Welcome to the opaque — and often confusing — world of RIA M&A deal reporting.

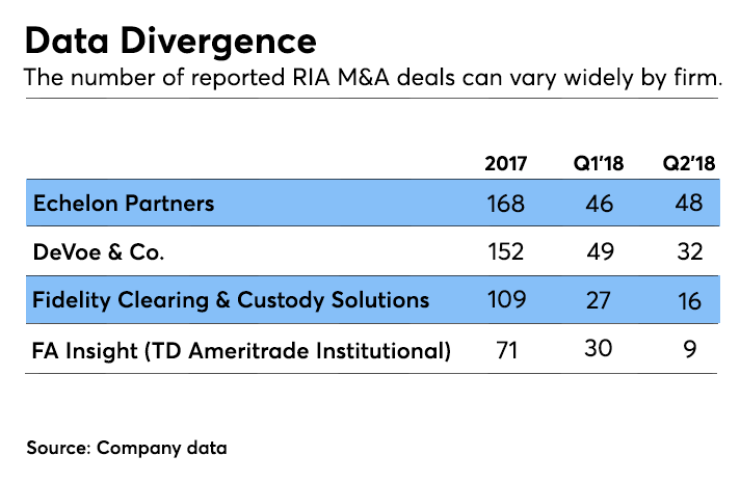

This year's second quarter saw a record 48 transactions, according to Echelon Partners. Wow, that's impressive. No, wait: after a slew of first quarter of deals, volume slowed to 32 the following three months, DeVoe & Co. reported.

Wrong again: there were actually 16 deals in Q2, according to Fidelity Clearing & Custody Solutions. Hold on, this just in: only nine RIA transactions transpired in April, May and June, states TD Ameritrade Institutional's FA Insights M&A Activity Update.

What gives? Why is there is such wide disparity in reporting RIA deals?

For starters, not all transactions are reported, and there is no transparent, stock market-like central clearinghouse of verifiable information for M&A deals.

"We've noticed this disparity as well," says David Wahlen, senior associate, recruiting and acquisitions for RIA aggregator Captrust. "There is not a single good source for information, so any report is just cobbled together from various sources."

As Dan Seivert, CEO of Echelon puts it, tracking deal activity "is still largely an imprecise science," owing to factors such as unreported deals, which deals should be included and "a general lack of clear data category definitions."

While each data report has its own set of sources and methodology — only Fidelity publicly lists all its criteria — the standards firms say they use to track deals often appear to be quite similar.

The lack of transparency when it comes to listing deals included in RIA M&A reports is troubling, executives say.

Echelon, DeVoe, Fidelity and TD Ameritirade all say they confine their lists to either RIAs or broker-dealer hybrids and check with the Form ADVs filed with the SEC. Echelon, DeVoe and Fidelity only include deals where the seller has at least $100 million in AUM; sellers included on FA Insights deal volume total may have $50 million in AUM, but must also have at least $500,000 in annual revenue.

The TD data division also doesn't include hybrid IBDs it deems to be focused on advisors as opposed to those "serving end-client, individual household investors," says Dan Inveen, the unit's head. "FA Insight has found the advisor-centric BD to be a very different kind of business with different margins, market valuations and demand than the investor-centric RIAs," Inveen says.

Echelon, DeVoe and TD's FA Insights do not include breakaway brokers who either join an existing firm or sign on with an outsourcing platform provider like Dynasty Financial Partners.

Fidelity, however, does include wirehouse breakaway teams that are expected to bring over at least $100 million in assets to an RIA, reasoning that the transition "would likely include remuneration."

And while Echelon has listed breakaway teams joining Dynasty's platform among its top 10 transactions in previous quarterly reports, Echelon CEO Dan Seivert says those deals were published erroneously.

-

Money pouring into the advisory business is making one prominent banker nervous.

July 22 -

The long-standing feud between founder Mark Hurley and majority owner Emigrant Bank has reached the boiling point.

July 18 -

Two RIAs turned out to be well-matched, and combined to form a $5 billion firm.

August 22 -

The IBD network is following its rivals in launching a centralized program on succession planning and acquisitions.

August 16

DeVoe, Fidelity and TD Ameritrade say they don't include non-U.S. deals. In the second quarter of 2018, Echelon did include a transaction involving two Canadian-based companies, MD Financial Management's sale to Scotiabank.

