When you’re interviewed by a reporter or quoted in a publication, you’re doing that journalist a favor. After all, we can’t do our jobs without financial planners who are willing to talk with us about their business lives.

In a sense, though, the reporter and the publication are also doing you a favor. When you’re quoted as an expert, everyone who reads that coverage either learns about your services for the first time or sees their faith in you confirmed. You can also amplify a story that quotes you by posting the link on your website, Facebook page, LinkedIn profile, Twitter or other social media outlets.

Should you simply take whatever interesting media opportunities turn up, or is it better to have a strategy around press coverage? Either option can work, though the outcome depends on the effort you put in.

“I hear ‘I saw you here or there’ from people in my circle and also from prospective clients.” – Kari Jean Glosser

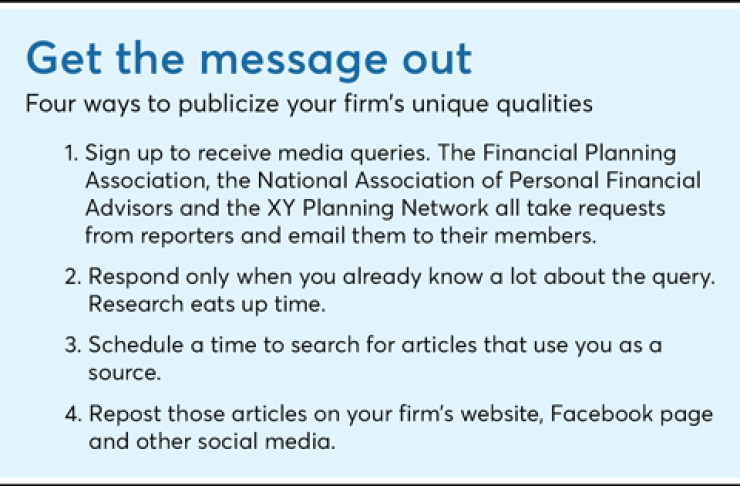

Kari Jean Glosser is a partner at Abacus Wealth Partners in Santa Monica, California. She sees press requests through the XY Planning Network and reaches out to writers who are working on things that she knows a lot about. When she doesn’t know much about a topic, she forwards the press request to a colleague who does.

Read also:

“There’s no special goal,” Glosser says. “I just respond as I see requests come along.” She could do one interview a week, she says, but ends up doing between one and four a month. “I’m picky, plus I want my coworkers to get a chance,” she says.

Her lightly structured media presence bears fruit. “It’s amazing how many people read the articles I’m in,” Glosser says. “I hear ‘I saw you here or there’ from people in my circle and also from prospective clients.”

“Before I started doing this, no one ever called me straight from my website. My only clients came from referrals, and that’s a slow way to build a business.” – Kristi Sullivan

Denver-based Kristi Sullivan, who owns Sullivan Financial Planning, takes a more assertive approach to press coverage, though she still handles it herself. She signed on to see press queries through the Financial Planning Association, where she answers any query that takes her five minutes or less.

When Investopedia put out a call for planners to answer reader questions, Sullivan signed up for that as well. Every Monday, she tries to answer three questions, spending no more than 15 minutes and only responding to questions for which she already has a clear answer.

-

Try these tips to improve credibility, gain free exposure and develop a solid voice.

April 29 -

Assume everything you say is on the record, and don’t overshare.

March 28 -

A professional website is a necessity, as is a presence on LinkedIn.

April 19

“Once a week I search for articles where I might be quoted,” Sullivan says. If she is quoted, she retweets the story, posts it on her firm’s Facebook page and then sends the link to the vendor who handles her social media presence. “It takes me maybe 10 minutes to search for articles. I might spend an hour a week in total on all my media presence.”

It’s not easy to directly measure the return on her investment. Sullivan says that she considers media exposure part of her search engine optimization. “The more you’re out there on the internet, the more people will find you,” she says. “Before I started doing this, no one ever called me straight from my website. My only clients came from referrals, and that’s a slow way to build a business,” Sullivan says.

Increasing her media mentions wasn’t a quick fix, but Sullivan says it was worth it. “It took six to nine months before I saw a difference, but now people find me who otherwise wouldn’t. I’m one of the first people who come up on a Google search for ‘Denver financial planner,’ and I never would have come up before.”

Existing clients love seeing her in print, too. “They’ll say, ‘I saw you quoted on CNBC!’ It makes you seem like the real deal,” Sullivan says.

“Probably half our new prospects came from Googling us, and maybe a quarter to half of those e-prospects become clients. Potential clients that call us as referrals also spend spent time looking at our web site, media mentions, and so forth, so this helps to impress them as well.” – Melissa Sudoteh

At other firms, planners have hired a full-time employee to handle media requests. Melissa Sotudeh, a wealth advisor at Halpern Financial in Rockville, Maryland, says that her company hired a media professional three years ago. “Her job is to streamline our media response system so as to increase our mentions and visibility,” Sotudeh says.

The employee networks with journalists, telling them about new planner blog posts and interview opportunities. She helped create a financial safety book and sent a follow-up email series when Sotudeh talked to a group of high-net-worth families about paying for college.

“Hiring her has really paid off,” Sotudeh says. “Probably half our new prospects came from Googling us, and maybe a quarter to half of those e-prospects become clients. Potential clients that call us as referrals also spend time looking at our website, media mentions and so forth, so this helps to impress them as well.”

Sotudeh could have done the work herself but feels that her time is better spent with clients and complex planning issues. She pays the media specialist about what she would pay any young financial professional and recent college graduate. “She might earn more than a contractor, but she is also embedded in our firm, and that’s worth a lot,” Sotudeh says. “She’s listening to what we’re doing, so she gets a better feel for things than a contractor would.”

“It’s very tempting to think that any young person on your staff can help with social media because they likely understand social media better than a more mature professional in your firm, but you want qualified expertise.” – Elizabeth Miller

An in-house presence was also important to Elizabeth Miller, who hired a full-time employee about six years ago to manage media strategy for Summit Place Financial in Summit, New Jersey, where Miller is president and founder. Miller initially considered hiring an outside firm but found their offerings too generic. “Plenty of friends outsource this, but I think you need someone immersed in your culture to be able to highlight anything that makes your financial practice unique,” she says.

She works with her media strategist to create both monthly and annual media and marketing plans. “Many firms have an ad hoc approach to marketing. Our efforts are more targeted and better developed for having spent the time to think through what we can achieve by marrying a communication professional’s efforts with the knowledge of our financial planning staff,” Miller says.

It’s not easy for Miller to measure return on investment for her media specialist, either, particularly as her ultrahigh-net-worth clients aren’t likely to hire her based on a Google hit. “We measure engagement by things like page views. Are viewers clicking through to a learning paper? Are they looking at links to other public relations exposure we’ve had? Are we interesting to people?” Miller says.

“I don’t think there’s a magic formula that says here’s the salary that justifies the outcome,” Miller continues. “It’s very tempting to think that any young person on your staff can help with social media because they likely understand social media better than a more mature professional in your firm, but you want qualified expertise.”

Do you have an idea for a “Should I … ” story? Please send it to