LPL Financial faces risks around recruiting and compliance in its quest to make its headcount the largest of any advisory firm in the country.

The firm last week

NPH advisors may not want to join, however. LPL’s acquisition also carries regulatory responsibility over four firms with recent troubles and a parent that shut down a TAMP after issuing massive refunds. LPL pledged to hire more than 600 back office staffers, but experts warn that onboarding will be complex.

“It really talks to the desire to build scale in the independent broker-dealer space,” says Bill Butterfield, a senior analyst for wealth management with consulting firm Aite Group. “From a pure compliance standpoint, it’s hard to scale compliance.”

-

The nation’s largest IBD paid $325 million, but it may spend as much as $508 million in the deal.

August 15 -

The nation’s largest broker-dealer must convince thousands of NPH advisors to make the transition.

August 16 -

The company spent $77 million on technology last year, but difficult changes lie ahead.

August 14 -

The advisors collected $1.7 million by fraudulently pushing variable annuities, investigators say.

August 3

Regulators have revealed what kind of issues advisors must address if faced with a review.

RECENT COMPLIANCE WOES

The experiences of former NPH owner Jackson National Life Insurance and the two firms’ British parent, Prudential, display some of the difficulties. Last year, they closed Curian Capital, which once managed $11 billion, after the firm paid clients back

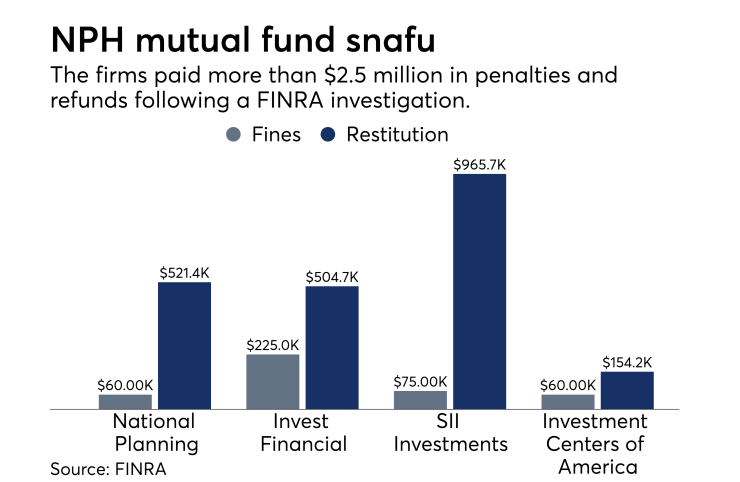

LPL did not buy Jackson’s asset management business, but NPH’s four firms — National Planning, Invest Financial, SII Investments and Investment Centers of America — also come with baggage. The firms paid $2.5 million in fines and restitution in March, after a FINRA probe of fees on clients’ mutual funds.

More than 1,150 clients of the firms paid avoidable sales charges or higher expenses between 2009 and 2015, according to FINRA. Following an examination by FINRA in 2015, NPH opened an internal review and self-reported the findings and remedial steps taken by the firms, the regulator says.

The FINRA penalties amount to “the kind of money that gets people fired,” according to Cipperman Compliance Services founder Todd Cipperman. The NPH deal could lead to unforeseen compliance costs for LPL, regardless of the firm’s due diligence, he says.

“The bigger you are, the more attention you’re going to get from regulators,” Cipperman says. “Regulators read the press too, and they’re going to want to hold them accountable.”

ADDING HEADCOUNT

Though Cipperman points out that LPL can be held liable for past conduct of NPH advisors uncovered by any future investigations, LPL spokesman Jeff Mochal says the firm assumed no compliance liabilities under the terms of the purchase.

LPL itself has struggled with regulators, amassing

“So we will add headcount as appropriate to support the larger business,” Mochal wrote in an email.

A WIN-WIN DEAL?

LPL already paid $325 million for NPH, and it could pay Jackson up to $123 million more based on its level of retention of NPH’s business. The firm would not pay so much unless executives expected success, says Rich Dragotta, a super OSJ manager for LPL based at INC Advisors in Paramus, New Jersey.

“It’s a win for everyone,” Dragotta says, noting

Terms of LPL’s agreement with NPH allowing for automated transfers of client assets do make for an easier changeover for NPH advisors, according to recruiter Mark Elzweig. LPL may find it difficult to convince some advisors to join the largest firm in the country, though, he says.

“Advisors at independent firms, many of them like to be at broker-dealers where they have access to the senior executives of their firm,” Elzweig says.

“There’s a big difference going from a smaller IBD culture to that of a gargantuan firm. I think there are many advisors who feel that’s not the kind of transition they want to make.”

SOLIDIFYING IMPACT

Aanes, whose firm is based in Larkspur, California, made such a switch back in 2009, however. LPL’s latest purchase is “a testament to LPL really solidifying itself as the 800-pound gorilla in the space,” he says.

After LPL bought his previous broker-dealer, Associated Securities, from Pacific Life Insurance, LPL carried out a “virtually seamless” migration of his client accounts, Aanes says.

“In many of the accounts, you didn’t have to do anything,” he says. “They made the integration easy from that perspective.”