Even though it’s adding tens of thousands of new accounts every week, Envestnet CEO Bill Crager said there are “accelerating” opportunities for the wealth technology firm in banking.

The Chicago-based tech firm and turnkey program has raked in a record in-flow of assets under management and administration in the first nine months of 2021, in part through new clients among large wealth managers, Crager said in a Nov. 8 call with analysts after the firm

Crager used a portion of his prepared remarks to point out one area he sees as ripe for potential expansion of the business. The giant data aggregator Yodlee, a firm Envestnet

“Every fintech and financial institution will need open banking capabilities to compete in the future,” Crager

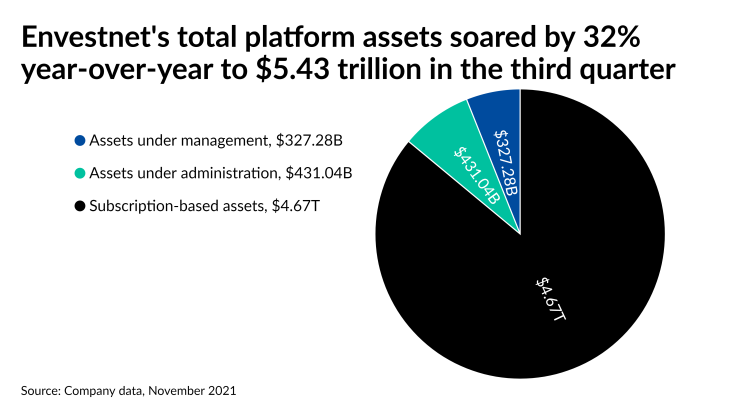

Platform assets: By the end of the third quarter, Envestnet was working with more than 108,000 advisors, 17 million investor accounts, 17 of the 20 largest banks, 47 of the 50 largest wealth managers and brokerages, 500 RIAs and 625 fintechs, according to the firm. Platform assets across subscribers and AUA- or AUM-based accounts surged by 32% year-over-year to $5.43 trillion, including $4.67 trillion in subscriber accounts and $758.32 billion in AUA or AUM. Excluding conversions from brokerage to advisory accounts, the in-flow of AUA and AUM of $89.91 billion in the first three quarters is nearly double the amount from the same span in 2020, Chief Financial Officer Pete D'Arrigo told analysts. The number of platform accounts rose by a third from the year-ago period, and Crager said Envestnet is opening more than 20,000 new accounts each week. With the average number of accounts per advisor increasing 9% year-over-year, the in-flow of total platform assets reached $239.58 billion for the quarter.

Mystery clients: Impact portfolios, customized models and direct indexing, three asset-based services offered by Envestnet, have reached 30,000 advisors across 285,000 more accounts than the same time a year ago and roughly $49 billion in client assets. The amount “ultimately will be a drop in the bucket,” Crager said, citing as an example a group of 19 firms participating in the initial rollout of its tax modeling overlay. Their ranks include two “very significant brand names that everybody on this call is very familiar with,” Crager said. Representatives from the firm didn’t immediately respond to a request to know the firms’ names or those of “several new large financial institutions” that Crager said had begun working with Envestnet in the quarter.

Expenses: In February, the company launched an “accelerated investment plan” aimed at tech enhancements across its platforms which it says will cost $30 million this year and grow to $45 million next year. Besides the internal improvements to its systems, Envestnet acquired automated savings and investing software firm

Bottom line: On a GAAP basis, the company earned $11.4 million in net income on total revenue of $303.1 million. After adjustments, the company said its net income amounted to $39.9 million and EBITDA of $66.2 million on the same amount of revenue. After the impact of the additional acquisition and operating expenses, the firm’s adjusted net income slipped by 1% from the year-ago period and the adjusted EBITDA ticked down by 2%. Based on the company’s forecast for the last quarter of the year, it expects to generate roughly $1.18 billion in annual revenue for 2021. Continued execution of its strategy will enable the firm to “capture more of the opportunities we’ve identified” and place it in position to achieve “our longer term targets” of $2 billion in revenue and an adjusted EBITDA margin of around 25% by 2025, D'Arrigo, Envestnet’s CFO, told the analysts.