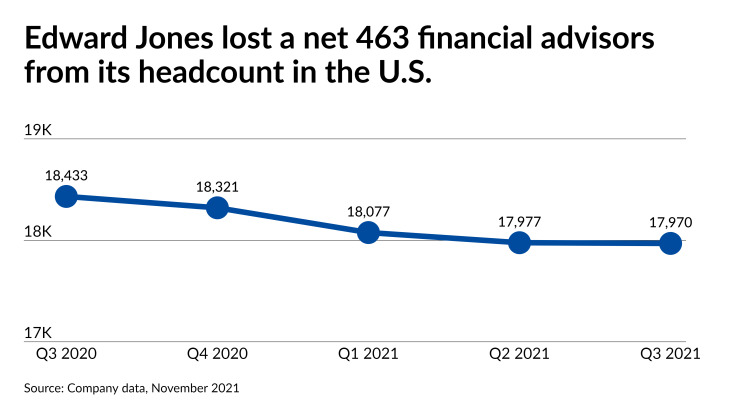

A giant wealth manager that once held the distinction of the largest headcount of financial advisors for three years has lost several hundred from its ranks over the past 12 months.

Edward Jones has never reached

Still, the firm’s income before allocations to partners of its parent, The Jones Financial Companies, rose by double digits year-over-year in the third quarter,

Note: Key metrics refer when possible to the company’s U.S. business rather than its combined results including those in Canada, where it has 859 advisors. The company breaks out most, but not all, of its returns between the two countries.

Advisor headcount: LPL Financial overtook Edward Jones for

Company’s explanation: Edward Jones paused its recruiting of new advisors in 2020 as part of a series of steps it took to save costs during the pandemic, according to a discussion included in the firm’s quarterly earnings filing. The firm “remains committed to financial advisor growth” through organic expansion, as well as recruiting and training, the company said. “The Partnership has restarted hiring and is committed to an innovative and intentional strategy to grow its impact by offering a plan and resources for both current financial advisors and new hires that is intended to help promote branch team success,” according to the filing. “This approach may continue to result in fewer financial advisors hired than in past periods.” In an email, representatives for the firm said they had no additional comment.

Other footprint figures: With the lower headcount, the firm has retained a slightly higher number of branch offices with bulked-up ratios of support employees to advisors. Across the U.S. and Canada, the number of branches ticked up by 53 year-over-year to 15,456, the number of branch office administrators surged by 4% to 17,302 and the number of associates in the firm’s corporate office climbed by 7% to 7,345. With the higher number of support staff and lower number of advisors, the ratio of each per 100 advisors rose by more than 6% apiece. In addition, the amount of operating expenses per financial advisor in the quarter jumped by 24% to $48,544.

Client assets and the bottom line: The amount of client assets under care in the U.S. rose by 27% year-over-year to $1.72 trillion in the third quarter, including $21.5 billion in net new assets. With an inflow rising by more than two-thirds from the same period a year ago and rising equity values from 2020, net revenue grew by 24% to $3.05 billion. Operating expenses excluding variable compensation increased by 22% to $2.17 billion based on the financial advisors’ pay for the higher asset levels. Income prior to allocations to partners expanded by 21% to $388 million.