Seivert cited Scotiabank's private banking unit in Miami and its U.S. institutional asset management division as well as the size of the deal (over $40 billion in assets) as evidence that the deal's "relevance to the wealth management space is undeniable."

Adding to the confusion, only Fidelity publishes all the deals it includes in its M&A report. Echelon publishes its top 10 transactions, while DeVoe and TD Ameritrade don't make public the deals each firm uses in their respective volume numbers, citing proprietary intellectual capital.

How does the RIA M&A community feel about this?

To be sure, all the data providers are highly respected. Echelon and DeVoe & Co. have been industry stalwarts for over a decade, providing M&A consulting, investment banking and valuation services for independent advisors. And Fidelity and TD Ameritrade are, of course, two of the industry's leading custodians.

But the lack of transparency when it comes to listing deals included in reports is troubling, executives say, although they appear to be less concerned by the discrepancy in the actual number of deals.

"There absolutely should be transparency or anyone can say anything," says investment banker Steve Levitt, managing director of Park Sutton Advisors. "If you say there's 48 deals or 32 deals, then list what they are, otherwise there's cause for doubt."

Beacon Pointe Wealth Advisors President Matt Cooper, an active RIA buyer, also would like to see "a uniform approach to transparency."

"The trends are more important than the numbers for each quarter," says investment banker Steve Levitt.

Details of each transaction "would be helpful so everyone could put each deal into proper context," Cooper says. "Sellers, buyers and service providers all have a different perspective when interpreting the data."

The divergence of M&A reporting data "is disappointing," says consultant John Furey, principal and founder of Phoenix-based Advisor Growth Strategies. "I think all of these data providers have their hearts in the right place, but the level of dispersion is concerning as it could lead to lower buyer and seller confidence. The net-net is bad result for advisors and industry participants."

But RIA executives involved in the M&A market say they aren't particularly troubled by the data discrepancy in quarterly volume reports.

"The overall accuracy of the reports in terms of numbers of deals is of no concern to us," says Captrust's Wahlen.

Savant Capital Management CEO Brent Brodeski, also an RIA buyer, says he is "not overly concerned" by the divergence in reported deals. "Measuring deals is an imperfect science because there is not a good reliable source of transactions," Brodeski says. "Best thing is to pay attention to all the data providers and draw one’s own conclusions."

Advisory firm buyers or sellers don't care that much quarterly deal volume, says Cooper, because "the number of deals recorded, relative to the number of RIAs, estimated to be over 16,000, is not a significant or meaningful percentage of firms."

M&A participants care about trends, multiples and deal terms.

Because around 30% of firms have over $100 million in AUM, Cooper explains, "that means there’s still a ton of firms that have yet to transact and sooner or later most may be forced to buy, sell or merge."

M&A participants do, however, care about volume trends, multiples and deal terms.

"The trends are more important than the numbers for each quarter," says Levitt. "Even if there was a dip in the second quarter, I'd be surprised if the trend doesn't show deals increasing over a 12-month period."

Pershing Advisor Solutions CEO Mark Tibergien would like to see the M&A reports show "how many times the same buyer keeps appearing, how many are consolidators as opposed to operating advisory firms and the size of firms that are being bought and sold."

What's more, he adds, "the industry is also acutely tuned into the terms of transactions. It’s a critical component of the deals, even more so than the price, because the ultimate payout is over time so the net price is impacted."

Peter Nesvold, managing partner of Silver Lane Advisors, an investment bank specializing in RIA M&A deals, agrees.

"What’s far more important than deal volume in any given quarter is deal pricing and transaction structures," Nesvold says. "Where are multiples and other deal terms trending? We actually spend more time and resources tracking down that information than we do on the raw deal count, because it gives a much clearer picture of where the market is."

What's indisputable, says Levitt, is that the RIA M&A market continues to attract well-funded buyers.

"We're getting calls every week from more and more people interested in buying, and they are way more qualified than we've seen in the past," says Levitt. "There are five to 15 buy offers for every seller. There's a lot of demand and not enough supply. But volume may be down slightly because deals can be hard to close for a variety of reasons. Aging advisors may want to transact, but it hard for many to pull away or to have a boss — or to face their own mortality."