A financial literacy business started by two college students during the pandemic launched online modules for high schools, athletic departments and other educational institutions.

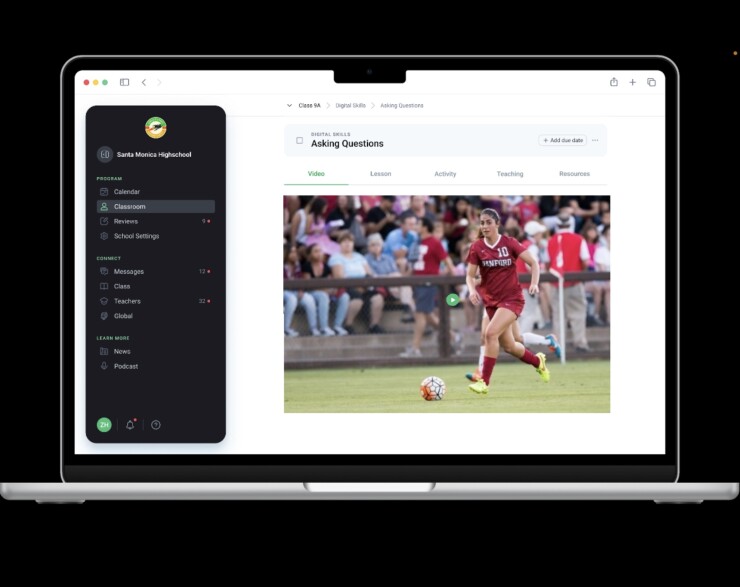

At a rate of $80 per student or at discounted levels in certain cases, Create Every Opportunity's "CEO Connect" service gives subscribers access to 300 interactive modules on topics like money management and taxes. Contributors include Major League Baseball Commissioner Rob Manfred and ex-Chicago Bulls player Bill Cartwright. Co-founders Ashley Henschel and Zachary Sarf

"There are 20 states now that have some sort of requirement for high school students," Sarf said in an interview. "I truly believe that, in the next two or three years, it'll be in all 50 states. It's a big step. There's a lot more that needs to be done."

An array of programming — including

"There really is a need to pair it with some type of job or internship opportunity," Ugwuomo said. "They can see the real-time effect of their financial decisions."

When applied to college athletes in particular, some level of customization reflecting how starting quarterbacks will generate much more "name, image and likeness" contracts than a backup player at another position also makes the programming more effective, according to financial advisors Brandon Williams and Jon Marc Carrier of Chicago-based

"Once you get over a certain amount of money that you're making, that's where the education really comes in," Williams said in an interview, suggesting that presentations on technical topics like setting up Delaware-based limited liability companies or the benefits of converting them to S-corporations be restricted to "really engaging" increments of no more than 20 minutes. "There are so many different things that you have to touch on and just make sure that these players know."

Targeted financial coaching can go deeper by engaging family members and close friends of a successful athlete who will be "getting a lot of information from them," Carrier said.

"It's huge and imperative to educate not just the athletes but those around the athletes as well," Carrier said. "How can you educate this circle of trust around the athlete?"

CEO's curriculum has reached more than 300 schools and 600,000 students so far, with a plan to introduce personal finance topics and entrepreneurship training to more through the online subscription service and private donations for programming in institutions lacking the resources, according to Sarf.

In addition to Manfred and Cartwright, the roughly 150 different guest speakers on the videos include former Girl Scouts CEO Sylvia Acevedo, Barstool Sports CEO Erika Nardini and Entrepreneur Magazine Editor in Chief Jason Feifer. The guests' companies will post internship opportunities in the portal, which also gives teachers and administrators tools for running the classes and connecting with each other.

"Rather than relying on antiquated programs that have been reused for decades, CEO Connect brings recognizable business leaders into the classroom to engage students with each lesson," Henschel said in a statement. "If you're a high school student reviewing student loan options, or a college athlete navigating an NIL deal, Create Every Opportunity wants to ensure every young person is adequately prepared to make the best financial decisions possible."

With the rising level of educational requirements and interest in teaching young people about financial topics, questions have emerged about what guidelines there are governing the programs and whether schools have received enough resources to implement them, Sarf said.

"You either need to bring in a teacher to teach it or bring in a program like us," he said. "It costs money."