Financial advisors and

Those three scenarios show in part why donor-advised funds have amassed

The other reasons for

In his presentation, Nash compared donor-advised funds to other types of tax-advantaged accounts that have evolved into pivotal roles as part of clients' long-term financial plans over recent decades, like individual retirement accounts, 401(k) plans and 529 college savings plans.

"A donor-advised fund is basically the perfect account for putting money aside for charity," Nash said. "You can put money or assets into the account, and you get an immediate tax deduction this year against income when you put the assets in the account. The accounts have investment options — some more than others — but your money is invested tax-free for as long as you want it to compound. And then any time you want to give money to an operating charity — it could just be a few clicks and that money gets sent off and taken care of.

"And it's not surprising that, even at the very high end, a lot of people are thinking about," Nash added, "'Do I really need to set up a foundation? Do I really need to set up a trust? I can just use a donor-advised fund to handle the philanthropy needs, the back end and the back office for my clients."

READ MORE:

The three examples Nash laid out in his talk displayed the possible role of donor-advised funds in a client's portfolio.

The sale of a stock that has risen in value or the spinoff of a part of a small business or another "positive event" can bring capital gains and income — along with accompanying taxes in a particular year, he noted. The donor-advised fund can help advisors and their clients offset those gains.

"If you have a windfall, you can immediately say, 'Hey, put that money, put some of those assets into a donor-advised fund and take your time evaluating organizations and thinking about who you want to give that money to," Nash said. "Maybe you can put aside money that's good enough to support your giving, not just for one year, five years, 10 years — build a real legacy for you and your family or for your business. And so this is the most common reason that advisors fall in love with donor-advised funds."

Regular gifts of assets to donor-advised funds at any time can bring a bigger tax advantage than donating cash, and the structure enables advisors and their clients to send stocks, ETFs or even digital holdings like cryptocurrency to organizations that may not have the capacity to receive non-cash contributions directly.

"Let's say they give $30,000 to charity every year," Nash said. "If you can just tell them, instead of taking that cash and giving it to the charity, to actually put the stock in a donor-advised fund, get those tax benefits, then they can give that cash to those charities, the same as they always did, but save money on taxes. And here's the kicker, for people who care about this stuff, there is no wash-sale rule with donations, right? You can donate the shares out of their account to the donor-advised fund that had the lowest cost basis and then, literally, a millisecond later, you can take the cash that they would have given to charity and use it instead to replenish their investment account with higher cost-basis shares. So you permanently eliminate that tax liability."

READ MORE:

Portfolio rebalancing may also present some "unforgiving" numbers when it comes to the "tax draft" of selling off one category of assets that took on unexpectedly high values in order to buy more investments in a lower-valued type of security, Nash pointed out.

"What if, instead of selling those appreciated shares, you actually donate some of those shares to a donor-advised fund, and then you use the cash that you would have used to rebalance the portfolio to buy up the underrepresented asset in the portfolio," he said. "So you're just moving the same amount of money around, but by having a donor-advised fund to capture that tax benefit of those appreciated securities, you just eliminate that liability."

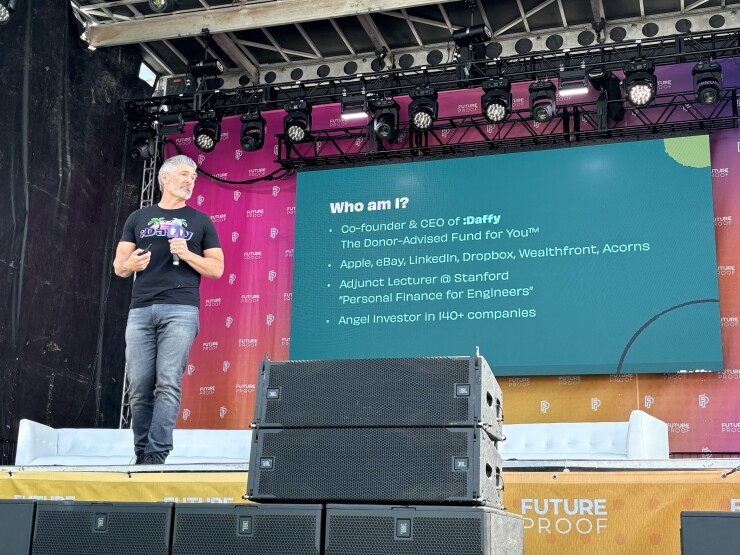

Advisors and their clients can choose among many donor-advised fund providers that are operating in the space, but Nash's firm is making its pitch based on newer technology tools, the capacity for clients to add other family members and advisors to their accounts and flat-fee price points between $3 and $20 a month.

Its name, Daffy, stands for "donor-advised funds for you," Nash noted. Last year, the firm launched a tool for matching campaigns, such as one that Nash shared with Future Proof attendees in which a widower started a fund in honor of his late wife.

"It's very personal, and the organizer, the person running the campaign, can pick up to six charities to support and let their donors pick amongst them, and then the matching just automatically happens within minutes every time someone makes a donation in a campaign," Nash said. "They're not just giving to the organization. They're supporting the organization, and they bring new people into the community — which is what the charities really want, is more and more exposure to people who care about their cause."