 10 years.

She said at the start of the decade, ESG investing was a topic typically reserved for specialists at investment houses with expertise in one or two specific areas serving a niche set of clients. Meanwhile, many others had no idea what ESG investments really were.

As ESG investing grows more popular by the day, Lee said the audience now includes “pretty much the whole world,” and the trends expected to dominate the conversation over the next decade have become much more complex.

“Ten years ago … the notion that some ESG issues would become financially material to companies and investors was really an idea that was just taking root,” said

Lee’s remarks came Tuesday morning and kicked off the unveiling of

The report put the 10 areas of focus into three categories: Matters related to climate, the rapid mainstreaming of ESG and looming issues that represent the potential risks of tomorrow.

Lee said the recent

“We know that only 10% of companies are currently on track to stay on or under the one-and-a-half degree temperature rise that we need to stay under,” Lee said, “It's not clear at the moment really to anyone what exactly the path is going to be for achieving a net-zero portfolio given where we're starting from.”

With that, Lee said there is still temptation among clients to make their portfolios appear as clean as possible, noting that climate has surpassed governance as the top issue driving investor concerns related to ESG.

That’s why two of the top trends for the coming year are related to transparency and how companies present themselves. One, referred to in the report as “The Amazon Effect,” focuses on how companies are pushing other companies to net-zero by addressing their supply chains.

That corporate pressure may lead to lasting positive change as companies compete to out-green their competitors.

“Amazon, Microsoft, Alphabet and Alibaba have all set net-zero commitments. Some are more comprehensive than others in how they define net-zero. But none of them can make a dent in their upstream supply-chain emissions without getting their server and chip purveyors to follow suit,” the report states. “As they discover how much their suppliers emit, “B2B engagement” could become the next frontier of climate influence.”

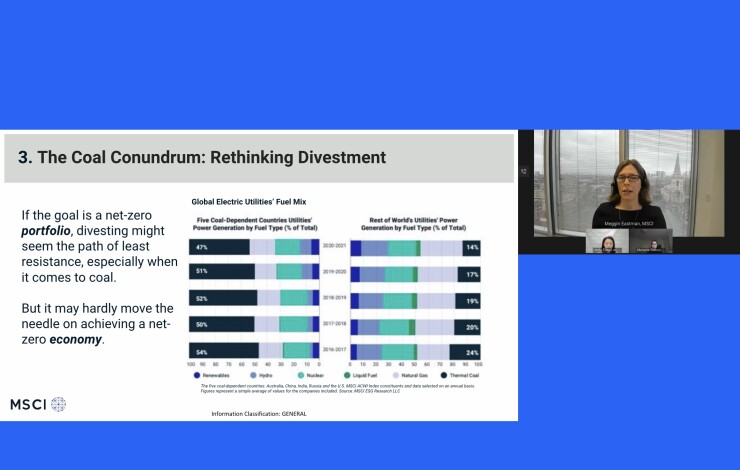

But new ESG conversations about topics like corporate transparency are still being had alongside age-old climate conversations like coal. Eastman said when cleaning up a client portfolio, divesting is often seen as the path of least resistance.

But the right approach may be deeper engagement, not outright abandonment.

“The discussion around investors and coal for the last several years has been mostly about divestment. Just get it out of your portfolio. Don't be associated with it. But then what?” Eastman said. “What we're seeing is that more investors are realizing that cleaning up a portfolio just doesn't do that much good if the overall economy is still dirty and the world is still headed somewhere well north of 2 degrees of warming.

“All the risk of a hotter planet is still there, but if you divest at these companies, you've lost a mechanism to influence them.”

Eastman said driving engagement in coal and other matters in need of improvement is akin to making change from within.

“It's a very old issue that has been on the table for discussion for a long time, but we're seeing a real evolution and change in the way investors are looking at it because they're realizing what they can do and the limits of their portfolio,” Eastman said.

Greenwashing, or rather the hype around it, also made the list of 2022 trends. Lee said she expects greenwashing allegations to recede as greater regulation and definitions emerge.

The 2022 report finds that common vocabulary related to ESG investments should aid transparency and clarify choice for clients. Asking 10 portfolio managers what a green investment is may yield 10 different answers based on their personal definitions.

“ESG funds are diverse because investors are diverse. They have different ESG goals and want a choice of routes toward their destination,” the report states. “Avoiding greenwashing and making more-informed choices could soon become a lot easier as disclosures about a fund’s ESG objectives, approach(es) and quantitative financial and nonfinancial characteristics all become part of the default information set for all investors.”

Lee and Eastman also see a trend of ESG ratings reverting back to their intended use. The report states that a decade ago, only a handful of investors truly understood and used them. Now, investors, companies and the media use ESG ratings to help answer questions about a company that they were never intended to address.

‘There are some people that are expecting the ESG rating to be a measure of corporate goodness,” Lee said. “It's not a measure of corporate goodness because your definition of goodness may be about a company's carbon footprint, and mine might be about a company's workforce diversity. So ESG ratings aren't a superset of all these different considerations.”

Other topics covered in MSCI’s annual ESG Trends to Watch report are a large scale expansion of the green bond market; the emission of private companies facing public scrutiny; how food production is impacting climate change; bacterial infections presenting the next global health crisis; and why efforts to stem climate risk are unlikely to succeed if the most vulnerable populations are left behind.

Find the full 2022 report and read about the other trends in detail by