John Brenkovich’s client would have missed out on $7,500 in Social Security benefits simply because she didn't know to ask.

The client, 68, hadn’t yet filed for spousal benefits even though she had been eligible to do so since reaching full retirement two years earlier.

“You may have waited too long to get the spousal benefit, but don't despair,” Brenkovich, a CFO and the principal of Brenkovich Financial Management in Mamaroneck, N.Y., told the client and her husband.

Brenkovich told them that if an applicant files for spousal benefits after reaching his or her full retirement age, the applicant can get up to six months' worth of back benefits.

But applicants have to ask, he says.

“They're not going to offer it to you otherwise,” Brenkovich says.

He accompanied the couple to the local Social Security office to help them file his client’s benefit application.

The client was eligible for a spousal benefit of $1,250 a month or half her spouse's $2,500 monthly benefit. Because she was 68, she was eligible for six months' worth of spousal back benefits or $7,500, which she received in one lump sum payment.

“They would not have told her that she was eligible for back benefits,” Brenkovich says. “I've seen this happen to people often.”

People frequently lose out on these benefits because there isn't much publicity surrounding them, Brenkovich says.

The client, of course, was very happy with the unexpected windfall. Learning that she would not only receive monthly spousal benefits but also an upfront $7,500 check was a pleasant surprise, given her misplaced fear that claiming spousal benefits might jeopardize her own Social Security benefit based on her work history.

“She and her husband were thrilled,” Brenkovich says.

In filing for back benefits, people can’t exceed their full-retirement age, he says.

For example, had his client been 66 and three months, instead of 68, she would have been eligible for only three months of back benefits.

His client and her husband had yet another reason to smile. Because she was 68 and her husband 67, they would be able to pursue the classic “claim now and claim more later” filing strategy, an option that the government is phasing out.

Under this strategy, Brenkovich’s client would continue to receive the $1,250 spousal benefit until her 70th birthday, at which point she would switch to her own Social Security benefit based on her own work history.

The so-called restricted application would allow the client to substantially boost her monthly benefit. At 66, the client's own benefit was $1,847 a month.

By waiting until 70, her monthly benefit would grow to $2,438 or nearly $600 a month more.

If Brenkovich’s client lives to 85, she will have received about $473,847 in benefits, including spousal and spousal back benefits as well as her own benefits. Had she merely claimed her own benefit at 70, she would have received $438,847 or $35,000 less.

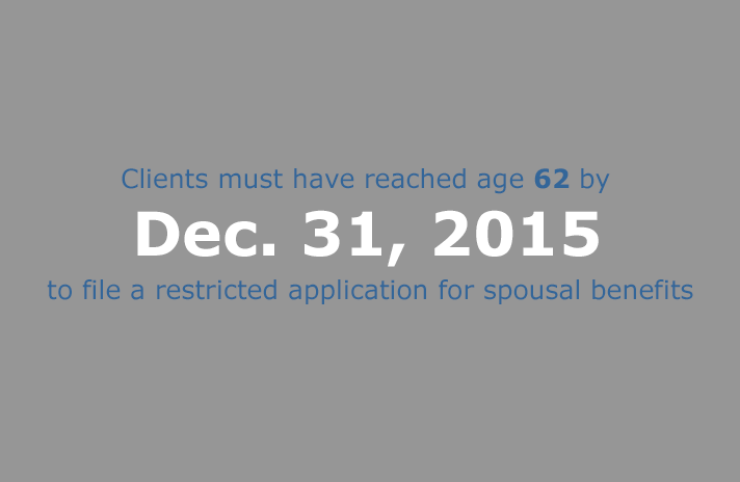

Not everyone can file a restricted application for spousal benefits. Applicants must have reached their 62nd birthday by Dec. 31, 2015, which Brenkovich’s client and her husband had.

Regardless of whether people are able to pursue a claim-now-and-claim-more-later strategy, they shouldn’t wait beyond their full-retirement age to claim spousal benefits because, unlike individual Social Security benefits, they won’t grow each year you wait to claim them.

“There is no economic benefit to beginning spousal benefits beyond full-retirement age,” Brenkovich says.

This story is part of a 30-day series on preparing for retirement. This story was originally published on March 1.