After alerting broker-dealers to compliance problems involving anti-money laundering rules, the SEC charged a prominent firm with running afoul of the law.

The BD of one of the largest retirement plan recordkeepers failed to file adequate suspicious activity reports for more than three years, the regulator says.

GWFS Equities — an affiliate of Empower Retirement and Great-West Life & Annuity Insurance —

In agreeing to the settlement with GWFS, the SEC “considered remedial acts promptly undertaken” by the firm and cooperation with investigators, according to the document. The failures between September 2015 and October 2018 came well before a public outcry and new rules targeting anonymous shell companies in the wake of the “

“Across the financial services industry, we have seen a large increase in attempts by outside bad actors to gain unauthorized access to client accounts,” Kurt Gottschall, the director of the SEC’s Denver office, said in a statement. “By failing to file SARs and by omitting information it knew about the suspicious activity it did report, GWFS deprived law enforcement of critical information relating to the threat that outside bad actors pose to retirees’ accounts, particularly when the unauthorized account access has been cyber-enabled.”

The Greenwood Village, Colorado-based firm overseeing 9.4 million participant accounts and more than $700 billion in assets has retained an outside AML consultant, hired more compliance staff and launched a new case management system as part of five “significant remedial measures” cited in the order by the SEC. The regulator accepted the settlement based on “remedial acts promptly undertaken” and “substantial cooperation” with investigators.

GWFS filed new reports for the earlier incidents described in the case, Empower spokesman Stephen Gawlik said in a statement, noting that it’s “historic in nature.”

“We have at all times put a heavy focus on the protection of client accounts, and have routinely shared robust information directly with law enforcement agencies to help them catch suspicious actors.” Gawlik said. “As the order mentions, we took corrective actions to address these issues over the past few years. We are confident the issues identified by the SEC are well behind us and have committed to maintaining an effective AML compliance program.”

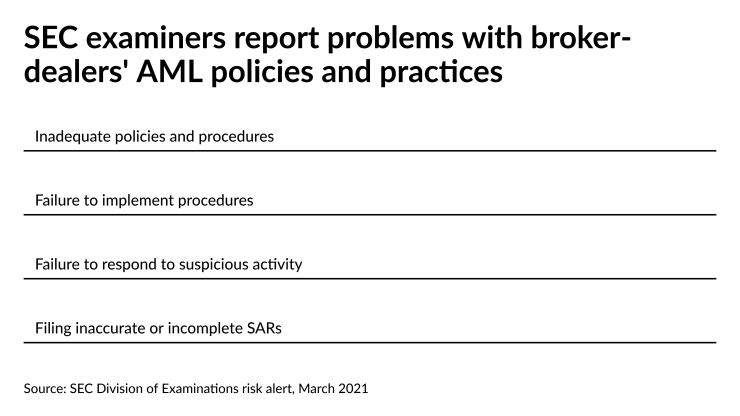

Other BDs may not have put their own potential issues behind them, if the SEC Division of Examinations’

Compliance with AML rules is “critically important to helping the Commission and law enforcement pursue misconduct that could threaten the safety of investor assets and the integrity of the financial markets,” the alert states.

With the required suspicious activity reports to the Treasury Department’s Financial Crimes Enforcement Network and other investigatory evidence under the Bank Secrecy Act being largely confidential, the GWFS case offers a glimpse into one firm’s procedures.

In one April 2016 case, the firm put a hold on a participant’s account after a retirement plan administrator reported that a fraudster impersonated the participant in order to make a distribution of $128,000, the SEC says. It didn’t file a suspicious activity report, though, according to the regulator. Later that year, the firm caught another bad actor trying to make a fraudulent distribution of $43,000 but failed to file the report to FinCen, the settlement states.

Investigators found about 130 transactions that should have been flagged in the required reports, according to the SEC. In addition, there were 297 other transactions in which the firm did file the reports but left out the mandatory “who, what, when, where, and why” of the incidents, the settlement states. On at least two occasions described by the SEC, the firm used a “template narrative” that failed to include key details about fraudsters.

It’s the kind of information that regulators, lawmakers and the industry have committed to ensuring will reach investigators tasked with solving complex cases often involving multiple firms across the financial services. The FinCen Files